EasyJet 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

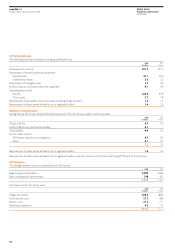

1 Accounting policies (continued)

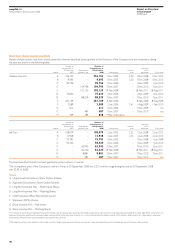

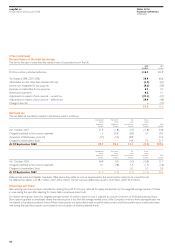

Property, plant and equipment

Property, plant and equipment is stated at cost less accumulated depreciation.

Depreciation is calculated to write off the cost, less estimated residual

value, of assets, on a straight-line basis over their expected useful lives.

Expected useful lives are reviewed annually.

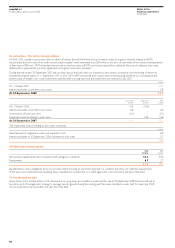

Expected useful life

Aircraft 23 years

Aircraft spares 14 years

Aircraft improvements 3-7 years

Aircraft – prepaid maintenance 3-10 years

Leasehold improvements 5-10 years or the length

of lease if shorter

Fixtures, fittings and equipment 3 years or length of lease

of property where

equipment is used

Computer hardware 5 years

Items held under finance leases are depreciated over the shorter

of the lease term and their expected useful lives, as shown above.

Residual values, where applicable, are reviewed annually against prevailing

market rates at the balance sheet date for equivalently aged assets and

depreciation rates adjusted accordingly on a prospective basis. The

carrying value is reviewed for impairment if events or changes in

circumstances indicate that the carrying value may not be recoverable.

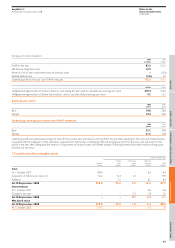

An element of the cost of a new aircraft is attributed on acquisition to prepaid

maintenance and is amortised over a period ranging from three to ten

years from the date of manufacture. Subsequent costs incurred which lend

enhancement to future periods, such as long-term scheduled maintenance

and major overhaul of aircraft and engines, are capitalised and amortised

over the length of period benefiting from these enhancements. All other

maintenance costs are charged to the income statement as incurred.

The cost of new aircraft comprises the invoiced price of the aircraft from

the supplier less the estimated value of other assets received by easyJet for

nil consideration. These assets principally comprise cash (recognised as an

asset) and aircraft spares (capitalised at list price and depreciated over

their expected useful life).

Pre-delivery and option payments made in respect of aircraft which are

expected to be funded out of cash reserves or by mortgage financing

are recorded in property, plant and equipment at cost.

Impairment of non-current assets

An impairment loss is recognised to the extent that the carrying value exceeds

the higher of the asset’s fair value less cost to sell and its value in use.

Impairment losses recognised on assets other than goodwill are only reversed

where changes in the estimates used result in an increase in recoverable

amount. Impairment losses recognised on goodwill are not reversed.

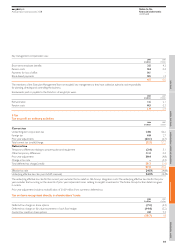

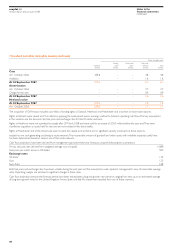

Leases

Non-contingent operating lease rentals are charged to the income

statement on a straight-line basis over the life of the lease. A number

of operating leases require the Group to make contingent rental

payments based on variable interest rates; these are expensed as incurred.

easyJet enters into sale and leaseback transactions whereby it sells to a

third-party rights to acquire aircraft. On delivery of the aircraft, easyJet

subsequently leases the aircraft back, by way of operating lease. Surpluses

arising on disposal, where the price that the aircraft is sold for is above fair

value, are recognised in deferred income and amortised on a straight-line

basis over the lease term of the asset.

Finance leases, which transfer to easyJet substantially all the risks and

benefits incidental to ownership of the leased item, are recognised at the

inception of the lease at the fair value of the leased asset, or, if lower, at

the present value of the minimum lease payments. Any directly attributable

costs of entering into financing sale and leasebacks are included in the

value of the asset recognised. Lease payments are apportioned between

the finance charges and the reduction of the lease liability so as to achieve

a constant rate of interest on the remaining balance of the liability. Finance

charges are included in interest payable and other financing charges.

easyJet plc

Annual report and accounts 2008

Notes to the

financial statements

continued

50