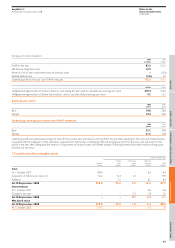

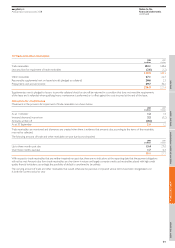

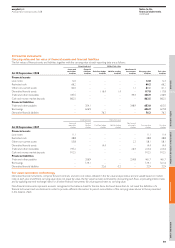

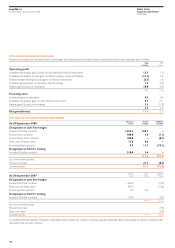

EasyJet 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

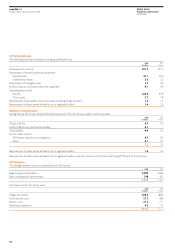

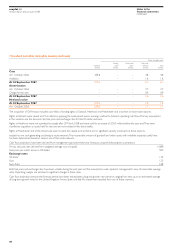

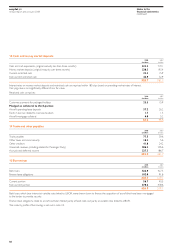

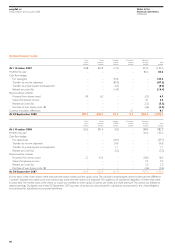

9 Loan notes – The Airline Group Limited

In March 2001, easyJet in consortium with six other UK airlines formed The Airline Group Limited in order to acquire a minority interest in NATS,

the company that owns the UK air traffic control system. easyJet’s initial investment was £6.9 million in the form of loan notes of two classes bearing interest

at fixed rates of 8% and 11%. The blended interest rate on the loan notes is 8.07%, and interest receivable is settled by the issue of additional loan notes.

Redemption is governed by a priority agreement among the consortium members.

During the year ended 30 September 2002 the carrying value of the loan notes was impaired to zero due to uncertainty over the timing of returns to

easyJet following the events of 11 September 2001. In June 2007 NATS announced that it would recommence paying dividends; as a consequence the

present value of easyJet’s loan notes investment exceeded their carrying value and the impairment was reversed in July 2007.

£million

At 1 October 2007 11.1

Interest receivable converted to loan notes 0.9

At 30 September 2008 12.0

Loan notes Impairment Total

£million £million £million

At 1 October 2006 10.6 (10.6) –

Interest receivable converted to loan notes 0.6 – 0.6

Amortisation of loan issue costs (0.1) – (0.1)

Impairment reversal relating to prior years – 10.6 10.6

At 30 September 2007 11.1 – 11.1

The impairment reversal relating to prior years comprises:

£million

Reinstatement of original loan notes and acquisition costs 6.9

Interest receivable to 30 September 2006 converted to loan notes 3.7

10.6

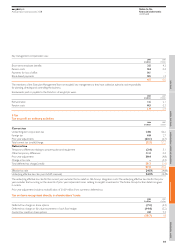

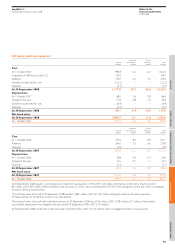

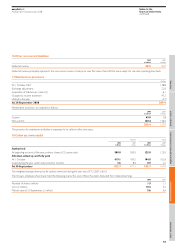

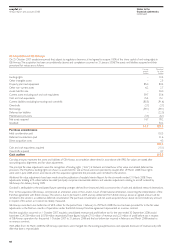

10 Other non-current assets

2008 2007

£million £million

Recoverable supplemental rent on leased aircraft (pledged as collateral) 54.2 54.4

Prepayments 6.9 3.7

61.1 58.1

Supplementary rent is pledged to lessors to provide collateral should an aircraft be returned in a condition that does not meet the requirements

of the lease and is refunded when qualifying heavy maintenance is performed, or is offset against the costs incurred at the end of the lease.

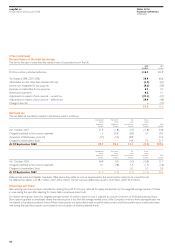

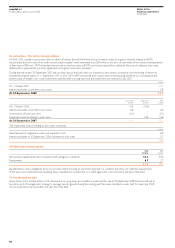

11 Assets held for sale

Seven Airbus A321 and five Airbus A319, measured at carrying value, are classified as assets held for sale at 30 September 2008. These aircraft are to

be sold as part of management’s strategy to manage capacity growth during the coming year. They were classified as assets held for sale in July 2008

and are expected to be sold within one year from that date.

easyJet plc

Annual report and accounts 2008

Notes to the

financial statements

continued

60