EasyJet 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

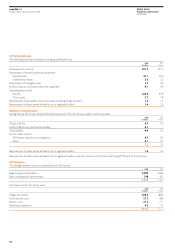

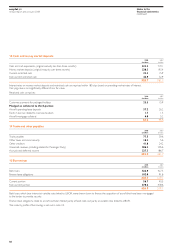

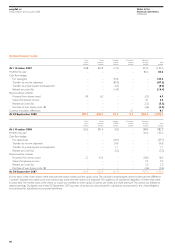

7 Goodwill and other intangible assets (continued)

Other intangible assets

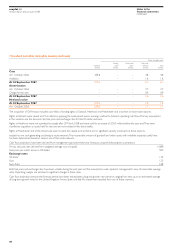

Landing Contractual Computer

Goodwill rights rights software Total

£million £million £million £million £million

Cost

At 1 October 2006 309.6 – – 4.8 4.8

Additions – – – 1.6 1.6

At 30 September 2007 309.6 – – 6.4 6.4

Amortisation

At 1 October 2006 – – – 3.7 3.7

Charge for the year – – – 0.9 0.9

At 30 September 2007 – – – 4.6 4.6

Net book value

At 30 September 2007 309.6 – – 1.8 1.8

At 1 October 2006 309.6 – – 1.1 1.1

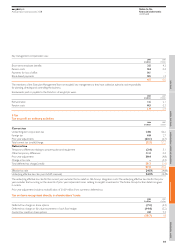

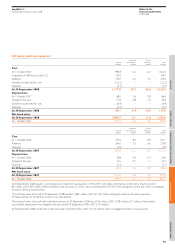

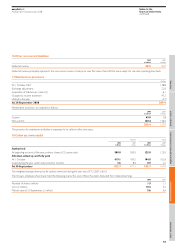

The acquisition of GB Airways included a portfolio of landing rights at Gatwick, Heathrow and Manchester and a number at downroute airports.

Rights at Gatwick were valued at £72.4 million by applying the multi-period excess earnings method to forecast operating cash flows. The key assumptions

in this valuation are the discount rate, fuel price and exchange rates for the US dollar and euro.

Rights at Heathrow were not operated by easyJet after 29 March 2008 and were sold for proceeds of £30.0 million before the year end. They were

classified at acquisition as assets held for sale and are not included in the above tables.

Rights at Manchester and at the downroute airports were fair valued at nil as there are no significant capacity constraints at those airports.

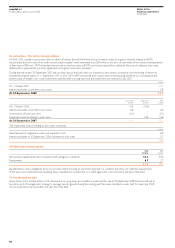

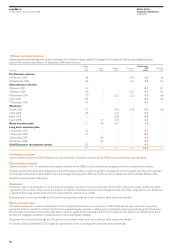

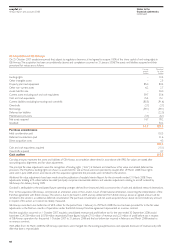

easyJet has one cash generating unit, being its route network. The recoverable amount of goodwill and other assets with indefinite expected useful lives

has been determined based on value in use of the route network.

Cash flow projections have been derived from management-approved three-year forecasts, using the following key assumptions:

Pre tax discount rate (derived from weighted average cost of capital) 10.8%

Fuel price, per metric tonne, in US dollars 920

Exchange rates

US dollar 1.75

Euro 1.25

Swiss franc 2.08

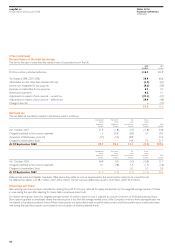

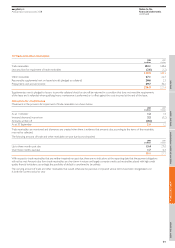

Both fuel price and exchange rates have been volatile during the past year, and the assumptions used represent management’s view of reasonable average

rates. Operating margins are sensitive to significant changes in these rates.

Cash flow projections beyond the forecast period have been extrapolated using real growth rate scenarios ranging from zero up to an estimated average

of long-term growth rates for the United Kingdom, France, Spain and Italy. No impairment resulted from any of these scenarios.

easyJet plc

Annual report and accounts 2008

Notes to the

financial statements

continued

58