EasyJet 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report and accounts 2008

Report on Directors’

remuneration

continued

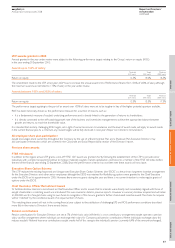

LTIP awards granted in 2008

Awards granted in the year under review were subject to the following performance targets relating to the Group’s return on equity (ROE)

in the year ending 30 September 2010:

Awards up to 100% of salary

Threshold Target Maximum

(25% vests) (50% vests) (100% vests)

Return on equity 12.5% 14.0% 16.5%

The amendment made to the LTIP at last year’s AGM was to increase the annual award limit of Performance Shares from 100% of 200% of salary, although

the maximum award was restricted to 175% of salary in the year under review.

Awards between 100% and 200% of salary

Threshold Target Maximum

(25% vests) (50% vests) (100% vests)

Return on equity 13.5% 15.5% 17.5%

The performance targets applying to the part of an award over 100% of salary were set to be tougher in lieu of the higher potential quantum available.

ROE has been historically chosen as the performance measure for a number of reasons, such as:

• It is a fundamental measure of easyJet’s underlying performance and is directly linked to the generation of returns to shareholders;

• It is directly connected to the self-sustaining growth rate of the business and incentivises management to achieve the appropriate balance between

growth and returns, to maximise shareholder value.

It is intended that similarly challenging ROE targets, set in light of current economic circumstances and the level of award made, will apply to awards made

in the current financial year. As a minimum, any revised targets will be fully disclosed in next year’s Report on Directors’ remuneration.

All employee share plan participation

easyJet encourages share ownership throughout the Company by the use of a Share Incentive Plan and a Sharesave Plan. Executive Directors may

also participate in these plans which are covered in the Corporate and Social Responsibility section of the Directors’ report.

Previous share awards

FTSE 100 Award

In addition to the regular annual LTIP grants, a one-off “FTSE 100” award was granted shortly following the establishment of the LTIP to provide senior

executives with a simple, transparent incentive to increase materially easyJet’s market capitalisation (and become a member of the FTSE 100 index before

the end of the financial year ending 30 September 2008). Since the performance criterion has not been met these awards will now lapse.

Executive Share Option Scheme

The LTIP replaced the existing Approved and Unapproved Executive Share Option Schemes (the “ESOS”) as the primary long-term incentive arrangement

for the Executive Directors and other senior employees although the ESOS was retained for flexibility, e.g. options were granted to the Chief Executive

under the ESOS on his appointment in 2005. However, there were no grants during the year and there is no current intention to make regular grants of

options under the ESOS.

Chief Executive Officer Recruitment Award

To facilitate Andrew Harrison’s recruitment as Chief Executive Officer and to ensure that his interests were directly and immediately aligned with those of

easyJet shareholders, a matching award was introduced. This was covered in detail in previous reports. However in summary, Andrew acquired and will retain

£1,000,000 worth of easyJet shares using his own funds. In recognition of this, he was granted a further share-based incentive award. The shares he acquires

will be “matched” by the conditional award of an equal number of shares.

This matching share award will vest in the coming financial year subject to the satisfaction of challenging EPS and ROE performance conditions described

more fully in the notes to Directors’ share awards below.

Pension contributions

Pension contributions for Executive Directors are set at 7% of their basic salary. While this is a non contributory arrangement, easyJet operates a pension

salary sacrifice arrangement where individuals can exchange their salary for Company paid pension contributions. Where individuals exchange salary this

reduces easyJet’s National Insurance contributions. easyJet credits half of this saving to the individual’s pension (currently 6.4% of the amount exchanged).

37

OverviewDirectors’ reportReport on Directors’ remunerationFinancial informationOther information