EasyJet 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OverviewDirectors’ reportReport on Directors’ remunerationFinancial informationOther information

easyJet plc

Annual report and accounts 2008

05

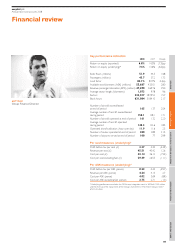

Business review

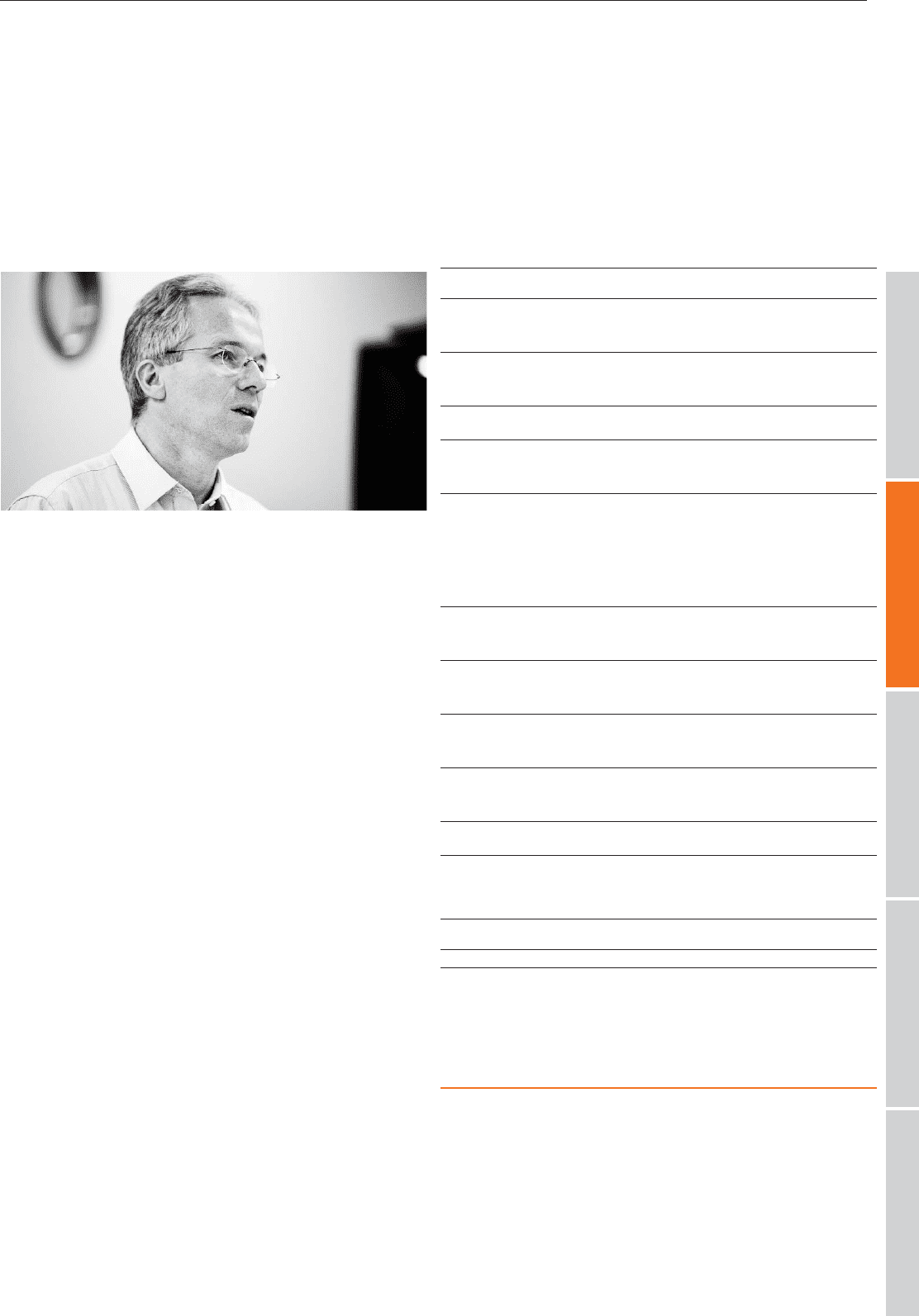

Andrew Harrison

Chief Executive

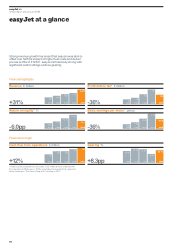

Highlights of the year

Underlying profit before tax of £123 million1(2007: £191

million1), equivalent to £2.37 (2007: £4.30) per seat flown

Reported profit before tax of £110 million

(2007: £202 million)

Total revenue up 31.5% to £2,363 million

Passenger numbers up 17.3% to 43.7 million and load

factor improved 0.4pp to 84.1%

Total revenue per seat up 12.6% (7.3% at constant currency)

for the full year and 15.2% (9.3% at constant currency)

for the second half, driven by improved ancillary revenue

performance and increased sector length associated with

the acquisition of GB Airways on 31 January 2008

Total cost per seat1(excluding fuel and exchange movement)

up 5.6% partly driven by increased sector length

Over half of the £210 million or £4.08 fuel cost per seat

increase recovered through revenue improvements

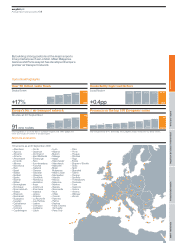

The fleet grew to 165 aircraft at 30 September 2008 (2007:

137) including 16 as part of the acquisition of GB Airways

Strong liquidity with cash and money market deposits of

£863 million (excluding restricted cash of £66 million)

Nearly half of passengers now originate outside the UK

Results at a glance

2008 2007 Change

Total revenue (£ million) 2,362.8 1,797.2 31.5%

Profit before tax – underlying (£ million)1123.1 191.3 (35.7)%

Profit before tax – reported (£ million) 110.2 201.9 (45.4)%

Pre tax margin – underlying (%)15.2 10.6 (5.4)pp

Return on equity – underlying (%)17.6 13.6 (6.0)pp

Basic EPS – reported (pence) 19.8 36.6 (45.9)%

Note 1: Underlying financial performance excludes £12.9 million of costs associated with

the integration of GB Airways in 2008 and excludes the reversal of the impairment of the

investment in The Airline Group of £10.6 million in 2007.