EasyJet 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

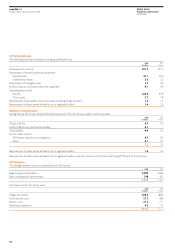

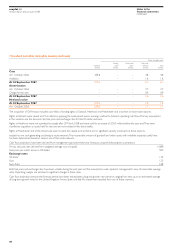

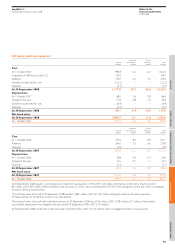

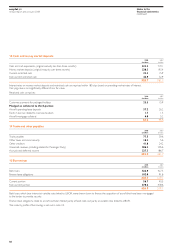

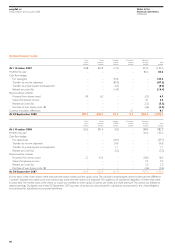

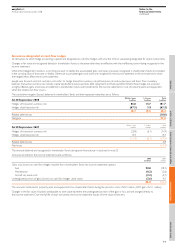

19 Share incentive schemes

easyJet operates the following share incentive schemes, all of which are equity settled. The change in the number of awards outstanding during the

year and the number exercisable at 30 September 2008 were as follows:

1 October 30 September

2007 Granted Forfeited Exercised 2008 Exercisable

Grant date million million million million million million

Pre-flotation scheme

29 February 2000 3.8 – – (0.2) 3.6 3.6

26 September 2000 0.6 – – (0.1) 0.5 0.5

Discretionary schemes

18 January 2001 0.1–––0.1 0.1

19 January 2004 0.6 – – (0.1) 0.5 0.5

8 December 2004 7.0 – (0.2) (2.2) 4.6 4.6

2 June 2005 0.4–––0.4 0.4

1 December 2005 0.7–––0.7 –

Sharesave

29 June 2005 1.7 – (0.1) (1.0) 0.6 0.6

2 June 2006 0.6 – (0.1) – 0.5 –

8 June 2007 1.1 – (0.6) – 0.5 –

6 June 2008 – 3.7 (0.2) – 3.5 –

Share incentive plan 1.1 0.9 (0.1) – 1.9 –

Long term incentive plan

1 December 2005 0.5–––0.5 –

1 December 2006 0.7–––0.7 –

3 December 2007 – 0.9 – – 0.9 –

29 February 2008 – 0.4 – – 0.4 –

Chief Executive recruitment award 0.3–––0.3 –

19.2 5.9 (1.3) (3.6) 20.2 10.3

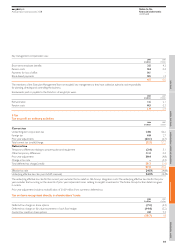

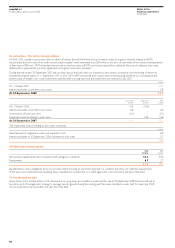

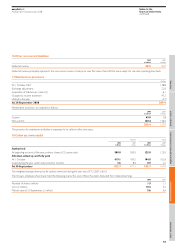

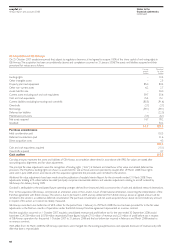

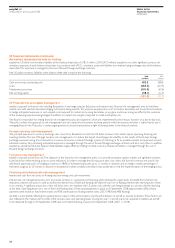

Pre-flotation scheme

Options vested in tranches of 25% ending on the third anniversary of easyJet’s admission to the Official List, and expire ten years after grant.

Discretionary schemes

Options awarded in 2001 in connection with easyJet’s admission to the Official List had a three-year vesting period and no performance conditions.

All other awards have a three-year vesting period and performance conditions based on growth in earnings per share. During the year the options granted

in December 2004 and June 2005 vested in full as the average annual growth in EPS over the three years to September 2007 exceeded RPI plus 20%.

All options expire ten years after grant.

Sharesave

Sharesave is open to all employees on the UK payroll. Participants may elect to save up to £250 per month under a three-year savings contract. An option

is granted by the Company to buy shares at a discount of 20% from market price at the time of the grant. At the end of the savings period, a tax free bonus

is applied to the savings and the option becomes exercisable for a period of six months.

Employees who are not paid through the UK payroll may save under similar terms and conditions, albeit without tax benefits.

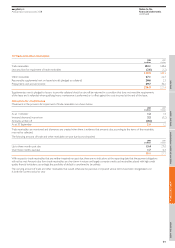

Share incentive plan

The share incentive plan is open to all employees on the UK payroll. Participants may invest up to £1,500 of their pre tax salary each year to purchase

partnership shares in easyJet. For each partnership share acquired easyJet purchases a matching share. Employees must remain with easyJet for three years

from the date of purchase of each partnership share in order to qualify for the matching share, and for five years for the shares to be transferred to them

tax free. The employee is entitled to dividends and to vote at shareholder meetings.

Employees who are not paid through the UK payroll may save under similar terms and conditions, albeit without tax benefits.

In October 2006 and December 2007, easyJet also granted free shares to all employees under the share incentive plan.

easyJet plc

Annual report and accounts 2008

Notes to the

financial statements

continued

64