EasyJet 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

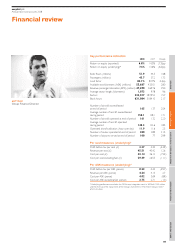

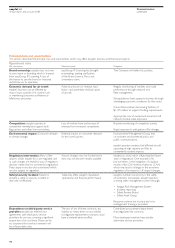

Due to the large impact that the stronger euro has had on the business

during the year and latterly the dollar at the end of the year, key

measures are also shown on a constant currency basis versus 2007.

2008 2007 Change %

Total revenue

Per seat (£) 45.51 40.42 12.6

At constant currency (£) 43.36 40.42 7.3

Per ASK (pence) 4.24 4.13 2.7

At constant currency (pence) 4.04 4.13 (2.1)

Cost excluding fuel

Underlying per seat (£) 29.49 26.55 (11.1)

At constant currency (£) 28.04 26.55 (5.6)

Underlying per ASK (pence) 2.75 2.71 (1.3)

At constant currency (pence) 2.61 2.71 3.7

Total revenue

Total revenue grew 31.5% to £2,362.8 million which, on a per seat basis,

reflects a growth of £5.09 or 12.6%. Passenger revenue grew 22.7% and

ancillary revenue, excluding bag charges, grew by 30.3%; the introduction,

this year, of the checked bag charge delivered £144.1 million, or £2.76

per seat, of revenue.

Passenger revenue

Passenger revenue growth of 22.7% to £1,995.7 million was driven by

an increase of 16.8% in seats flown from 44.5 million to 51.9 million

using an average of 150 aircraft in 2008 compared to 128 in 2007, the

acquisition of GB Airways and the strengthening of the euro. Load factor

improved by 0.4pp to 84.1% resulting in passenger numbers increasing

17.3% to 43.7 million. The growth in capacity (seats flown) reflected a

net increase of 22, or 17.1%, in the average number of aircraft compared

to last year. Apart from the increase in aircraft at Gatwick through the

acquisition of GB Airways, which accounts for almost all of the growth

in London capacity, most of the growth, continuing the trend seen in

the past two years, has been into continental Europe, particularly

in France, Italy and Spain.

Average passenger yields rose 5.1% to £38.44 whilst on a constant

currency basis the increase was 0.5%. Yield dilution from the introduction

of the checked bag charge and the full year impact of the doubling of

APD in the UK, from February 2007, has been more than offset by

organic growth supplemented by the acquisition of GB Airways.

Ancillary revenue

Ancillary revenue increased by 114.5%, or £195.9 million to

£367.1 million principally driven by the introduction of the checked

bag charge which delivered £144.1 million of revenue. As expected

there has been some yield dilution at ticket price level but with 71%

of passengers having checked baggage the net result is positive.

Speedy Boarding continues to perform well and has recently been

improved with the introduction of Speedy Boarding Plus; typically

11 passengers per flight take up Speedy Boarding. Total revenue in

the year was £19.7 million up from £7.9 million in the previous year.

easyJet plc

Annual report and accounts 2008

Financial review

continued

Reported profit before tax for 2008 was £110.2 million including

£12.9 million of one-off integration costs related to the acquisition

of GB Airways. Excluding these costs the underlying profit for the year

was £123.1 million compared to £191.3 million in 2007. The fundamental

performance trends within the business remain strong despite a £1.93

fall in underlying profit per seat from £4.30 in 2007 to £2.37 in 2008.

The financial presentation of the results is significantly influenced by

the following factors:

• Fuel prices;

• GB Airways acquisition;

• Strengthening euro exchange rate.

Fuel prices

The average market price for jet fuel during 2008 was $1,070 per metric

tonne (excluding fees and taxes) compared to $643 in 2007. After taking

account of hedging the effective rates were $948 in 2008 compared

to $688 in 2007. Total fuel cost amounted to £708.7 million for 2008

an increase of 66.6% on 2007; this equates to a cost per seat of £13.65,

up £4.08, or 42.6%, from 2007. With underlying profit per seat falling

by £1.93 per seat over 50% of the increase in fuel costs has been offset

in the year.

Despite adding heavier aircraft into the fleet during the year (GB Airways’

A320s and A321s) the average fuel burn remained broadly flat at 717

(2007: 716) US gallons per block hour.

GB Airways acquisition

The acquisition of GB Airways was completed on 31 January 2008.

The business continued to operate as a British Airways franchise until

29 March 2008 and was then fully integrated into the easyJet operation;

thereafter separate performance information is not available for the

ex GB Airways business.

The acquisition brought into easyJet 18 new destinations with,

on average, double the sector length of the existing business.

Consequently there has been a significant increase of 9.6% in average

sector length this year compared to 2007 from 978km in 2007 to

1,073km in 2008 and this results in an increase in both revenue and

most cost per seat flown performance measures.

Strengthening euro exchange rate

The euro has strengthened by 11% from an average rate of 1.48/£

in 2007 to 1.32/£ in 2008. As easyJet continues to grow and expand

relatively more into mainland Europe the impact of the euro exchange

rate on revenues and costs increases; approximately 42% of revenues

and 30% of costs are denominated in euro or Swiss francs. Both revenue

and cost per seat measures, when compared to 2007, increased by just

over 5% due to exchange rate movements.

Given the impact of the GB Airways acquisition on key performance

per seat measures these are also presented on an ASK basis. However,

key measures on a per seat basis are still the key unit metrics used by

management to monitor the financial performance of the business.

10