EasyJet 2008 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2008 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

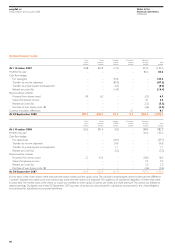

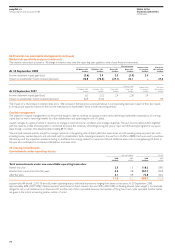

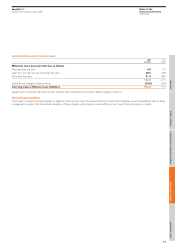

23 Financial instruments (continued)

Derivatives designated as held for trading

easyJet has US dollar net monetary liabilities at the balance sheet date of £181.0 million (2007: £47.0 million). easyJet has no other significant currency net

monetary exposure at each balance sheet date. In accordance with IAS 21, monetary assets and liabilities are revalued using exchange rates at the balance

sheet date. This exposure is managed by the use of forward foreign exchange contracts.

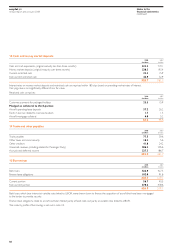

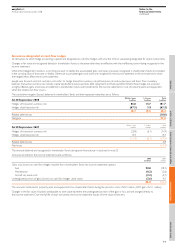

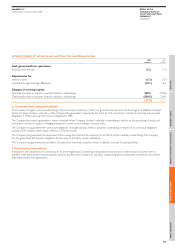

Net US dollar monetary liabilities at the balance sheet date comprise the following:

2008 2007

£million £million

Cash and money market deposits 432.5 369.6

Loans (453.5) (327.5)

Maintenance provisions (101.9) (67.6)

Net working capital (58.1) (21.5)

(181.0) (47.0)

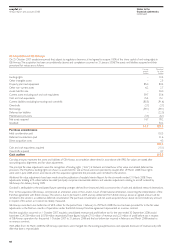

24 Financial risk and capital management

easyJet is exposed to financial risks including fluctuations in exchange rates, jet fuel prices and interest rates. Financial risk management aims to limit these

market risks with selected derivative hedging instruments being used for this purpose. easyJet policy is not to trade in derivatives but to use the instruments

to hedge anticipated exposure, as such, easyJet is not exposed to market risk by using derivatives as any gains and losses arising are offset by the outcome

of the underlying exposure being hedged. In addition to market risks, easyJet is exposed to credit and liquidity risk.

The Board is responsible for setting financial risk management policy and objectives which are implemented by the treasury function on a day-to-day basis.

The policy outlines the approach to risk management and also states the instruments and time periods which the treasury function is authorised to use in

managing financial risks. The policy is under ongoing review to ensure best practice in light of developments in the financial markets.

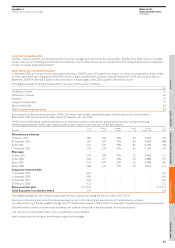

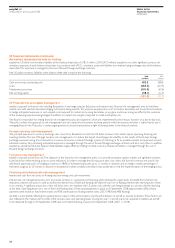

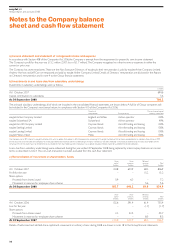

Foreign currency risk management

The principal exposure to currency exchange rates arises from fluctuations in both the US dollar and euro rates which impact operating, financing and

investing activities. The aim of foreign currency risk management is to reduce the impact of exchange rate volatility on the results of the Group. Foreign

exchange exposure arising from transactions in various currencies is reduced through a policy of matching, as far as possible, receipts and payments in each

individual currency. Any remaining anticipated exposure is managed through the use of forward foreign exchange contracts and zero cost collars. In addition,

easyJet has substantial US dollar balance sheet liabilities, largely offset by holding US dollar cash; any residual net liability is managed through the use of

forward foreign exchange contracts.

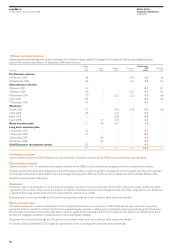

Fuel price risk management

easyJet is exposed to fuel price risk. The objective of the fuel price risk management policy is to provide protection against sudden and significant increases

in jet fuel prices whilst retaining access to price reductions. In order to manage the risk exposure, zero cost collars and forward contracts are used in line

with Board approved policy of hedging a maximum of 80% of estimated exposures up to 12 months in advance, and to hedge a smaller percentage of

estimated usage up to 24 months in advance. In exceptional market conditions, the Board may accelerate or limit the implementation of the hedging policy.

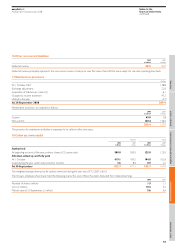

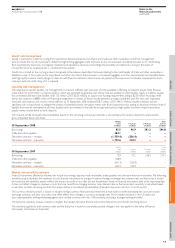

Financing and interest rate risk management

Interest rate cash flow risk arises on floating rate borrowings and cash investments.

Interest rate risk management policy aims to provide certainty in a proportion of financing while retaining the opportunity to benefit from interest rate

reductions. Interest rate policy is used to achieve the desired mix of fixed and floating rate debt. All loans are at floating interest rates repricing every three

to six months. A significant proportion of the US dollar loans are matched with US dollar cash, with the cash being invested to coincide with the repricing

of the debt. Operating leases are a mix of fixed and floating rates. Of the operating leases in place at 30 September 2008 approximately 60% of lease

payments were based on fixed interest rates and 40% were based on floating interest rates (2007: 54% fixed, 46% floating).

All debt is asset related, reflecting the capital intensive nature of the airline industry and the attractiveness of aircraft as security to lenders. These factors are

also reflected in the medium-term profile of the Group’s loans and operating leases. During the year 13 aircraft were cash acquired. In addition, all aircraft

to be delivered through to 30 September 2009 have committed financing in place at 30 September 2008 (2007: 11 of 49).

easyJet plc

Annual report and accounts 2008

Notes to the

financial statements

continued

72