Dollar General 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

shareholders, regulatory approval and other customary closing conditions. The Merger

Agreement places specified restrictions on certain of the Company’s business activities,

including but not limited to: acquisitions or dispositions of assets, capital expenditures,

modifications of debt, leasing activities, compensatory changes, dividend increases, investments

and share repurchases. The accompanying consolidated financial statements do not include any

financial reporting impacts related to potential consummation of the Merger, including but not

limited to potential change in basis of accounting, and acceleration of vesting of restricted stock,

stock units or options.

Subsequent to the announcement of the Merger Agreement, the Company and its

directors were named in seven putative class actions alleging claims for breach of fiduciary duty

arising out of the proposed sale of the Company to KKR, all as described more fully under

“Legal Proceedings” in Note 8 above.

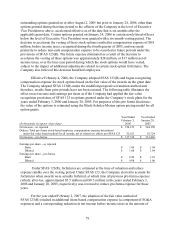

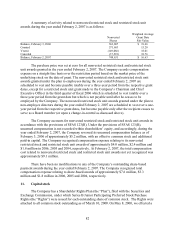

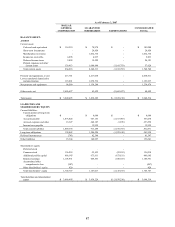

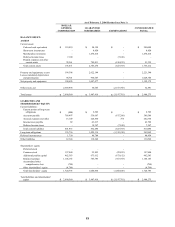

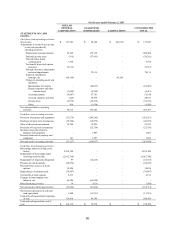

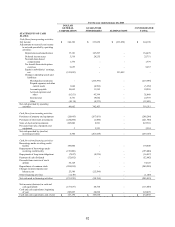

15. Quarterly financial data (unaudited)

The following is selected unaudited quarterly financial data for the fiscal years ended

February 2, 2007 and February 3, 2006. With the exception of the fourth quarter of 2005, which

was a 14-week accounting period, each quarter listed below was a 13-week accounting period.

The sum of the four quarters for any given year may not equal annual totals due to rounding.

Amounts are in thousands except per share data.

Quarter First Second Third Fourth

2006:

Net sales $ 2,151,387 $ 2,251,053 $ 2,213,396 $ 2,553,986

Gross profit 584,274 611,534 526,447 645,950

Operating profit 81,285 80,577 3,339 83,075

Net income (loss) 47,670 45,468 (5,285) 50,090

Basic earnings (loss) per

share

0.15

0.15

(0.02)

0.16

Diluted earnings (loss) per

share

0.15

0.15

(0.02)

0.16

2005:

Net sales $ 1,977,829 $ 2,066,016 $ 2,057,888 $ 2,480,504

Gross profit 563,349 591,530 579,016 730,929

Operating profit 106,921 121,070 101,612 232,264

Net income 64,900 75,558 64,425 145,272

Basic earnings per share 0.20 0.23 0.20 0.46

Diluted earnings per share 0.20 0.23 0.20 0.46

As discussed in Note 12, during the first and third quarters of 2006, the Company

received proceeds, net of taxes, of $3.2 million ($0.01 per diluted share), and $5.0 million,

($0.02 per diluted share) respectively, representing insurance recoveries for destroyed and

damaged assets, costs incurred and business interruption coverage related to Hurricane Katrina,

which is reflected in results of operations for these periods as a reduction of SG&A expenses.

As discussed in Note 2, in the third quarter of 2006, the Company completed a strategic

review of its real estate portfolio and traditional inventory packaway strategy. The review

resulted in plans to close approximately 400 underperforming stores and to eliminate nearly all

85