Dollar General 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from investing activities and recoveries related to inventory losses and business interruption are

included in cash flows from operating activities.

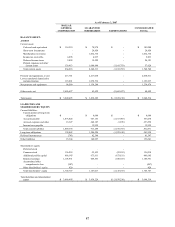

13. Segment reporting

The Company manages its business on the basis of one reportable segment. See Note 1

for a brief description of the Company’ s business. As of February 2, 2007, all of the Company’s

operations were located within the United States with the exception of an immaterial Hong Kong

subsidiary formed to assist in the process of importing certain merchandise that began operations

in early 2004. The following data is presented in accordance with SFAS 131, “Disclosures about

Segments of an Enterprise and Related Information.”

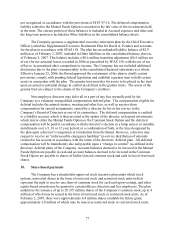

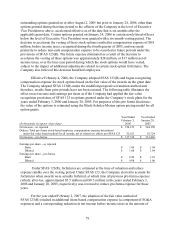

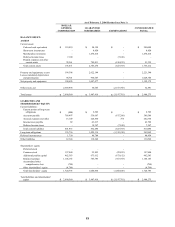

(In thousands) 2006 2005 2004

Classes of similar products:

Highly consumable $ 6,022,014

$ 5,606,466 $ 4,825,051

Seasonal 1,509,999

1,348,769 1,263,991

Home products 914,357

907,826 879,476

Basic clothing 723,452

719,176 692,409

Net sales $ 9,169,822

$ 8,582,237 $ 7,660,927

14. Subsequent event

On March 11, 2007, the Company entered into an Agreement and Plan of Merger (the

“Merger Agreement”) with Buck Holdings LP, a Delaware limited partnership (“Parent”) and

Buck Acquisition Corp., a Tennessee corporation and wholly owned subsidiary of Parent

(“Merger Sub”).

Pursuant to the Merger Agreement, Merger Sub will be merged with and into the

Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary

of Parent. Merger Sub and Parent are affiliates of Kohlberg Kravis Roberts & Co., L.P. Pursuant

to the Merger Agreement, at the effective time of the Merger, each outstanding share of common

stock of the Company, other than any shares held by any wholly owned subsidiary of the

Company and any shares owned by Parent or Merger Sub or held by the Company, will be

cancelled and converted into the right to receive $22.00 in cash, without interest (the “Merger

Consideration”). In addition, immediately prior to the effective time of the Merger, all shares of

Company restricted stock and restricted stock units will, unless otherwise agreed by the holder

and Parent, vest and be converted into the right to receive the Merger Consideration. All options

to acquire shares of Company common stock will vest immediately prior to the effective time of

the Merger and holders of such options will, unless otherwise agreed by the holder and Parent, be

entitled to receive an amount in cash equal to the excess, if any, of the Merger Consideration

over the exercise price per share of Company common stock subject to the option.

The Board of Directors of the Company unanimously approved the Merger Agreement

and amended the Company’ s Shareholder Rights Plan to exempt the Merger from that Plan’ s

operation.

Consummation of the Merger is not subject to a financing condition but is subject to

customary closing conditions, including approval of the Merger Agreement by the Company’ s

84