Dollar General 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

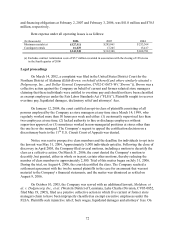

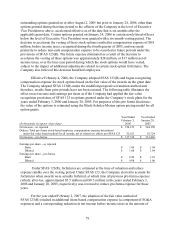

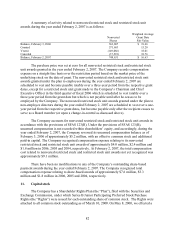

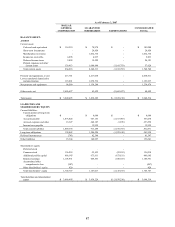

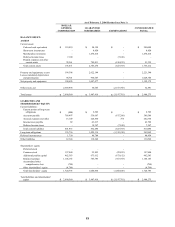

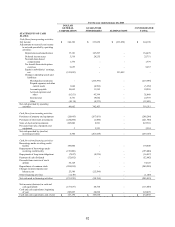

A summary of activity related to nonvested restricted stock and restricted stock unit

awards during the year ended February 2, 2007 is as follows:

Nonvested

Shares

Weighted Average

Grant Date

Fair Value

Balance, February 3, 2006 363,687 $ 19.66

Granted 571,603 15.20

Vested (149,066) 18.01

Canceled (37,593) 18.76

Balance, February 2, 2007 748,631 $ 16.63

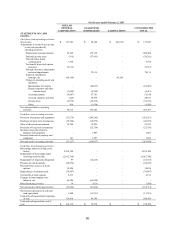

The purchase price was set at zero for all nonvested restricted stock and restricted stock

unit awards granted in the year ended February 2, 2007. The Company records compensation

expense on a straight-line basis over the restriction period based on the market price of the

underlying stock on the date of grant. The nonvested restricted stock and restricted stock unit

awards granted under the plan to employees during the year ended February 2, 2007 are

scheduled to vest and become payable ratably over a three-year period from the respective grant

dates, except for a restricted stock unit grant made to the Company’ s Chairman and Chief

Executive Officer in the third quarter of fiscal 2006 which is scheduled to vest ratably over a

three-year period from the grant date but which is not payable until after he ceases to be

employed by the Company. The nonvested restricted stock unit awards granted under the plan to

non-employee directors during the year ended February 2, 2007 are scheduled to vest over a one-

year period from the respective grant dates, but become payable only after the recipient ceases to

serve as a Board member (or upon a change-in-control as discussed above).

The Company accounts for nonvested restricted stock and restricted stock unit awards in

accordance with the provisions of SFAS 123(R). Under the provisions of SFAS 123(R),

unearned compensation is not recorded within shareholders’ equity, and accordingly, during the

year ended February 2, 2007, the Company reversed its unearned compensation balance as of

February 3, 2006 of approximately $5.2 million, with an offset to common stock and additional

paid-in capital. The Company recognized compensation expense relating to its nonvested

restricted stock and restricted stock unit awards of approximately $4.0 million, $2.4 million and

$1.8 million in 2006, 2005 and 2004, respectively. At February 2, 2007, the total compensation

cost related to nonvested restricted stock and restricted stock unit awards not yet recognized was

approximately $9.1 million.

There have been no modifications to any of the Company’ s outstanding share-based

payment awards during the year ended February 2, 2007. The Company recognized total

compensation expense relating to share-based awards of approximately $7.6 million, $3.3

million and $1.8 million in 2006, 2005 and 2004, respectively.

11. Capital stock

The Company has a Shareholder Rights Plan (the “Plan”), filed with the Securities and

Exchange Commission, under which Series B Junior Participating Preferred Stock Purchase

Rights (the “Rights”) were issued for each outstanding share of common stock. The Rights were

attached to all common stock outstanding as of March 10, 2000. On May 8, 2000, we effected a

82