Dollar General 2006 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“Final average compensation” is calculated as Mr. Perdue’ s base salary plus his incentive

“Teamshare” bonus earned in a fiscal year for the highest 3 consecutive fiscal years of credited

service out of the last 10 preceding retirement or termination of employment.

“Normal retirement date” is the first of the month coincident with or next following the

later of the date Mr. Perdue attains age 60 or is credited with 15 years of credited service.

We have established a grantor trust that provides for assets in connection with Mr.

Perdue’ s SERP to be placed in the trust upon an actual or potential change-in-control (as defined

in the grantor trust) of Dollar General. The trust’s assets are subject to the claims of Dollar

General’ s creditors. The trust also provides for a distribution to Mr. Perdue to pay certain taxes

in the event he is taxed in connection with the funding of the trust and prior to normal payment

of his SERP benefit.

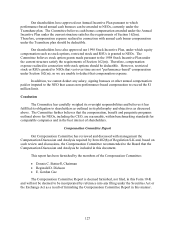

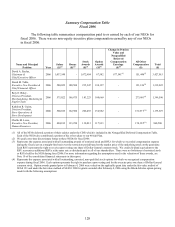

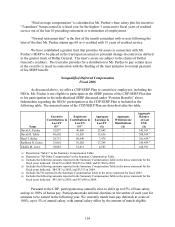

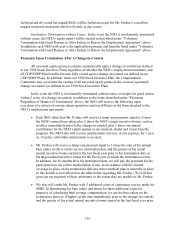

Nonqualified Deferred Compensation

Fiscal 2006

As discussed above, we offer a CDP/SERP Plan to certain key employees, including the

NEOs. Mr. Perdue is not eligible to participate in the SERP portion of the CDP/SERP Plan due

to his participation in his individualized SERP discussed under “Pension Benefits” above.

Information regarding the NEOs’ participation in the CDP/SERP Plan is included in the

following table. The material terms of the CDP/SERP Plan are described after the table.

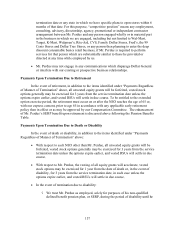

Name

Executive

Contributions in

Last FY

($)(1)

Registrant

Contributions in

Last FY

($)(2)

Aggregate

Earnings in

Last FY

($)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance

at Last

FYE

($)

David A. Perdue 51,877 40,460 27,685 - 342,013

3

David M. Tehle 40,602 61,503 13,636 - 208,014 4

Beryl J. Buley 28,751 60,640 7,476 - 101,659 5

Kathleen R. Guion 25,001 36,502 17,294 - 189,459 6

Challis M. Lowe 38,885 52,611 4,583 - 100,591

(1) Reported as "Salary" in the Summary Compensation Table.

(2) Reported as "All Other Compensation" in the Summary Compensation Table.

(3) Includes the following amounts reported in the Summary Compensation Table in the proxy statement for the

fiscal years indicated: $94,670 in 2005; $84,253 in 2004; and $7,500 in 2003.

(4) Includes the following amounts reported in the Summary Compensation Table in the proxy statement for the

fiscal years indicated: $84,387 in 2005; and $3,333 in 2004.

(5) Includes $4,792 reported in the Summary Compensation Table in the proxy statement for fiscal 2005.

(6) Includes the following amounts reported in the Summary Compensation Table in the proxy statement for the

fiscal years indicated: $43,168 in 2005; and $57,689 in 2004.

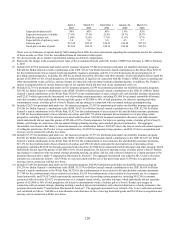

Pursuant to the CDP, participants may annually elect to defer up to 65% of base salary

and up to 100% of bonus pay. Participants make deferral elections in November of each year for

amounts to be earned in the following year. We currently match base pay deferrals at a rate of

100%, up to 5% of annual salary, with annual salary offset by the amount of match-eligible

134