Dollar General 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Expected term of options - This is the period of time over which the options granted are

expected to remain outstanding. Because the terms of the Company’ s stock option grants prior to

August 2002 were significantly different than grants issued on and after that date and the

Company does not currently intend to grant stock options similar to those granted prior to

August 2002 in future periods, the Company believes that the historical and post-vesting

employee behavior patterns for grants prior to August 2002 are of little or no value in

determining future expectations and, therefore, has generally excluded these pre-August 2002

grants from its analysis of expected term. The Company has estimated expected term using a

computation based on an assumption that outstanding options will be exercised approximately

halfway through their contractual term, taking into consideration such factors as grant date,

expiration date, weighted-average time-to-vest, actual exercises and post-vesting cancellations.

Options granted have a maximum term of 10 years. An increase in the expected term will

increase compensation expense.

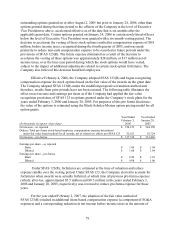

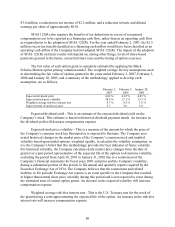

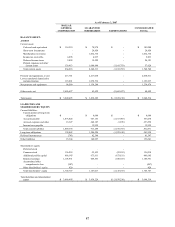

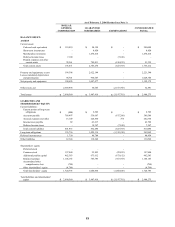

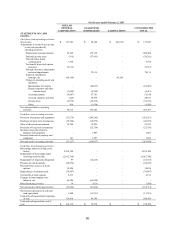

The Company issues new shares when options are exercised. A summary of stock option

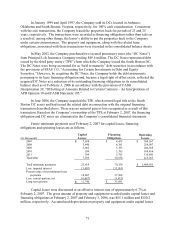

activity during the year ended February 2, 2007 is as follows:

Options

Issued

Weighted Average

Exercise Price

Balance, February 3, 2006 20,258,324 $ 18.19

Granted 2,648,600 17.41

Exercised (1,573,354) 12.65

Canceled (1,934,689) 19.68

Balance, February 2, 2007 19,398,881 $ 18.38

During the years ended February 2, 2007, February 3, 2006 and January 28, 2005, the

weighted average grant date fair value of options granted was $5.86, $6.33 and $6.36,

respectively; 617,234, 8,281,184 and 1,037,126 options vested, net of forfeitures, respectively;

with a total fair value of approximately $2.5 million, $56.5 million and $4.2 million,

respectively; and the total intrinsic value of stock options exercised was $6.8 million, $16.7

million and $24.0 million, respectively.

At February 2, 2007, the aggregate intrinsic value of all outstanding options was $14.6

million with a weighted average remaining contractual term of 5.2 years, of which 16,923,305 of

the outstanding options are currently exercisable with an aggregate intrinsic value of $14.1

million, a weighted average exercise price of $18.50 and a weighted average remaining

contractual term of 4.7 years. At February 2, 2007, the total unrecognized compensation cost

related to non-vested stock options was $11.6 million with an expected weighted average

expense recognition period of 3.1 years.

All stock options granted in the years ended February 2, 2007 and February 3, 2006

under the terms of the Company’s stock incentive plan were non-qualified stock options issued at

a price equal to the fair market value of the Company’ s common stock on the date of grant, were

originally scheduled to vest ratably over a four-year period, and expire 10 years following the

date of grant.

81