Dollar General 2006 Annual Report Download - page 85

Download and view the complete annual report

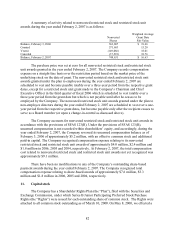

Please find page 85 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.five for four stock split at which time, pursuant to the adjustment provisions contained in the

Rights Agreement, each outstanding share of the Company’ s common stock evidenced the right

to receive eight-tenths of a right. Such Rights will be attached to all additional shares of

common stock issued prior to the Plan’ s expiration on February 28, 2010, or such earlier

termination, if applicable. The Rights entitle the holders to purchase from the Company one

one-hundredth of a share (a “Unit”) of Series B Junior Participating Preferred Stock (the

“Preferred Stock”), no par value, at a purchase price of $100 per Unit, subject to adjustment.

Initially, the Rights will attach to all certificates representing shares of outstanding common

stock, and no separate Rights Certificates will be distributed. The Rights will become

exercisable upon the occurrence of a triggering event as defined in the Plan. The triggering

events generally include any unsolicited attempt to acquire more than 15 percent of the

Company's outstanding common stock. The practical operation of the Plan, if triggered, allows a

holder of rights: (a) to acquire $200 of the Company's common stock in exchange for the $100

purchase price in the event of an acquisition of the Company in which the Company is the

surviving entity; and (b) in the event of an acquisition of the Company in which the Company is

not the surviving entity, to acquire $200 of the surviving entity's securities in exchange for the

$100 purchase price.

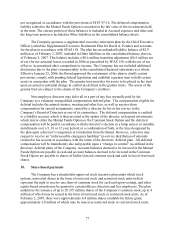

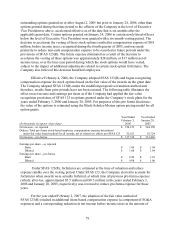

On November 29, 2006, the Board of Directors authorized the Company to repurchase up

to $500 million of its outstanding common stock. On September 30, 2005 and November 30,

2004, the Board of Directors authorized the Company to repurchase up to 10 million shares of its

outstanding common stock on each date. These authorizations allow or allowed, as applicable,

for purchases in the open market or in privately negotiated transactions from time to time,

subject to market conditions. The objective of the Company’ s share repurchase initiative is to

enhance shareholder value by purchasing shares at a price that produces a return on investment

that is greater than the Company's cost of capital. Additionally, share repurchases generally are

undertaken only if such purchases result in an accretive impact on the Company's fully diluted

earnings per share calculation. The 2006 authorization expires December 31, 2008 and as of

February 2, 2007 no purchases had been made pursuant to this authorization. The 2005 and 2004

authorizations were completed prior to their expiration dates. During 2006, the Company

purchased approximately 4.5 million shares pursuant to the 2005 authorization at a total cost of

$79.9 million. During 2005, the Company purchased approximately 5.5 million shares pursuant

to the 2005 authorization at a total cost of $104.7 million and approximately 9.5 million shares

pursuant to the 2004 authorization at a total cost of $192.9 million. During 2004, the Company

purchased approximately 0.5 million shares pursuant to the 2004 authorization at a total cost of

$10.9 million and approximately 10.5 million shares pursuant to a 2003 authorization at a total

cost of $198.4 million.

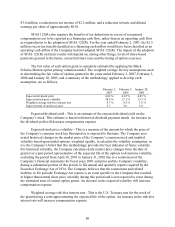

12. Insurance settlement

During 2006 and 2005, the Company received proceeds of $13.0 million and $8.0

million, respectively, representing insurance recoveries for destroyed and damaged assets, costs

incurred and business interruption coverage related to Hurricane Katrina, which is reflected in

results of operations for these years as a reduction of SG&A expenses. The claim was settled in

2006. The business interruption portion of the proceeds was approximately $5.8 million and was

received in 2006. Insurance recoveries related to fixed assets losses are included in cash flows

83