Dollar General 2006 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

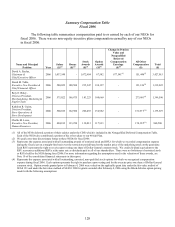

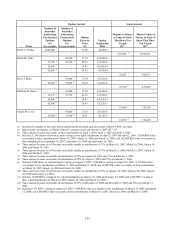

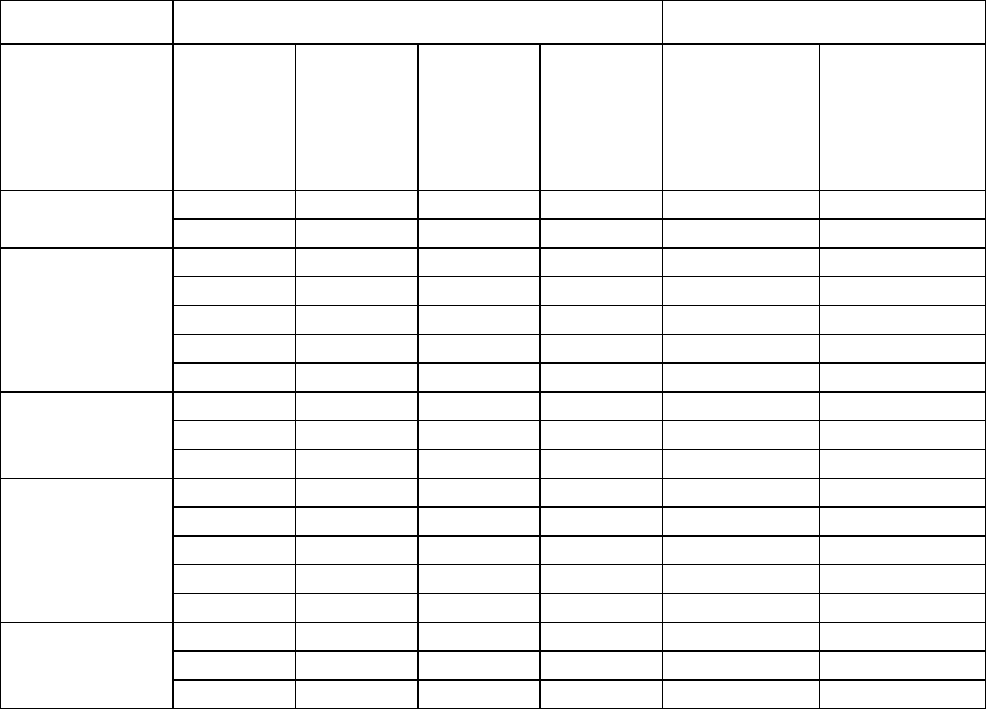

Option Awards Stock Awards

Name

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

Option

Exercise

Price

($)

Option

Expiration

Date

Number of Shares

or Units of Stock

That Have Not

Vested

(#)(1)

Market Value of

Shares or Units of

Stock That Have

Not Vested

($)(2)

David A. Perdue 1,000,000 3 - 12.68 4/2/2013 - -

- - - - 475,581

48,194,261

David M. Tehle - 69,900 5 17.54 3/16/2016 - -

15,750

6 47,250

6 22.35 3/15/2015 - -

52,600

7 - 18.83 8/24/2014 - -

62,800

8 - 18.75 8/9/2014 - -

- - - - 22,427

9386,417

Beryl J. Buley - 55,800 5 17.54 3/16/2016 - -

25,000

10 75,000

10 16.94 1/24/2016 - -

- - - - 25,530

11 439,882

Kathleen R. Guion - 55,800 5 17.54 3/16/2016 - -

12,575

6 37,725

6 22.35 3/15/2015 - -

42,000

7 - 18.83 8/24/2014 - -

62,800

12 - 20.63 12/2/2013 - -

- - - - 18,964

13 326,750

Challis M. Lowe - 50,000 5 17.54 3/16/2016 - -

10,500

14 31,500

14 18.51 9/1/2015 - -

- - - - 18,016

15 310,416

(1) Includes the number of unvested shares underlying the dividend equivalent units credited to RSU accounts.

(2) Based on the closing price of Dollar General’s common stock on February 2, 2007 ($17.23).

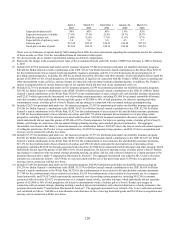

(3) These options became exercisable in three installments on April 2, 2004, April 2, 2005 and April 2, 2006.

(4) Includes 31,546 shares of restricted stock vesting in two equal installments on April 2, 2007 and April 2, 2008; 75,000 RSUs that

vest ratably in three installments on March 16, 2007, March 16, 2008 and March 16, 2009; and 365,000 RSUs that vest ratably in

three installments on September 18, 2007, September 18, 2008 and September 18, 2009.

(5) These options became or will become exercisable ratably in installments of 25% on March 16, 2007, March 16, 2008, March 16,

2009 and March 16, 2010.

(6) These options became or will become exercisable ratably in installments of 25% on March 15, 2006, March 15, 2007, March 15,

2008 and March 15, 2009.

(7) These options became exercisable in installments of 25% on August 24, 2005 and 75% on February 3, 2006.

(8) These options became exercisable in installments of 25% on August 9, 2005 and 75% on February 3, 2006.

(9) Includes 5,000 shares of restricted stock vesting on August 9, 2007; 2,200 RSUs vesting on August 24, 2007; 4,333 RSUs that

vest ratably in two installments on March 15, 2007 and March 15, 2008; and 10,600 RSUs that vest ratably in three installments

on March 16, 2007, March 16, 2008 and March 16, 2009.

(10) These options became or will become exercisable ratably in installments of 25% on January 24, 2007, January 24, 2008, January

24, 2009 and January 24, 2010.

(11) Includes 16,800 RSUs vesting in two equal installments on January 24, 2008 and January 24, 2009; and 8,400 RSUs vesting in

three equal installments on March 16, 2007, March 16, 2008 and March 16, 2009.

(12) These options became exercisable in installments of 25% on December 2, 2004 and December 2, 2005 and 50% on February 3,

2006.

(13) Includes 6,733 RSUs vesting on August 24, 2007; 3,466 RSUs that vest ratably in two installments on March 15, 2007 and March

15, 2008; and 8,400 RSUs that vest ratably in three installments on March 16, 2007, March 16, 2008 and March 16, 2009.

131