Dollar General 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

generally means a limitation from performing the material and substantial duties of

the person’ s regular occupation due to sickness or injury accompanied by a 20% or

more loss in the person’ s indexed monthly earnings due to the same sickness or

injury.

• Normal retirement means retirement from Dollar General on or after age 65.

• A change-in-control generally is deemed to occur:

√ if any person (other than Dollar General or one of our employee benefit plans)

acquires 35% or more of our voting securities (other than as a result of our

issuance of securities in the ordinary course of business);

√ if a majority of our Board members at the beginning of any consecutive 2-year

period are replaced within that period without the approval of at least 2/3 of

our Board members who served as directors at the beginning of the period; or

√ upon the consummation of a merger, other business combination or sale of

assets of, or cash tender or exchange offer or contested election with respect

to, Dollar General if less than a majority of our voting securities are held after

the transaction in the aggregate by holders of our securities immediately prior

to the transaction.

• A “potential change-in-control” generally is deemed to occur:

√ If our shareholders approve an agreement which, if consummated, would

result in a change-in-control, as described above; or

√ If any person (other than Dollar General or any of our employee benefit plans)

acquires 5% or more of our voting securities (other than as a result of our

issuance of securities in the ordinary course of business).

Prior to June 2, 2003, we also annually granted non-qualified stock options to our non-

employee directors under certain stock incentive plans. All of those options have since fully

vested.

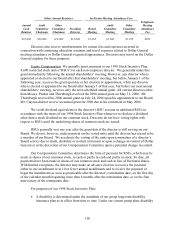

Deferred Compensation Program for Non-Employee Directors. Non-employee directors

may defer up to 100% of eligible compensation paid by us to them pursuant to a voluntary

nonqualified compensation deferral plan known as the Deferred Compensation Plan for Non-

Employee Directors (“DDCP”). Eligible compensation includes the annual retainer(s), meeting

fees, and any per diem compensation for special assignments earned by a director for service to

the Board or one of its committees. We credit the deferred compensation to a liability account,

which is then invested at the director’ s option in one or more accounts that mirror the

performance of funds selected by our Compensation Committee or its delegate (the “Mutual

Fund Options”) or that mirrors the performance of our common stock (the “Common Stock

Option”).

We generally distribute the amounts deferred, at the director’ s option, in a lump sum or in

monthly installments over a 5, 10 or 15-year period, or a combination of both, at the time

106