Dollar General 2006 Annual Report Download - page 135

Download and view the complete annual report

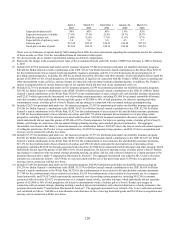

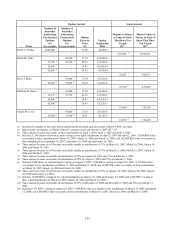

Please find page 135 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) Represents the actuarial present value as of February 2, 2007 of the benefit computed as of the same pension

plan measurement date, discount rate, and lump sum interest rate used for financial statement reporting

purposes. No pre-retirement decrements are assumed. The benefit is calculated assuming Mr. Perdue retires

at age 60, the earliest age he can retire without a penalty for early commencement. The actuarial present

value of the additional three years of credited service earned under the two-for-one crediting agreement for

Mr. Perdue’ s first three years of employment is $924,199.

Mr. Perdue’ s SERP provides an annual normal retirement benefit equal to 25% of “final

average compensation” upon retirement on or after his “normal retirement date”, payable as a

joint and 50% spouse annuity assuming the spouse is the same age as Mr. Perdue. Mr. Perdue

can elect to receive his benefit as a lump sum or any annuity form that is the actuarial equivalent

of the normal retirement benefit.

Mr. Perdue can retire with an early retirement benefit any time after he has 10 years of

credited service. Benefits are prorated based on actual credited service divided by 15 if Mr.

Perdue retires with less than 15 years of credited service. In the event Mr. Perdue retires prior to

age 60, his benefit is reduced 5% for each year or portion thereof that his retirement age precedes

age 60.

If Mr. Perdue separates for any reason prior to earning 10 years of credited service, no

benefits are payable from this plan, subject to the following provisions:

• Upon disability under Internal Revenue Code section 409A(a)(2)(C), Mr. Perdue will

be deemed to continue employment and receive his then base salary and “applicable

annual bonus” until he has earned the full 25% maximum benefit.

• Upon death, Mr. Perdue’ s spouse will receive the 50% survivor portion of the benefit

Mr. Perdue would be entitled to receive based on “final average compensation” and

years of credited service at the time of his death.

• Upon termination by us without cause, or termination by Mr. Perdue for good reason

within 2 years of a change-in-control, Mr. Perdue is entitled to a benefit based on his

years of credited service earned at the time of termination plus 5 additional years of

credited service, subject to the SERP maximum of 15 years. Mr. Perdue’ s base salary

and “applicable annual bonus” will be deemed to be paid during the 5 additional years

of credited service for calculating his “final average compensation”.

Subject to any 6 month deferral in payment requirement for tax law compliance and

subject to his providing a release of claims against us if and as required in his employment

agreement, Mr. Perdue’ s SERP benefit commences on the first day of the calendar month on or

after he ceases employment and is eligible for a benefit. In the event of disability, benefits begin

at his “normal retirement date” assuming he continued to work until that date. In the event of

death, the benefit is payable to the spouse on the first day of the month following the date of

death.

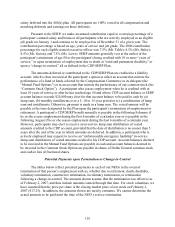

“Applicable annual bonus” is the greater of the actual bonus paid for the immediately

preceding fiscal year or the target annual bonus for the current fiscal year.

133