Dollar General 2006 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

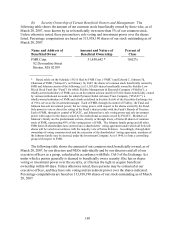

(b) Security Ownership of Certain Beneficial Owners and Management. The

following table shows the amount of our common stock beneficially owned by those who, as of

March 20, 2007, were known by us to beneficially own more than 5% of our common stock.

Unless otherwise noted, these persons have sole voting and investment power over the shares

listed. Percentage computations are based on 313,938,190 shares of our stock outstanding as of

March 20, 2007.

Name and Address of

Beneficial Owner

Amount and Nature of

Beneficial Ownership

Percent of

Class

FMR Corp.

82 Devonshire Street

Boston, MA 02109

31,450,642 * 10.02%

* Based solely on the Schedule 13G/A filed by FMR Corp. (“FMR”) and Edward C. Johnson 3d,

Chairman of FMR (“Johnson”), on February 14, 2007, the shares of common stock beneficially owned by

FMR and Johnson consist of the following: (a) 31,195,620 shares beneficially owned by Fidelity Low

Priced Stock Fund (the “Fund”) for which Fidelity Management & Research Company (“Fidelity”), a

wholly-owned subsidiary of FMR, acts as an investment advisor and (b) 255,022 shares beneficially owned

by various institutional accounts for which Pyramis Global Advisors Trust Company (“PGATC”), a

wholly-owned subsidiary of FMR and a bank as defined in Section 3(a)(6) of the Securities Exchange Act

of 1934, serves as the investment manager. Each of FMR, through its control of Fidelity, the Fund and

Johnson has sole investment power, but no voting power, with respect to the shares owned by the Fund.

Sole power to vote or direct the voting of the Fund’ s shares resides with the Fund’ s Boards of Trustees.

Each of FMR, through its control of PGATC, and Johnson have sole voting power and sole investment

power with respect to the shares owned by the institutional accounts served by PGATC. Members of

Johnson’s family are the predominant owners, directly or through trusts, of Series B shares of common

stock of FMR, representing 49% of the voting power of FMR. The Johnson family group and all other

FMR Series B shareholders have entered into a shareholders’ voting agreement under which all Series B

shares will be voted in accordance with the majority vote of Series B shares. Accordingly, through their

ownership of voting common stock and the execution of the shareholders’ voting agreement, members of

the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling

group with respect to FMR.

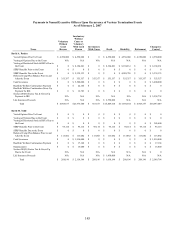

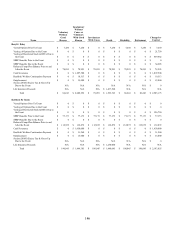

The following table shows the amount of our common stock beneficially owned, as of

March 20, 2007, by our directors and NEOs individually and by our directors and all of our

executive officers as a group, calculated in accordance with Rule 13d-3 of the Exchange Act

under which a person generally is deemed to beneficially own a security if he has or shares

voting or investment power over the security, or if he has the right to acquire beneficial

ownership within 60 days. Unless otherwise noted, these persons may be contacted at our

executive offices, and they have sole voting and investment power over the shares indicated.

Percentage computations are based on 313,938,190 shares of our stock outstanding as of March

20, 2007.

149