Dollar General 2006 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• We reimburse NEOs for all reasonable and customary home purchase closing costs

(we limit our reimbursement to other employees to 2% of the purchase price to a

maximum of $2,000).

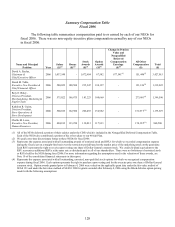

Mr. Buley’ s relocation to Tennessee was completed in fiscal 2006 and the costs we

incurred are reported in the “All Other Compensation” column of the Summary Compensation

Table set forth in this report.

As an exception to the normal NEO relocation benefit, the Committee approved a one-

time payment, which was subsequently grossed up to pay the tax cost of the benefit, to Ms. Lowe

for miscellaneous expenses she incurred in her relocation to Tennessee. These expenses were in

lieu of normal home sale assistance and personal goods shipping costs that Ms. Lowe did not

incur in her relocation. The Committee believes that, based on the experience of moving other

executives, had Ms. Lowe incurred these normal relocation costs, they would have been

significantly in excess of this exception payment. The amount of the costs we incurred and gross

up are reported in the “All Other Compensation” column of the Summary Compensation Table

set forth in this report.

The Committee also approved an exception payment to Ms. Guion to gross up the tax

cost of relocation expenses she incurred that could not be deducted from her 2006 tax return,

since her move to Tennessee did not occur until after the period in which these expenses could

have been deducted. The amount of the costs we incurred and the gross up payment is reported

in the “All Other Compensation” column of the Summary Compensation Table set forth in this

report.

We also provide to each NEO other minor perquisites such as the opportunity to take an

annual physical exam at our expense of up to $1,000, occasional tickets to certain sporting or

other entertainment events, a holiday gift, and golf or spa events in connection with our annual

strategic planning meeting. In addition, we believe that our officers’ participation on non-profit

boards and in community events serves as a positive reflection upon Dollar General and a great

example of corporate leadership. Therefore, we support nonprofit organizations for which our

officers actively serve as a board or committee member with a maximum total contribution for

all charities for which they serve to equal no more than $5,000.

How was the compensation for the CEO, David A. Perdue, determined?

Mr. Perdue’ s compensation is determined by the independent directors of the Board of

Directors considering the recommendations of the Committee. These recommendations are

based upon a number of factors, including benchmarking data provided by Hewitt, the current

compensation and compensation history of Mr. Perdue compared against those benchmarks and

the achievement of financial and non-financial measures set by the Committee as goals for Mr.

Perdue’ s performance at the beginning of the year. The results of the Committee’s evaluation of

Mr. Perdue’ s performance against those previously established goals determine Mr. Perdue’ s

eligibility for changes in base salary and Teamshare payout. As with the other NEOs, Mr.

Perdue’ s compensation reflects an emphasis on achieving both short and long-term performance

results. A substantial portion of his compensation is tied directly to our overall financial

performance as well as to non-financial measures, including those derived from our mission

statement.

122