Dollar General 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• A broadening of the list of competitors in the non-compete portion of the contract to

include the same companies listed in the employment contracts of our executive vice

presidents.

What compensation and benefits would be paid to NEOs upon the occurrence of various

termination of employment events or upon a change-in-control?

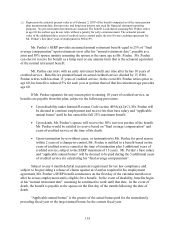

Termination arrangements are provided to NEOs in case of termination in various

situations to protect the employee against circumstances over which they have no control and as

consideration for the promises of non-compete, non-solicit and non-interference that we require

in employment agreements. Furthermore, we provide termination payments in the case of a

change-in-control to align executive and shareholder interests by enabling NEOs to evaluate a

transaction in the best interests of our shareholders and our other constituents without undue

concern over whether the transaction may jeopardize the NEO’ s own employment. In the case of

a change-in-control, all equity awards and all CDP/SERP Plan benefits are fully vested under a

single trigger, but termination benefits have a double trigger that requires both a change-in-

control and a loss of employment within two years after the event under various termination

circumstances.

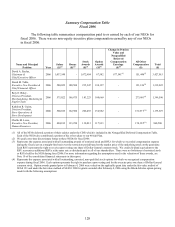

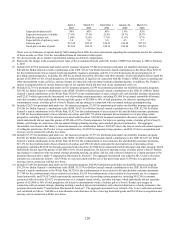

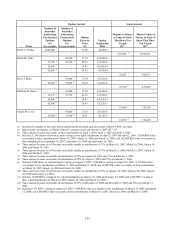

A table detailing the compensation and benefit payments that would be made to our

NEOs had their employment terminated due to the occurrence of one of various events as of

February 2, 2007 is presented under “Potential Payments upon Termination or Change-in-

Control” in this report. The Committee has reviewed the payouts that would occur and has

determined that the total compensation that would be payable is reasonable.

The transactions contemplated by the merger agreement with affiliates of KKR will

constitute a change-in-control for purposes of our plans and arrangements.

Does the Committee consider the deductibility of compensation in determining NEO

compensation?

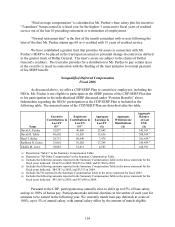

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to

public companies for compensation over $1 million paid in any fiscal year to an NEO that is not

performance-based compensation.

The Committee’ s policy is generally to design compensation plans and programs to

ensure full deductibility. The Committee attempts to balance this policy with compensation

programs designed to retain and motivate NEOs to maximize shareholder value. Should the

Committee determine that the shareholders’ interests are best served by the implementation of

compensation programs that are not deductible under Section 162(m), the policy does not restrict

the Committee from approving such a compensation program even though that decision may

result in a non-deductible compensation expense. The Committee’ s decision to pay discretionary

bonuses to NEOs (other than the CEO) for 2006 could have resulted in non-deductible

compensation; however these payments did not result in compensation in excess of $1 million

for any NEO.

126