Dollar General 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presentation and accounting policies

Basis of presentation

These notes contain references to the years 2007, 2006, 2005 and 2004, which represent

fiscal years ending or ended February 1, 2008, February 2, 2007, February 3, 2006 and

January 28, 2005, respectively. Fiscal year 2007 will be, and each of 2006 and 2004 was, a 52-

week accounting period while 2005 was a 53-week accounting period. The Company’ s fiscal

year ends on the Friday closest to January 31. The consolidated financial statements include all

subsidiaries of the Company, except for its not-for-profit subsidiary the assets and revenues of

which are not material. Intercompany transactions have been eliminated.

The Company leases three of its distribution centers (“DCs”) from lessors, which meet

the definition of a Variable Interest Entity (“VIE”) as described by Financial Accounting

Standards Board (“FASB”) Interpretation 46, “Consolidation of Variable Interest Entities” (“FIN

46”), as revised. One of these DCs has been recorded as a financing obligation whereby the

property and equipment, along with the related lease obligations, are reflected in the consolidated

balance sheets. The other two DCs, excluding the equipment, have been recorded as operating

leases in accordance with Statement of Financial Accounting Standards (“SFAS”) 98,

“Accounting for Leases.” The Company is not the primary beneficiary of these VIEs and,

accordingly, has not included these entities in its consolidated financial statements.

Business description

The Company sells general merchandise on a retail basis through 8,229 stores (as of

February 2, 2007) located primarily in the southern, southwestern, midwestern and eastern

United States. The Company has DCs in Scottsville, Kentucky; Ardmore, Oklahoma; South

Boston, Virginia; Indianola, Mississippi; Fulton, Missouri; Alachua, Florida; Zanesville, Ohio;

Jonesville, South Carolina and Marion, Indiana.

The Company purchases its merchandise from a wide variety of suppliers. Approximately

11% of the Company’ s purchases in 2006 were made from The Procter & Gamble Company.

The Company’ s next largest supplier accounted for approximately 5% of the Company’ s

purchases in 2006.

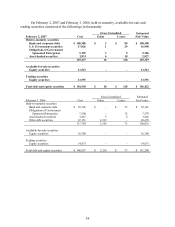

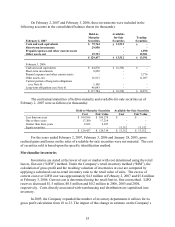

Restatement of previously issued consolidated financial statements

The Company has historically classified self-insurance and deferred rent liabilities within

Accrued expenses and other, which is included in Total current liabilities on the Company’s

consolidated balance sheets. Management has concluded that a portion of these liabilities

(including approximately $89.3 million and $23.0 million of self-insurance and deferred rent

liabilities, respectively) and certain other assets of $15.8 million and liabilities of $18.3 million

should be classified as noncurrent, along with the related deferred income tax impacts, where

applicable. As a result, the Company has restated the accompanying February 3, 2006

consolidated balance sheet to correct the prior presentation.

51