Dollar General 2006 Annual Report Download - page 77

Download and view the complete annual report

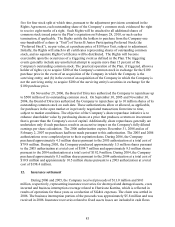

Please find page 77 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.alleging claims for breach of fiduciary duty arising out of the proposed sale of the Company to

KKR. The cases are captioned City of Miami General Employees’ & Sanitation Employees’

Retirement Trust and Louisiana Sheriffs’ Pension and Relief Fund v. David A. Perdue, et al (the

“City of Miami Complaint”), Lee S. Grubman v. Dollar General Corporation, et al (the

“Grubman Complaint”), William Hochman, IRA v. Dollar General Corporation, et al (the

“Hochman Complaint”), Helene Hutt v. Dollar General Corporation, et al (the “Hutt

Complaint”), Shalom Rechnieder v. David L. Beré, et al (the “Rechnieder Complaint”),

Catherine Rubbery v. Dollar General Corporation, et al (the “Rubbery Complaint”), and David

B. Shaev, IRA v. David A. Perdue, et al, Case No. 07-559 (the “Shaev Complaint”). The City of

Miami Complaint, the Grubman Complaint, the Hochman Complaint, the Hutt Complaint, the

Rubbery Complaint, and the Shaev Complaint were each brought in the Chancery Court for

Davidson County, Tennessee, and the Rechnieder Complaint was brought in the Circuit Court of

Davidson County, Tennessee. Each of the complaints allege, among other things, that the $22

per share price of the proposed transaction is inadequate and that the process leading to the

transaction was unfair. The plaintiffs seek, among other things, an injunction enjoining

completion of the transaction and, in certain cases, compensatory damages.

The Company believes that each of the foregoing lawsuits is without merit and intends to

defend these actions vigorously.

In addition to the matters described above, the Company is involved in other legal actions

and claims arising in the ordinary course of business. The Company believes, based upon

information currently available, that such other litigation and claims, both individually and in the

aggregate, will be resolved without a material effect on the Company’s financial statements as a

whole. However, litigation involves an element of uncertainty. Future developments could cause

these actions or claims to have a material adverse effect on the Company’ s financial statements

as a whole.

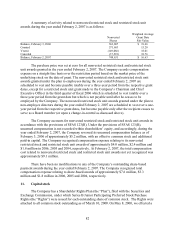

9. Benefit plans

The Dollar General Corporation 401(k) Savings and Retirement Plan became effective on

January 1, 1998. The 401(k) plan is a safe harbor defined contribution plan and is subject to the

Employee Retirement and Income Security Act (“ERISA”).

Participants are permitted to contribute between 1% and 25% of their pre-tax annual

eligible compensation as defined in the 401(k) plan document, subject to certain limitations

under the Internal Revenue Code. Employees who are over age 50 are permitted to contribute

additional amounts on a pre-tax basis under the catch-up provision of the 401(k) plan subject to

Internal Revenue Code limitations. The Company currently matches employee contributions,

including catch-up contributions, at a rate of 100% of employee contributions, up to 5% of

annual eligible salary, after an employee has been employed for one year and has completed a

minimum of 1,000 hours of service.

A participant’ s right to claim a distribution of his or her account balance is dependent on

ERISA guidelines and Internal Revenue Service regulations. All active employees are fully

vested in all contributions to the 401(k) plan. During 2006, 2005 and 2004, the Company

75