Dollar General 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

outstanding options granted on or after August 2, 2005 but prior to January 24, 2006, other than

options granted during that time period to the officers of the Company at the level of Executive

Vice President or above, accelerated effective as of the date that is six months after the

applicable grant date. Certain options granted on January 24, 2006 to certain newly hired officers

below the level of Executive Vice President were granted with a six-month vesting period. The

decision to accelerate the vesting of these stock options resulted in compensation expense of $0.9

million, before income taxes, recognized during the fourth quarter of 2005, and was made

primarily to reduce non-cash compensation expense to be recorded in future periods under the

provisions of SFAS 123(R). The future expense eliminated as a result of the decision to

accelerate the vesting of these options was approximately $28 million, or $17 million net of

income taxes, over the four-year period during which the stock options would have vested,

subject to the impact of additional adjustments related to certain stock option forfeitures. The

Company also believed this decision benefited employees.

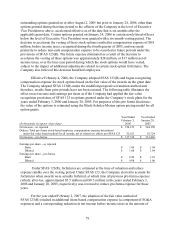

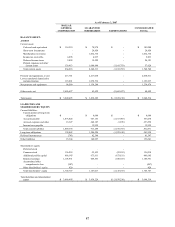

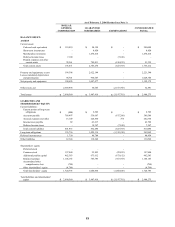

Effective February 4, 2006, the Company adopted SFAS 123(R) and began recognizing

compensation expense for stock options based on the fair value of the awards on the grant date.

The Company adopted SFAS 123(R) under the modified-prospective-transition method and,

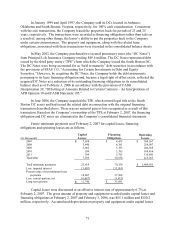

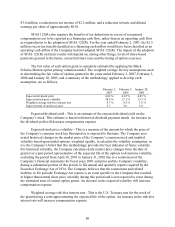

therefore, results from prior periods have not been restated. The following table illustrates the

effect on net income and earnings per share as if the Company had applied the fair value

recognition provisions of SFAS 123 to options granted under the Company’ s stock plans for the

years ended February 3, 2006 and January 28, 2005. For purposes of this pro forma disclosure,

the value of the options is estimated using the Black-Scholes-Merton option pricing model for all

option grants.

(In thousands except per share data)

Year Ended

February 3,

2006

Year Ended

January 28,

2005

Net income – as reported $ 350,155 $ 344,190

Deduct: Total pro forma stock-based employee compensation expense determined

under fair value based method for all awards, net of related tax effects per SFAS 123 32,621

10,724

Net income – pro forma $ 317,534 $ 333,466

Earnings per share – as reported

Basic $ 1.09 $ 1.04

Diluted $ 1.08 $ 1.04

Earnings per share – pro forma

Basic $ 0.99 $ 1.01

Diluted $ 0.98 $ 1.00

Under SFAS 123(R), forfeitures are estimated at the time of valuation and reduce

expense ratably over the vesting period. Under SFAS 123, the Company elected to account for

forfeitures when awards were actually forfeited, at which time all previous pro forma expense

(which, after-tax, approximated $5.5 million and $8.5 million in the years ended February 3,

2006 and January 28, 2005, respectively) was reversed to reduce pro forma expense for those

years.

For the year ended February 2, 2007, the adoption of the fair value method of

SFAS 123(R) resulted in additional share-based compensation expense (a component of SG&A

expenses) and a corresponding reduction in net income before income taxes in the amount of

79