Dollar General 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

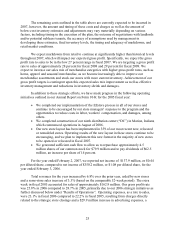

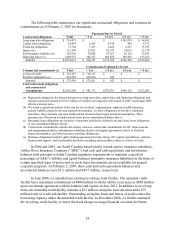

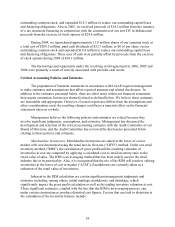

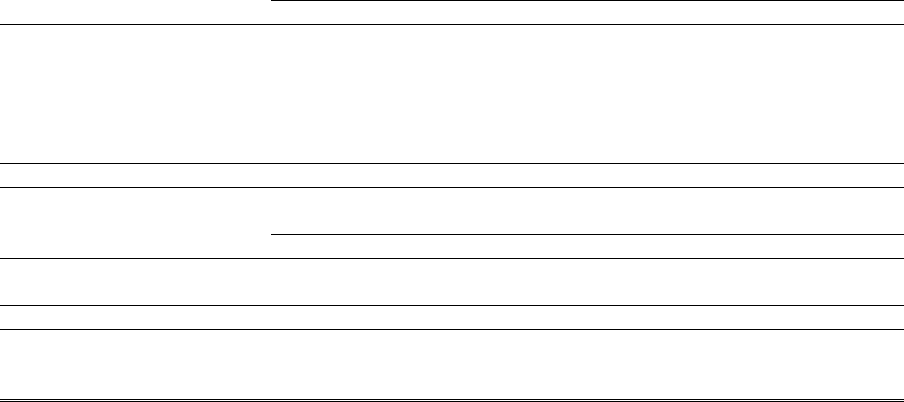

The following table summarizes our significant contractual obligations and commercial

commitments as of February 2, 2007 (in thousands):

Payments Due by Period

Contractual obligations Total < 1 yr 1-3 yrs 3-5 yrs > 5 yrs

Long-term debt obligations $ 214,473 $ - $ - $199,978 $ 14,495

Capital lease obligations 18,407 6,667 6,476 492 4,772

Financing obligations 37,304 1,413 2,466 2,233 31,192

Interest (a) 111,509 22,012 42,747 14,012 32,738

Self-insurance liabilities (b) 183,538 76,062 63,813 20,118 23,545

Operating leases (c) 1,489,581 304,567 460,456 309,295 415,263

Subtotal $2,054,812 $ 410,721 $575,958 $546,128 $522,005

Commitments Expiring by Period

Commercial commitments (d) Total < 1 yr 1-3 yrs 3-5 yrs > 5 yrs

Letters of credit $ 116,147 $116,147$-$-$-

Purchase obligations (e) 459,289 458,864 425 - -

Subtotal $ 575,436 $ 575,011 $ 425 $ - $ -

Total contractual obligations

and commercial

commitments $2,630,248 $ 985,732 $576,383 $546,128 $522,005

(a) Represents obligations for interest payments on long-term debt, capital lease and financing obligations and

includes projected interest on $14.5 million of variable rate long-term debt issued in 2005, based upon 2006

effective interest rates.

(b) We retain a significant portion of the risk for our workers’ compensation, employee health insurance,

general liability, property loss and automobile insurance. As these obligations do not have scheduled

maturities, these amounts represent undiscounted estimates based upon actuarial assumptions. These

amounts are reflected on an undiscounted basis in our consolidated balance sheets.

(c) Operating lease obligations are inclusive of amounts included in deferred rent and closed store obligations

in our consolidated balance sheets.

(d) Commercial commitments include advertising contracts, contractual commitments for DC improvements

and equipment purchases, information technology license and support agreements, letters of credit for

import merchandise, and other inventory purchase obligations.

(e) Purchase obligations include legally binding agreements for advertising, DC capital expenditures, software

licenses and support, and merchandise purchases excluding such purchases subject to letters of credit.

In 2006 and 2005, our South Carolina-based wholly owned captive insurance subsidiary,

Ashley River Insurance Company (“ARIC”), had cash and cash equivalents and investments

balances held pursuant to South Carolina regulatory requirements to maintain a specified

percentage of ARIC’ s liability and equity balances (primarily insurance liabilities) in the form of

certain specified types of assets and, as such, these investments are not available for general

corporate purposes. At February 2, 2007, these cash and cash equivalents balances and

investments balances were $3.2 million and $49.7 million, respectively.

In June 2006, we amended our existing revolving credit facility. The amended credit

facility has a maximum commitment of $400 million (with the ability to increase to $500 million

upon our mutual agreement with the lenders) and expires in June 2011. In addition to revolving

loans, the amended credit facility includes a $15 million swingline loan sub-limit and a $75

million letter of credit sub-facility. Outstanding swingline loans and letters of credit reduce the

borrowing capacity under the amended credit facility. In December 2006, we further amended

the revolving credit facility to lower the fixed charge coverage financial covenant for future

34