Dollar General 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 2, 2007

Commission file number: 001-11421

DOLLAR GENERAL CORPORATION

(Exact name of registrant as specified in its charter)

TENNESSEE

(State or other jurisdiction of

incorporation or organization)

61-0502302

(I.R.S. Employer

Identification No.)

100 MISSION RIDGE

GOODLETTSVILLE, TN 37072

(Address of principal executive offices, zip code)

Registrant’s telephone number, including area code: (615) 855-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Common Stock

Series B Junior Participating

Preferred Stock Purchase Rights

Name of the exchange on which registered

New York Stock Exchange

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Table of contents

-

Page 1

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended February 2, 2007 Commission file number: 001-11421 DOLLAR GENERAL CORPORATION (Exact name of registrant as ... -

Page 2

... [ ] Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b2 of the Exchange Act). Yes [ ] No [X] The aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price on the New York Stock Exchange as of... -

Page 3

... "Overall Business Strategy", "Seasonality" and "Competition"; Item 3; and Item 7 subsections "Executive Overview" and "Critical Accounting Policies and Estimates", in our other filings with the Securities and Exchange Commission ("SEC"), press releases and other communications provide examples of... -

Page 4

... general merchandise at everyday low prices. Through conveniently located stores, we offer a focused assortment of basic consumable merchandise including health and beauty aids, packaged food and refrigerated products, home cleaning supplies, housewares, stationery, seasonal goods, basic clothing... -

Page 5

... merchandise in a number of core categories, such as health and beauty aids, packaged food and refrigerated products, home cleaning supplies, housewares, stationery, seasonal goods, basic clothing and domestics. This focused merchandise assortment allows customers to shop at Dollar General stores... -

Page 6

... related to our merchandising and real estate strategies based upon a comprehensive analysis of the performance of each of our stores and the impact of our inventory model on our ability to effectively serve our customers. With regard to merchandising, we reviewed our historic inventory management... -

Page 7

..., we installed new systems for store operating statements, store labor scheduling, supplier communications and transportation and claims management. In addition, we enhanced our store systems to allow us to sell Dollar General gift cards. In 2004, we added a merchandising data warehouse, completed... -

Page 8

...as home products, basic clothing and seasonal merchandise, as we become increasingly able to improve our merchandise assortments and stock our stores with more current inventory. Achievement of our goals is contingent upon this expected sales mix improvement as well as effective inventory management... -

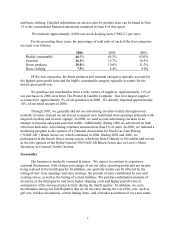

Page 9

... clothing. Detailed information on our net sales by product class can be found in Note 13 to the consolidated financial statements contained in Item 8 of this report. We maintain approximately 4,900 core stock-keeping units ("SKUs") per store. For the preceding three years, the percentage of total... -

Page 10

... below under "Management' s Discussion and Analysis of Financial Condition and Results of Operations". The Dollar General Store The typical Dollar General store is operated by a manager, an assistant manager and two or more sales clerks. Approximately 49% of our stores are located in strip shopping... -

Page 11

... bargaining agreements. Competition We operate in the discount retail merchandise business, which is highly competitive with respect to price, store location, merchandise quality, assortment and presentation, in-stock consistency, and customer service. We compete with discount stores and with many... -

Page 12

... planned real estate and merchandising strategic and operational changes and their related timing, charges and cost estimates and anticipated results and benefits; the expected number of new store openings, relocations and remodels; our gross profit rate; the expected sale of inventory and our plans... -

Page 13

... costs, transportation costs, inflation, higher costs of labor, insurance and healthcare, foreign exchange rate fluctuations, higher tax rates and other changes in tax laws, changes in other laws and regulations and other economic factors increase our cost of sales and operating, selling, general... -

Page 14

..., merchandise selection and availability, services offered to customers, location, store hours, in-store amenities and price. If we fail to respond effectively to competitive pressures and changes in the retail markets, it could adversely affect our financial performance. See "Business" in Item... -

Page 15

... and training needs, store disruptions due to management changeover and potential delays in new store openings or adverse customer reactions to inadequate customer service levels due to personnel shortages. Competition for qualified employees exerts upward pressure on wages paid to attract such... -

Page 16

... a network of geographically dispersed management personnel. Our inability to effectively and efficiently operate our stores, including the ability to control losses resulting from inventory and cash shrinkage, may negatively affect our sales and/or operating margins. Our planned future growth... -

Page 17

... governing the sale of products, may require extensive system and operating changes that may be difficult to implement and could increase our cost of doing business. Untimely compliance or noncompliance with applicable regulations or untimely or incomplete execution of a required product recall can... -

Page 18

... to be expected for any other quarter or for any year, and revenues and net income for any particular future period may decrease. In the future, operating results may fall below the expectations of securities analysts and investors. In that event, the price of our securities could decrease. Failure... -

Page 19

... disruption to our business and a distraction of our management and employees from day-to-day operations, because matters related to the merger may require substantial commitments of their time and resources; uncertainty about the effect of the merger may adversely affect our credit rating and our... -

Page 20

... New Jersey New Mexico New York North Carolina Ohio Oklahoma Pennsylvania South Carolina South Dakota Tennessee Texas Utah Vermont Virginia West Virginia Wisconsin Number of Stores 90 24 41 231 456 452 281 410 306 5 409 958 4 1 252 151 99 As of March 2, 2007, we operated 8,260 retail stores located... -

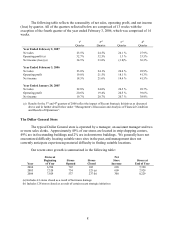

Page 21

... quarter of 2006. PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Our common stock is traded on the New York Stock Exchange under the symbol "DG." The following table sets forth the range of the high and low sales prices... -

Page 22

...31/06 01/01/07-02/02/07 Total Total Number of Shares Purchased (a) 1,040 40 464 1,544 Average Price Paid per Share $ 15.80 $ 15.44 $ 17.26 $ 16.23 (a) Shares purchased in open market transactions in satisfaction of our obligations under certain employee benefit plans. (b) On November 29, 2006, we... -

Page 23

...stock Weighted average diluted shares FINANCIAL POSITION: Total assets Long-term obligations Shareholders' equity Return on average assets (c) Return on average equity (c) OPERATING DATA: Retail stores at end of period Year-end selling square feet Highly consumable sales Seasonal sales Home products... -

Page 24

... competitive retail industry and face strong sales competition from other retailers that sell general merchandise and food. We strive to keep operating costs as low as possible in order to support our every day low price strategy while seeking a strong return on our investment. This effort affects... -

Page 25

... of its efforts throughout the organization. In particular, this team developed and has begun to implement significant new programs related to our merchandising and real estate strategies. Early in the fiscal year, we made changes to address unexpected shortfalls in same-store sales performance and... -

Page 26

...had a positive impact on sales, they had a negative impact on our gross profit rate in 2006. In total, our gross profit rate declined by 289 basis points to 25.8% in 2006 compared to 28.7% in 2005. Significantly impacting our gross profit rate, as a result of the related effect on cost of goods sold... -

Page 27

... merchandise assortments and stock our stores with more current inventory. Achievement of our gross profit targets is contingent upon this expected sales mix improvement as well as effective inventory management and reductions in inventory shrink and damages. In addition to these strategic efforts... -

Page 28

... success of our selection of new store locations and merchandising strategies. Total net sales increased 6.8% in 2006. Note that fiscal 2005 included a 53rd week. Same-store sales growth indicates whether our merchandising strategies, store execution and customer service in existing stores have been... -

Page 29

... in our merchandise planning, buying and allocation processes. In addition, we intend to continue our efforts to significantly reduce inventory shrink and to develop a strategic roadmap to reduce store manager turnover. We can provide no assurance that we will be successful in executing these... -

Page 30

... of net sales Seasonal % of net sales Home products % of net sales Basic clothing % of net sales Net sales Cost of goods sold % of net sales Gross profit % of net sales Selling, general and administrative expenses % of net sales Operating profit % of net sales Interest income % of net sales Interest... -

Page 31

... in same-store sales is primarily attributable to an increase in average customer purchase. We also believe that the strategic merchandising and real estate initiatives discussed above in the "Executive Overview" had a positive impact on net sales. We monitor our sales internally by the following... -

Page 32

...had a positive impact on sales, they had a negative impact on our gross profit rate in 2006. In total, our gross profit rate declined by 289 basis points to 25.8% in 2006 compared to 28.7% in 2005. Significantly impacting our gross profit rate, as a result of the related effect on cost of goods sold... -

Page 33

... close in 2007, as further discussed above in the "Executive Overview"; lease contract terminations totaling $5.7 million related to these stores; higher store occupancy costs (increased 12.1%) due to higher average monthly rentals associated with our leased store locations; higher debit and credit... -

Page 34

... from an internal restructuring. Offsetting these rate increases was a reduction in the income tax rate related to federal income tax credits. Due to the reduction in the Company' s 2006 income before tax, a small increase in the amount of federal income tax credits earned yielded a much larger... -

Page 35

... allowed, as applicable, purchases in the open market or in privately negotiated transactions from time to time, subject to market conditions. The objective of our share repurchase initiative is to enhance shareholder value by purchasing shares at a price that produces a return on investment that is... -

Page 36

... software licenses and support, and merchandise purchases excluding such purchases subject to letters of credit. In 2006 and 2005, our South Carolina-based wholly owned captive insurance subsidiary, Ashley River Insurance Company ("ARIC"), had cash and cash equivalents and investments balances held... -

Page 37

... in funding our growth. Interest on the notes is payable semi-annually on June 15 and December 15 of each year. We may seek, from time to time, to retire the notes through cash purchases on the open market, in privately negotiated transactions or otherwise. Such repurchases, if any, will depend on... -

Page 38

... for capital projects in existing stores. During 2006 we opened 537 new stores and remodeled or relocated 64 stores. Purchases and sales of short-term investments in 2006, which equaled net sales of $1.9 million, reflect our investment activities in tax-exempt auction rate securities as well as... -

Page 39

... of our new DCs in South Carolina and Indiana. Net sales of short-term investments in 2005 of $34.1 million primarily reflect our investment activities in tax-exempt auction rate securities. Purchases of long-term investments are related to our captive insurance subsidiary. Cash flows used... -

Page 40

...selection of the critical accounting estimates with the Audit Committee of our Board of Directors, and the Audit Committee has reviewed the disclosures presented below relating to those policies and estimates. Merchandise Inventories. Merchandise inventories are stated at the lower of cost or market... -

Page 41

... to a group of products that is not fairly uniform in terms of its cost and selling price relationship and turnover; applying the RIM to transactions over a period of time that include different rates of gross profit, such as those relating to seasonal merchandise; inaccurate estimates of inventory... -

Page 42

... future cash flows (discounted at our credit adjusted risk-free rate) or other reasonable estimates of fair market value. In connection with the strategic real estate initiatives noted above, we performed a comprehensive review of all of our stores and recorded impairment charges in 2006 totaling... -

Page 43

...the life of the applicable lease term or the estimated useful life of the asset. For store closures where a lease obligation still exists, we record the estimated future liability associated with the rental obligation on the date the store is closed in accordance with SFAS 146, "Accounting for Costs... -

Page 44

... price equal to the market value of the underlying common stock on the date of grant, employee compensation cost related to stock options generally was not reflected in our results of operations prior to the adoption of SFAS 123(R), "Share-Based Payment." The Compensation Committee of our Board... -

Page 45

... 158 includes a requirement to measure plan assets and benefit obligations as of the date of a company' s fiscal year-end statement of financial position effective for fiscal years ending after December 15, 2008. No final determination has yet been made regarding the timing or adoption of the second... -

Page 46

... derivatives. As a matter of policy, we do not buy or sell financial instruments for speculative or trading purposes and all financial instrument transactions must be authorized and executed pursuant to approval by the Board of Directors. All financial instrument positions taken by us are used to... -

Page 47

... Standards No. 123(R), "Share-Based Payment." We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Dollar General Corporation and subsidiaries' internal control over financial reporting as of February 2, 2007... -

Page 48

... (see Note 1) ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Income taxes receivable Deferred income taxes Prepaid expenses and other current assets Total current assets Net property and equipment Other assets, net Total assets LIABILITIES AND... -

Page 49

CONSOLIDATED STATEMENTS OF INCOME (In thousands except per share amounts) February 2, 2007 (52 weeks) Net sales Cost of goods sold Gross profit Selling, general and administrative Operating profit Interest income Interest expense Income before income taxes Income taxes Net income Earnings per share:... -

Page 50

... on derivatives Comprehensive income Cash dividends, $0.20 per common share Issuance of common stock under stock incentive plans Tax benefit from share-based payments Repurchases of common stock Purchases of common stock by employee deferred compensation trust, net (3 shares) Reversal of unearned... -

Page 51

...: Merchandise inventories Prepaid expenses and other current assets Accounts payable Accrued expenses and other liabilities Income taxes Other Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Purchases of short-term investments Sales... -

Page 52

Supplemental schedule of noncash investing and financing activities: Purchases of property and equipment awaiting processing for payment, included in Accounts payable Purchases of property and equipment under capital lease obligations Elimination of financing obligations (See Note 8) Elimination of ... -

Page 53

... statements. Business description The Company sells general merchandise on a retail basis through 8,229 stores (as of February 2, 2007) located primarily in the southern, southwestern, midwestern and eastern United States. The Company has DCs in Scottsville, Kentucky; Ardmore, Oklahoma; South... -

Page 54

...-party credit card, debit card and electronic benefit transactions classified as cash and cash equivalents totaled approximately $11.6 million and $7.8 million at February 2, 2007 and February 3, 2006, respectively. The Company' s cash management system provides for daily investment of available... -

Page 55

...as a component of Selling, general and administrative ("SG&A") expense. In general, the Company invests excess cash in shorter-dated, highly liquid investments such as money market funds, certificates of deposit, and commercial paper. Depending on the type of securities purchased (debt versus equity... -

Page 56

...securities Other debt securities Cost $ 59,196 7,590 3,847 47,151 117,784 $ Gross Unrealized Gains Losses 5 2,319 2,324 $ 55 12 6 73 Estimated Fair Value $ 59,141 7,578 3,846 49,470 120,035 Available-for-sale securities Equity securities Trading securities Equity securities Total debt and equity... -

Page 57

...sold is based upon the specific identification method. Merchandise inventories Inventories are stated at the lower of cost or market with cost determined using the retail last-in, first-out ("LIFO") method. Under the Company' s retail inventory method ("RIM"), the calculation of gross profit and the... -

Page 58

... of the assets exceeds the undiscounted future cash flows over the life of the lease. The Company' s estimate of undiscounted future cash flows over the lease term is based upon historical operations of the stores and estimates of future store profitability which encompasses many factors that are... -

Page 59

... and is accounted for as a reduction of merchandise purchase costs and recognized in the statement of operations at the time the goods are sold. However, certain specific, incremental and otherwise qualifying SG&A expenses related to the promotion or sale of vendor products may be offset by cash... -

Page 60

... the operating subsidiary companies premiums to insure the retained workers' compensation and non-property general liability exposures. Pursuant to South Carolina insurance regulations, ARIC has cash and cash equivalents and investment balances that are not available for general corporate purposes... -

Page 61

... incentive plan under which stock options, restricted stock, restricted stock units and other equity-based awards may be granted to officers, directors and key employees. Effective February 4, 2006, the Company adopted SFAS 123 (Revised 2004) "Share Based Payment" and began recognizing compensation... -

Page 62

... Stock Issued to Employees" ("APB 25"), and had provided pro forma disclosures as permitted under SFAS 123. Because stock options were granted at an exercise price equal to the market price of the underlying common stock on the date of grant, compensation cost related to stock options was generally... -

Page 63

...stores at the time the customer takes possession of merchandise. All sales are net of discounts and estimated returns and are presented net of taxes assessed by governmental authorities that are imposed concurrent with those sales. The liability for retail merchandise returns is based on the Company... -

Page 64

...Deferred income tax expense or benefit is the net change during the year in the Company' s deferred income tax assets and liabilities. Management estimates The preparation of financial statements and related disclosures in conformity with accounting principles generally accepted in the United States... -

Page 65

... Report on Form 10-Q for the quarterly period ended August 4, 2006, the Company announced it was considering modifying its historical inventory management model and accelerating its recently enhanced real estate strategy. The outcome of these deliberations is set forth below. Inventory management... -

Page 66

...1.6 $ 7.8 2006 Payments and Other $ 0.7 1.3 $ 2.0 Balance, February 2, 2007 $ 5.0 0.3 0.2 0.3 $ 5.8 Lease contract termination costs One-time employee termination benefits Other associated store closing costs Inventory liquidation fees Total In addition, non-cash costs and charges of approximately... -

Page 67

...below-cost inventory adjustments, which are included in cost of goods sold in the consolidated statement of income for 2006. As noted above, the Company expects to incur additional charges in future periods when the related expenses are incurred. The estimated amount and timing of these future costs... -

Page 68

... increase of $2.6 million related to a benefit recognized in 2005 related to an internal restructuring. Offsetting these rate increases was a reduction in the income tax rate related to federal income tax credits. Due to the reduction in the Company' s 2006 income before tax, a small increase in the... -

Page 69

... 2004 tax rate include the recognition of state tax credits of approximately $2.3 million related to the Company' s construction of a DC in Indiana and a benefit of approximately $2.6 million related to an internal restructuring that was completed during 2005. Deferred taxes reflect the effects of... -

Page 70

... state tax credits that were unrelated to the 2005 internal restructuring. The change in the valuation allowance was an increase of $3.2 million in 2006 and a decrease of $0.1 million in both 2005 and 2004. Based upon expected future income and available tax planning strategies, management believes... -

Page 71

...2007). In December 2006, the Company amended the revolving credit facility to lower the fixed charge coverage test for future periods through fiscal 2008 to take into account the impact that the initiatives discussed in Note 2 related to merchandising and real estate strategies may have on the ratio... -

Page 72

... carry a primary lease term of between 7 and 10 years with multiple renewal options. Approximately half of the stores have provisions for contingent rentals based upon a percentage of defined sales volume. Certain leases contain restrictive covenants. As of February 2, 2007, the Company is not aware... -

Page 73

... statements. Future minimum payments as of February 2, 2007 for capital leases, financing obligations and operating leases are as follows: (In thousands) 2007 2008 2009 2010 2011 Thereafter Total minimum payments Less: imputed interest Present value of net minimum lease payments Less: current... -

Page 74

...for the Northern District of Alabama (Edith Brown, on behalf of herself and others similarly situated v. Dolgencorp, Inc., and Dollar General Corporation, CV02-C-0673-W ("Brown")). Brown was a collective action against the Company on behalf of current and former salaried store managers claiming that... -

Page 75

... Inc., et al. was filed in the United States District Court for the Northern District of Alabama (Case No. 7:06-cv-01537-LSC) in which the plaintiff alleges that she and other current and former Dollar General store managers were improperly classified as exempt executive employees under the FLSA and... -

Page 76

...all others similarly situated, v. Dolgencorp, Inc. d/b/a Dollar General, 06-CV-0250 ("Beeman"), filed on February 28, 2006 in the United States District Court for the Northern District of New York, in which the plaintiff, a former store manager, raised claims substantially similar to those raised in... -

Page 77

...of the 401(k) plan subject to Internal Revenue Code limitations. The Company currently matches employee contributions, including catch-up contributions, at a rate of 100% of employee contributions, up to 5% of annual eligible salary, after an employee has been employed for one year and has completed... -

Page 78

... Dollar General Corporation CDP/SERP Plan) for a select group of management and highly compensated employees. The supplemental retirement plan is a noncontributory defined contribution plan with annual Company contributions ranging from 2% to 12% of base pay plus bonus depending upon age plus years... -

Page 79

... Stock Option and the deferred compensation will be paid in accordance with the director' s election in a lump sum or in monthly installments over a 5, 10 or 15 year period, or a combination of both, at the time designated by the plan upon a director' s resignation or termination from the Board... -

Page 80

... stock units to each non-employee director that vest one year after the grant date (subject to earlier vesting upon retirement, change in control or other circumstances set forth in the plan) and generally may not be paid until the individual has ceased to be a member of the Company' s Board... -

Page 81

... to January 24, 2006, other than options granted during that time period to the officers of the Company at the level of Executive Vice President or above, accelerated effective as of the date that is six months after the applicable grant date. Certain options granted on January 24, 2006 to certain... -

Page 82

... 5.0 Expected dividend yield Expected stock price volatility Weighted average risk-free interest rate Expected term of options (years) Expected dividend yield - This is an estimate of the expected dividend yield on the Company' s stock. This estimate is based on historical dividend payment trends... -

Page 83

... unrecognized compensation cost related to non-vested stock options was $11.6 million with an expected weighted average expense recognition period of 3.1 years. All stock options granted in the years ended February 2, 2007 and February 3, 2006 under the terms of the Company' s stock incentive plan... -

Page 84

... the plan to non-employee directors during the year ended February 2, 2007 are scheduled to vest over a oneyear period from the respective grant dates, but become payable only after the recipient ceases to serve as a Board member (or upon a change-in-control as discussed above). The Company accounts... -

Page 85

... 30, 2004, the Board of Directors authorized the Company to repurchase up to 10 million shares of its outstanding common stock on each date. These authorizations allow or allowed, as applicable, for purchases in the open market or in privately negotiated transactions from time to time, subject to... -

Page 86

from investing activities and recoveries related to inventory losses and business interruption are included in cash flows from operating activities. 13. Segment reporting The Company manages its business on the basis of one reportable segment. See Note 1 for a brief description of the Company' s ... -

Page 87

... a 14-week accounting period, each quarter listed below was a 13-week accounting period. The sum of the four quarters for any given year may not equal annual totals due to rounding. Amounts are in thousands except per share data. Quarter 2006: Net sales Gross profit Operating profit Net income (loss... -

Page 88

...by the close of fiscal 2007. As a result, in the third quarter of 2006, the Company recorded SG&A charges and a lower of cost or market inventory impairment, which reduced the Company' s net income and related per share amounts. Also, the fourth quarter 2006 change in merchandising strategy resulted... -

Page 89

... 2007 DOLLAR GENERAL CORPORATION BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Income tax receivable Deferred income taxes Prepaid expenses and other current assets Total current assets Property and equipment, at cost Less accumulated... -

Page 90

... GENERAL CORPORATION BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents Short-term investments Merchandise inventories Deferred income taxes Prepaid expenses and other current assets Total current assets Property and equipment, at cost Less accumulated depreciation and amortization Net... -

Page 91

... 82,420 - $ 86,160 $ (86,160) $ 137,943 For the year ended February 3, 2006 DOLLAR GENERAL CORPORATION STATEMENTS OF INCOME: Net sales Cost of goods sold Gross profit Selling, general and administrative Operating profit Interest income Interest expense Income before income taxes Income taxes... -

Page 92

...Merchandise inventories Prepaid expenses and other current assets Accounts payable Accrued expenses and other Income taxes Other Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Purchases of short-term investments Sales of short-term... -

Page 93

...Merchandise inventories Prepaid expenses and other current assets Accounts payable Accrued expenses and other Income taxes Other Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Purchases of short-term investments Sales of short-term... -

Page 94

...Merchandise inventories Prepaid expenses and other current assets Accounts payable Accrued expenses and other Income taxes Other Net cash provided by operating activities Cash flows from investing activities: Purchases of property and equipment Purchases of short-term investments Sales of short-term... -

Page 95

... in Exchange Act Rule 13a-15(e), as of February 2, 2007. Based on this evaluation, the Chief Executive Officer and the Chief Financial Officer each concluded that our disclosure controls and procedures were effective as of February 2, 2007. (b) Management' s Annual Report on Internal Control Over... -

Page 96

...Reporting. Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting To the Board of Directors and Shareholders of Dollar General Corporation Goodlettsville, Tennessee We have audited management's assessment, included in the accompanying Management's Annual... -

Page 97

... in conditions, or that the degree of compliance with the policies or procedures may deteriorate. In our opinion, management's assessment that Dollar General Corporation and subsidiaries maintained effective internal control over financial reporting as of February 2, 2007, is fairly stated, in all... -

Page 98

... Committees), and the Code of Business Conduct and Ethics adopted by the Board and applicable to all Dollar General directors, officers and employees. Requests for copies may be directed to Investor Relations, Dollar General Corporation, 100 Mission Ridge, Goodlettsville, TN 37072, or telephone (615... -

Page 99

... Officer Division President, Merchandising, Marketing & Supply Chain Division President, Store Operations & Store Development Executive Vice President & General Counsel Executive Vice President, Human Resources Senior Vice President & Controller Senior Vice President, Dollar General Market Director... -

Page 100

... 2006) and as Director of Development and Corporate Relations (1992-2006) for North Central College in Naperville, Illinois. From 1988 to 1992, Ms. Knuckles was a private investor managing several family businesses. Ms. Knuckles also served as a Corporate Vice President both for Beatrice Foods... -

Page 101

...2005 as Division President, Merchandising, Marketing and Supply Chain. Prior to joining Dollar General, he served from April 2005 through November 2005 as Executive Vice President, Retail Operations of Mervyn' s Department Store, a privately held company operating 265 department stores, where he was... -

Page 102

...locations as Sears' Senior Vice President and General Merchandise Manager of the Specialty Retail Group. Prior to joining Sears, Mr. Buley spent 15 years in various positions with Kohl' s Corporation, which operates a chain of specialty department stores, including Executive Vice President of Stores... -

Page 103

... to communicate directly with the Board, with a particular director (including the Presiding Director) or with the non-management directors as a group. To do so, send a letter addressed to the applicable Board member(s), c/o Corporate Secretary, 100 Mission Ridge, Goodlettsville, TN 37072. The... -

Page 104

... to the applicable Board member(s) on at least a quarterly basis. Complaints or concerns about our accounting, internal accounting controls, auditing or other matters may be submitted to our legal department or to our Audit Committee using the address or phone number published on our web site. These... -

Page 105

...Mr. Gee (13,800); Ms. Knuckles (13,800); Mr. Purcell (13,800); Mr. Robbins (13,800); Mr. Thornburgh (4,600); and Mr. Wilds (13,800). Dividend equivalents on the RSUs are credited to the director' s RSU account in accordance with the terms of the 1998 Stock Incentive Plan. No compensation expense was... -

Page 106

... units and stock options count towards these stock ownership requirements. A director who also is a Dollar General employee does not receive any separate compensation for Board service. Cash Compensation. We pay non-employee directors an annual cash retainer (payable in quarterly installments) and... -

Page 107

... units upon termination of a director' s Board service due to death, disability or normal retirement or upon a change-in-control of Dollar General or in the discretion of our Compensation Committee upon a potential change-in-control. Our Compensation Committee determines the form of payment for RSUs... -

Page 108

... of at least 2/3 of our Board members who served as directors at the beginning of the period; or upon the consummation of a merger, other business combination or sale of assets of, or cash tender or exchange offer or contested election with respect to, Dollar General if less than a majority of... -

Page 109

... relating to the compensation of directors and executive officers (including the NEOs). The Committee operates pursuant to a written Charter adopted by the Board, a current copy of which is available on the "Investing - Corporate Governance" portion of our web site located at www.dollargeneral.com... -

Page 110

...or supplements to our benefit plans, trusts and related documents. The Board has adopted a Charter to govern the BAC, and the members of the BAC are appointed and removed by the Committee. The BAC reports directly to the Committee at least annually. The Compensation Committee Charter also authorizes... -

Page 111

... to meet in separate private sessions with each of the compensation consultant, the EVP of Human Resources and the General Counsel. What are the philosophy and objectives of Dollar General's compensation programs for its NEOs? The goals of our executive compensation strategy are to attract, retain... -

Page 112

... between base salary and long-term and annual incentive compensation. In approving compensation, the recent compensation history of the officer, including special or unusual compensation payments, shall be taken into consideration. Cash incentive compensation plans for officers shall link pay to... -

Page 113

... below under "Does management determine or recommend the amount or form of executive or director compensation?") and in general employee compensation and benefits matters. Neither the Committee nor Hewitt believes that providing these services undermines in any way the independence of the advice or... -

Page 114

... to lock-in members of a new management team to execute changes necessary to meet strategic objectives. The Committee also wanted to give standard protections to the NEOs as well as to Dollar General from a competitive standpoint should the NEO decide to leave our employ. The Committee approved... -

Page 115

... NEO' s specific compensation, the Committee starts with the competitive median. The Committee then considers any unique job responsibilities of any of our NEOs, the importance of that role to Dollar General, and our specialized niche in the retail sector. The Committee, working with Hewitt, tries... -

Page 116

executive officer and director compensation in the best interests of Dollar General and our shareholders. What are the elements of NEO compensation and why does the Committee choose to pay them? We provide compensation in the form of base salary, short-term incentives, long-term incentives, benefits... -

Page 117

..., inventory management, distribution and capacity management, new concept development, leadership development, succession planning, diversity, employee benefits, turnover reduction and retention strategies, workplace improvements, customer satisfaction, technology improvements, internal controls... -

Page 118

• Executive Vice President, Human Resources, Challis M. Lowe: The Committee reviewed with Mr. Perdue the objectives for Ms. Lowe, which included recruiting a significant number of new executives and driving more analytical rigor in the human resources group in its support of the Committee. The ... -

Page 119

... set at 32.5% of base salary (threshold), 65% of base salary (target), and 130% of base salary (maximum). Hewitt also advised at this meeting that the prior year' s Teamshare target payout level of 80% of base salary for the CEO was low in relation to the market comparator group and general industry... -

Page 120

... to the real estate site selection strategy resulting in slowing the growth in store openings in favor of improved site quality; changing sourcing and packaway strategies; and closing a significant number of stores in underperforming locations. After extensive discussion and analysis, and with... -

Page 121

... generally at the level of Vice President or above. Those grants are made at the first Committee meeting following the officer' s start date per the terms of the officer' s employment agreement. In these cases also, it is our practice to establish the exercise price of options as the closing market... -

Page 122

...per share of Dollar General common stock. All options to acquire shares of Dollar General common stock will vest immediately prior to the effective time of the merger and holders of such options will, unless otherwise agreed by the holder and Parent, be entitled to receive an amount in cash equal to... -

Page 123

... the leased option, we provided Ms. Lowe with a company-leased automobile, and paid for her gasoline, repairs, service, and insurance and provided a gross-up payment to pay the tax cost of the imputed income. The incremental costs we incurred related to these benefits in fiscal 2006 are reported in... -

Page 124

... connection with our annual strategic planning meeting. In addition, we believe that our officers' participation on non-profit boards and in community events serves as a positive reflection upon Dollar General and a great example of corporate leadership. Therefore, we support nonprofit organizations... -

Page 125

... share, total sales growth, same store sales growth, operating margins, return on invested capital, free cash flow, inventory turns and return on assets), leadership development and succession, strategic planning, our growth, new concept development, distribution and capacity management, inventory... -

Page 126

...' s base salary and long-term incentive compensation at the regular executive compensation review session in March 2006. Rather, the Committee decided to include those decisions in the negotiation process relating to the contract extension discussed further below. As described above, the net income... -

Page 127

... the market comparator group and general industry data provided by Hewitt. The Committee believed it was necessary to provide above median long-term incentive compensation as an inducement for Mr. Perdue to sign the contract extension. Also, this above market compensation was provided in the form of... -

Page 128

... same companies listed in the employment contracts of our executive vice presidents. What compensation and benefits would be paid to NEOs upon the occurrence of various termination of employment events or upon a change-in-control? Termination arrangements are provided to NEOs in case of termination... -

Page 129

... including the CEO, are reasonable, within benchmarking standards for comparable companies and in the best interest of shareholders. Compensation Committee Report Our Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of... -

Page 130

...Tehle, Executive Vice President & Chief Financial Officer Beryl J. Buley, Division President, Merchandising, Marketing & Supply Chain Kathleen R. Guion, Division President, Store Operations & Store Development Challis M. Lowe, Executive Vice President, Human Resources Year 2006 Salary ($)(1) 1,037... -

Page 131

...,119 due to acquisition and moving costs in connection with his new home. Includes $7,175 for premiums paid under our life insurance program, $3,333 for premiums paid under our disability insurance program, $22,501 for Dollar General' s contributions to the SERP, $14,001 for Dollar General' s match... -

Page 132

...During Fiscal 2006 The table below sets forth information regarding grants of plan-based awards to our NEOs during fiscal 2006. There are no estimated possible payouts under equity incentive plan awards for fiscal 2006. All Other Stock Awards: Number of Shares of Stock or Units (#)(2) 365,000 10,600... -

Page 133

....63 17.54 18.51 - (5) (6) (7) (8) (9) (10) (11) (12) (13) Includes the number of unvested shares underlying the dividend equivalent units credited to RSU accounts. Based on the closing price of Dollar General' s common stock on February 2, 2007 ($17.23). These options became exercisable in three... -

Page 134

...Guion Challis M. Lowe (1) Includes the number of shares underlying dividend equivalents that vested in conjunction with the vesting of the related RSUs. (2) The value realized is based on the closing market price of the underlying stock on the applicable vesting dates. Pension Benefits Fiscal 2006... -

Page 135

...the SERP maximum of 15 years. Mr. Perdue' s base salary and "applicable annual bonus" will be deemed to be paid during the 5 additional years of credited service for calculating his "final average compensation". • • Subject to any 6 month deferral in payment requirement for tax law compliance... -

Page 136

... the following amounts reported in the Summary Compensation Table in the proxy statement for the fiscal years indicated: $43,168 in 2005; and $57,689 in 2004. Pursuant to the CDP, participants may annually elect to defer up to 65% of base salary and up to 100% of bonus pay. Participants make... -

Page 137

...be paid in cash by (a) lump sum, (b) monthly installments over a 5, 10 or 15-year period or (c) a combination of lump sum and installments. Otherwise, payment is made in a lump sum. The vested amount will be payable at the time designated by the Plan upon the participant' s termination of employment... -

Page 138

...by the terms of that plan or agreement. These benefits include vested amounts in the CDP/SERP Plan discussed after the Non Qualified Deferred Compensation Table in this report. Regardless of the manner in which Mr. Perdue' s employment terminates, but subject to any 6-month delay in payment required... -

Page 139

... Dollar Stores, Fred' s, the 99 Cents Stores and Dollar Tree Stores, or any person then planning to enter the deep discount consumable basics retail business, if Mr. Perdue is required to perform services for that person which are substantially similar to those he provided or directed at any time... -

Page 140

... payments under our group life insurance program in an amount, up to a maximum of $3 million, equal to 2.5 times the NEO' s annual base salary. We have excluded from the tables below amounts that the NEO would receive under our disability insurance program since the same benefit level is provided... -

Page 141

... (as more fully described in the applicable employment agreement): • our failure to continue any significant compensation plan or benefit without replacing it with a similar plan or a compensation equivalent (except for across-the-board changes or terminations similarly affecting at least 95% of... -

Page 142

... to 2.5 times the sum of his annual base salary and the greater of his actual annual incentive bonus earned in the fiscal year immediately prior to his service termination date or his target incentive bonus for the fiscal year in which his employment terminated. Subject to any applicable prohibition... -

Page 143

... pay for or provide medical benefits no less favorable than our retiree medical benefits in effect as of April 2, 2003. We also will gross-up our payment of those premiums to the extent they are taxable to Mr. Perdue. √ We will credit Mr. Perdue with 5 additional years of continuous service under... -

Page 144

..., "cause" means (as more fully described in the applicable employment agreement): • • • any act involving fraud or dishonesty; any material breach of any SEC or other law or regulation or any Dollar General policy governing securities trading or inappropriate disclosure or "tipping"; any... -

Page 145

... of continuous service under his SERP. In determining his base salary and bonus for these additional years for purposes of calculating final average compensation, we use his base salary on his termination date (or, if higher, at the time immediately prior to the change-in-control) and the greater... -

Page 146

... the consummation of a merger, other business combination or sale of assets of, or cash tender or exchange offer or contested election with respect to, Dollar General if less than 65% (less than a majority, for purposes of our 1998 Stock Incentive Plan and our CDP/SERP Plan) of our voting securities... -

Page 147

... Stock & RSUs Due to the Event SERP Benefits Prior to the Event SERP Benefits Due to the Event Deferred Comp Plan Balance Prior to and After the Event Cash Severance Health & Welfare Continuation Payment Outplacement Section 280(G) Excise Tax & Gross-Up Due to the Event Life Insurance Proceeds Total... -

Page 148

... Stock & RSUs Due to the Event SERP Benefits Prior to the Event SERP Benefits Due to the Event Deferred Comp Plan Balance Prior to and After the Event Cash Severance Health & Welfare Continuation Payment Outplacement Section 280(G) Excise Tax & Gross-Up Due to the Event Life Insurance Proceeds Total... -

Page 149

... of which any of our directors served as an executive officer during fiscal 2006. ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS (a) Equity Compensation Plan Information. The following table sets forth information about securities authorized... -

Page 150

... to the Employment Agreement, effective as of April 2, 2003, by and between Dollar General and Mr. Perdue, as well as 133,253 shares of phantom stock allocated to an employee' s or a director' s account under our CDP/SERP Plan or the DDCP (collectively, the "Deferred Plans"). The number of shares... -

Page 151

... Investment Company Act of 1940, to form a controlling group with respect to FMR. The following table shows the amount of our common stock beneficially owned, as of March 20, 2007, by our directors and NEOs individually and by our directors and all of our executive officers as a group, calculated... -

Page 152

... Robbins Richard E. Thornburgh David M. Wilds David M. Tehle Beryl J. Buley Kathleen R. Guion Challis M. Lowe All current directors and executive officers as a group (18 persons) Amount and Nature of Beneficial Ownership 29,444 (1) 50,251 (1) 13,780 (1) 49,313 (1) 15,938 (1) 19,602 (1)(2)(4) 1,107... -

Page 153

... set forth in the New York Stock Exchange listing standards as well as certain Board-adopted categorical independence standards. These guidelines are contained in our Corporate Governance Principles or, with respect to interests of less than 1% of a publicly held vendor, in our Code of Business... -

Page 154

... entity' s consolidated gross revenues. In addition, simultaneous service by a director or an immediate family member and a member of our management team or an immediate family member on the board of a tax-exempt entity will not preclude a director' s independence. • • Certain Relationships... -

Page 155

... last 3 years a partner or employee of that firm who personally worked on our audit within that time. Certain Compensatory Relationships. A director' s independence is not impaired by our employment of any of the director' s immediate family members in a capacity other than executive officer if the... -

Page 156

...our executive officers on the board of a non-profit entity. Less than 1% shareholder of a privately-held entity to which we made payments for merchandise in each of the entity' s last 3 and current fiscal years that exceeded (or are expected to exceed) 2% of the entity' s consolidated gross revenues... -

Page 157

.... 2005 fees include services relating to accounting consultations with respect to FASB Statement 123(R), "Share-Based Payment." (2) Both 2006 and 2005 fees include services relating to a LIFO tax calculation and tax advisory services related to inventory, as well as international, federal, state and... -

Page 158

... meeting with respect to all services so pre-approved by him or her. PART IV ITEM 15. (a) EXHIBITS AND FINANCIAL STATEMENT SCHEDULES Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Shareholders' Equity... -

Page 159

... Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. DOLLAR GENERAL CORPORATION Date: March 29, 2007 By: /s/ David A. Perdue David A. Perdue, Chairman and Chief Executive Officer We, the undersigned directors... -

Page 160

...29, 2007 /s/ Reginald D. Dickson REGINALD D. DICKSON Director March 29, 2007 /s/ E. Gordon Gee E. GORDON GEE Director March 29, 2007 /s/ Barbara M. Knuckles BARBARA M. KNUCKLES Director March 29, 2007 /s/ J. Neal Purcell J. NEAL PURCELL Director March 29, 2007 /s/ James D. Robbins JAMES... -

Page 161

...to the Company' s Current Report on Form 8-K filed February 29, 2000). First Amendment to Rights Agreement, dated August 30, 2006, between Dollar General Corporation and the Rights Agent (incorporated by reference to the Company' s Registration Statement on Form 8-A (Amendment No. 1) filed September... -

Page 162

...among Dollar General Corporation, the lenders from time to time parties thereto, SunTrust Bank, Bank of America, N.A., Keybank National Association, Regions Bank and U.S. Bank National Association (incorporated by reference to the Company' s Current Report on Form 8-K dated June 28, 2006, filed July... -

Page 163

...Statement for the June 5, 1995, Annual Meeting of Stockholders).* 1998 Stock Incentive Plan (As Amended and Restated effective as of May 31, 2006) (incorporated by reference to the Company' s Current Report on Form 8-K dated May 31, 2006, filed June 2, 2006).* Amendment to Dollar General Corporation... -

Page 164

... Restated Employment Agreement, effective as of September 18, 2006, by and between Dollar General Corporation and David A. Perdue (incorporated by reference to the Company' s Current Report on Form 8-K dated September 18, 2006, filed September 19, 2006).* 10.23 Supplemental Executive Retirement Plan... -

Page 165

... Current Report on Form 8-K dated October 14, 2005, filed on October 18, 2005). 21 23 24 31 32 * Subsidiaries of the Registrant. Consent of Independent Registered Public Accounting Firm. Power of Attorney (included as part of the signature page). Certifications of CEO and CFO under Exchange Act Rule...