Delta Airlines 2003 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2003 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

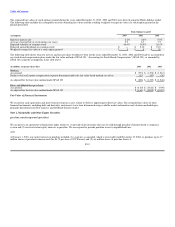

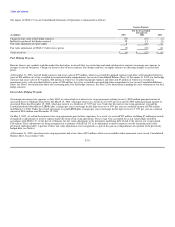

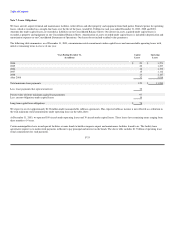

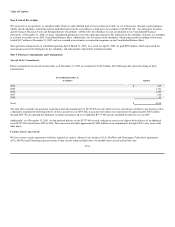

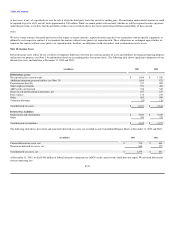

(dollars in millions) 2003 2002

Unsecured

Massachusetts Port Authority Special Facilities Revenue Bonds

5.0-5.5% Series 2001A due in installments from 2012 to 2027 338 338

1.2% Series 2001B due in installments from 2027 to January 1, 2031 (2) 80 80

1.2% Series 2001C due in installments from 2027 to January 1, 2031 (2) 80 80

8.10% Series C Guaranteed Serial ESOP Notes, due in installments from 2003 to 2009 18 92

6.65% Series C Medium-Term Notes, due March 15, 2004 236 300

7.7% Notes due December 15, 2005 302 500

7.9% Notes due December 15, 2009 499 499

9.75% Debentures due May 15, 2021 106 106

Development Authority of Clayton County, loan agreement,

1.1% Series 2000A due June 1, 2029 (2) 65 65

1.2% Series 2000B due May 1, 2035 (2) 110 116

1.3% Series 2000C due May 1, 2035 (2) 120 120

8.3% Notes due December 15, 2029 925 925

8.125% Notes due July 1, 2039 (8) 538 538

10.0% Senior Notes due August 15, 2008 248 —

8.0% Convertible Senior Notes due June 3, 2023 350 —

3.01% to 10.375% Other unsecured debt due in installments from 2004 to 2033 587 607

Less: unamortized discounts, net (62) (33)

Total unsecured debt 4,540 4,333

Total debt 12,462 10,740

Less: current maturities 1,002 666

Total long-term debt $ 11,460 $ 10,074

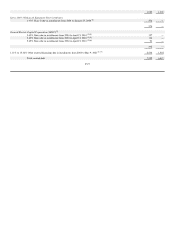

(1)

Our secured debt is collateralized by first mortgage liens on a total of 320 aircraft (71 B-737-800, 41 B-757-200, two B-767-300, 38 B-767-300ER, 21

B-767-400, eight B-777-200, and 139 CRJ-100/200/700) delivered new to us from March 1992 through December 2003. In addition, certain debt is

secured by 96 spare mainline aircraft engines (Engine Collateral), which constitute substantially all the spare mainline aircraft engines currently owned

by us, and by a substantial portion of the mainline aircraft spare parts owned by us (Spare Parts Collateral). These aircraft, engines and spare parts had

an aggregate net book value of approximately $10.6 billion at December 31, 2003.

(2)

Our variable interest rate long-term debt is shown using interest rates which represent LIBOR or Commercial Paper plus a specified margin, as

provided for in the related agreements. The rates shown were in effect at December 31, 2003.

(3)

In connection with these financings, GECC issued irrevocable, direct-pay letters of credit, which totaled $404 million at December 31, 2003, to back

our obligations with respect to $397 million principal amount of tax exempt municipal bonds. We are required to reimburse GECC for drawings under

the letters of credit. Our reimbursement obligation is secured by nine B-767-400 and three B-777-200 aircraft (LOC Aircraft Collateral) and the Engine

Collateral. See "Letter of Credit Enhanced Municipal Bonds" in this Note for additional information on this subject. In addition to our obligations

described in Notes 3-6 of this table, the Engine Collateral also secures, on a subordinated basis, certain of our other existing debt and aircraft lease

obligations to General Electric Company and its affiliates up to a maximum amount of $230 million. The outstanding amount of these obligations is

substantially in excess of $230 million.

(4)

This debt is secured by the Engine Collateral and the LOC Aircraft Collateral. It is not repayable at our election prior to maturity.

(5)

This debt is secured by five B-767-400 aircraft (Other Aircraft Collateral), the Engine Collateral and the Spare Parts Collateral. It is repayable at our

election at any time, subject to certain prepayment fees if repayment occurs before April 2005.

(6)

This debt is secured by the Other Aircraft Collateral, the Engine Collateral and the Spare Parts Collateral. It is repayable at our election at any time,

subject to certain prepayment fees if repayment occurs before April 2005.

(7)

The 15.46% interest rate applies to $86 million of debt due in installments through June 2011. The maximum interest rate on the remaining secured

debt is 6.23%; the majority of this debt is related to aircraft financings for Comair and ASA.

(8)

The 8.125% Notes due 2039 are redeemable by us, in whole or in part, at par on or after July 1, 2004.

F-28