Delta Airlines 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Statements if different estimates, which we reasonably could have used, were made. Our critical accounting estimates are briefly described below.

Goodwill. SFAS 142 addresses financial accounting and reporting for goodwill and other intangible assets, including when and how to perform

impairment tests of recorded balances. We have three reporting units that have assigned goodwill: Delta-Mainline, Atlantic Southeast Airlines, Inc. and

Comair. Quoted stock market prices are not available for these individual reporting units. Accordingly, consistent with SFAS 142, our methodology for

estimating the fair value of each reporting unit primarily considers discounted future cash flows. In applying this methodology, we (1) make assumptions

about each reporting unit's future cash flows based on capacity, yield, traffic, operating costs and other relevant factors and (2) discount those cash flows

based on each reporting unit's weighted average cost of capital. Changes in these assumptions may have a material impact on our Consolidated Financial

Statements. For additional information about our accounting policy related to goodwill and other intangibles, see Notes 1 and 5 in the Notes to the

Consolidated Financial Statements.

Income Tax Valuation Allowance. In accordance with SFAS No. 109, "Accounting for Income Taxes" ("SFAS 109"), deferred tax assets should be

reduced by a valuation allowance if it is more likely than not that some portion or all of the deferred tax assets will not be realized. The future realization of

our net deferred tax assets depends on the availability of sufficient future taxable income. In making this determination, we consider all available positive and

negative evidence and make certain assumptions. We consider, among other things, the overall business environment; our historical earnings, including our

significant pretax losses incurred during the last three years; our industry's historically cyclical periods of earnings and losses; and our outlook for future

years.

We performed this analysis as of December 31, 2003 and determined that there was sufficient positive evidence to conclude that it is more likely than not

that our net deferred tax assets will be realized. The positive evidence included (1) our expectation that we will report pre-tax book and taxable income in

future years; (2) our federal net operating losses ("NOL"s) have never expired unused; (3) our alternative minimum tax ("AMT") credit carryforwards do not

expire; (4) substantially all of our cumulative NOL carryforward at December 31, 2003 will not begin to expire until 2022; and (5) given the long economic

cycles of this industry, our belief that we are not in a cumulative loss position for purposes of assessing recoverability of our net deferred tax assets.

Additionally, a significant portion of our deferred tax assets is associated with our additional minimum pension liability. Over time, this liability is required to

be funded, which will eliminate the related deferred tax asset. We will assess the need for a deferred tax asset valuation allowance on an ongoing basis

considering factors such as those mentioned above as well as other relevant criteria. Changes in the assumptions discussed above may have a material impact

on our Consolidated Financial Statements. For additional information about income taxes, see Notes 1 and 10 of the Notes to the Consolidated Financial

Statements.

Pension Plans. We sponsor defined benefit pension plans ("Plans") for eligible employees and retirees. The impact of the Plans on our Consolidated

Financial Statements as of December 31, 2003 and 2002 and for the years ended December 31, 2003, 2002 and 2001 is presented in Note 11 of the Notes to

the Consolidated Financial Statements. We currently

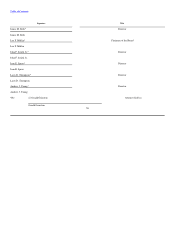

49