Delta Airlines 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

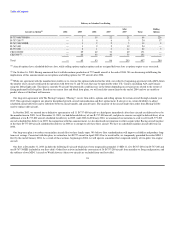

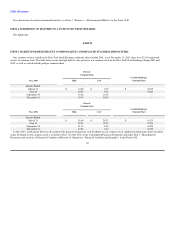

(2) Includes a $439 million charge ($277 million net of tax, or $2.25 diluted EPS) for restructuring, asset writedowns, and related items, net; a $34 million

gain ($22 million net of tax, or $0.17 diluted EPS) for Stabilization Act compensation; and a $94 million charge ($59 million net of tax, or $0.47 diluted EPS)

for certain other income and expense items (see Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this

Form 10-K).

(3) Includes a $1.1 billion charge ($695 million net of tax, or $5.63 diluted EPS) for restructuring, asset writedowns, and related items, net; a $634 million gain

($392 million net of tax, or $3.18 diluted EPS) for Stabilization Act compensation; and a $186 million gain ($114 million net of tax, or $0.92 diluted EPS) for

certain other income and expense items (see Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this

Form 10-K).

(4) Includes a $108 million charge ($66 million net of tax, or $0.50 diluted EPS) for restructuring, asset writedowns, and related items, net; a $151 million

gain ($93 million net of tax, or $0.70 diluted EPS) for certain other income and expense items; and a $164 million cumulative effect, non-cash charge

($100 million net of tax, or $0.77 diluted EPS), resulting from our adoption of SFAS 133 on July 1, 2000.

(5) Includes a $469 million charge ($286 million net of tax, or $1.94 diluted EPS) for asset writedowns; $927 million gain ($565 million net of tax, or $3.83

diluted EPS) from the sale of certain investments; an $89 million non-cash charge ($54 million net of tax, or $0.37 diluted EPS) from the cumulative effect of

a change in accounting principle resulting from our adoption on January 1, 1999 of SAB 101; and a $40 million charge ($24 million net of tax, or $0.16

diluted EPS) for the early extinguishment of certain debt obligations.

(6) Includes interest income.

(7)Includes gains (losses) from the sale of investments.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Business Environment

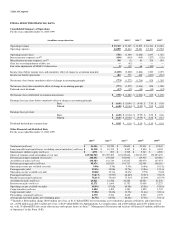

Our net loss was $773 million for the year ended December 31, 2003, the third consecutive year we recorded a substantial net loss. These financial results

reflect the unprecedented challenges confronting us and other airlines. Since the terrorist attacks on September 11, 2001, the airline industry has experienced a

severely depressed revenue environment and significant cost pressures. These factors have resulted in industry-wide liquidity issues, including the

restructuring of certain hub and spoke airlines due to bankruptcy or near bankruptcy.

The continuing impact of the September 11, 2001 terrorist attacks and other events have resulted in fundamental, and what we believe will be long-term,

changes in the airline industry. The revenue environment continues to be severely impacted by the following factors:

• a sharp decline in high yield business travel;

• the continuing growth of low-cost carriers with which we compete in most of our domestic markets;

• industry capacity exceeding demand, which has resulted in significant fare discounting to stimulate demand; and

• increased price sensitivity by our customers, reflecting in part the availability of airline fare information on the Internet.

Our revenues have also been negatively affected by a passenger security fee, imposed by the U.S. government after September 11, 2001, which airlines are

required to collect from customers and remit to the government. Due to the depressed revenue environment, we have not been able to increase our fares to

pass these fees on to our customers. Although suspended for tickets sold between June 1, 2003 and September 30, 2003, the passenger security fee was re-

imposed on October 1, 2003.

31