Dell 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

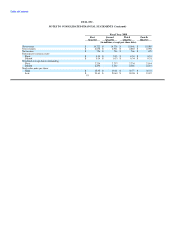

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

On December 29, 2005, Zentralstelle Für private Überspielungrechte ("ZPÜ"), a joint association of various German collection societies, instituted

arbitration proceedings against Dell's German subsidiary before the Arbitration Body in Munich. ZPÜ claims a levy of €18.4 per PC that Dell sold

in Germany from January 1, 2002, through December 31, 2005. On July 31, 2007, the Arbitration Body recommended a levy of €15 on each PC

sold during that period for audio and visual copying capabilities. Dell and ZPÜ rejected the recommendation, and on February 21, 2008, ZPÜ filed

a lawsuit in the German Regional Court in Munich. Dell plans to continue to defend this claim vigorously and does not expect the outcome to have

a material adverse effect on its financial condition or results of operations.

Dell is involved in various other claims, suits, investigations, and legal proceedings that arise from time to time in the ordinary course of its

business. Dell does not expect that the outcome in any of these other legal proceedings, individually or collectively, will have a material adverse

effect on its financial condition or results of operations.

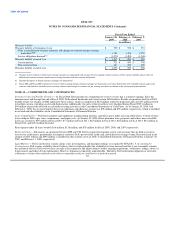

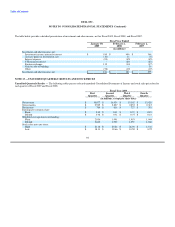

Certain Concentrations — All of Dell's foreign currency exchange and interest rate derivative instruments could involve elements of market and

credit risk in excess of the amounts recognized in the consolidated financial statements. The counterparties to the financial instruments consist of a

number of major financial institutions rated AA and A. In addition to limiting the amount of agreements and contracts it enters into with any one

party, Dell monitors its positions with, and the credit quality of the counterparties to, these financial instruments. Dell does not anticipate

nonperformance by any of the counterparties.

Dell's investments in debt securities are in high quality financial institutions and companies. As part of its cash and risk management processes, Dell

performs periodic evaluations of the credit standing of the institutions in accordance with its investment policy. Dell's investments in debt securities

have effective maturities of less than five years. Management believes that no significant concentration of credit risk for investments exists for Dell.

As of January 30, 2009, approximately 25% of Dell's cash and cash equivalents were deposited with two large financial institutions.

Dell markets and sells its products and services to large corporate clients, governments, healthcare and education accounts, as well as small and

medium businesses and individuals. No single customer accounted for more than 10% of Dell's consolidated net revenue during Fiscal 2009, 2008,

and 2007.

Dell purchases a number of components from single or limited sources. In some cases, alternative sources of supply are not available. In other cases,

Dell may establish a working relationship with a single source or a limited number of sources if Dell believes it is advantageous due to performance,

quality, support, delivery, capacity, or price considerations.

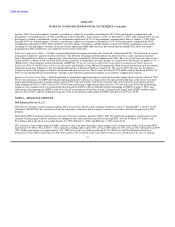

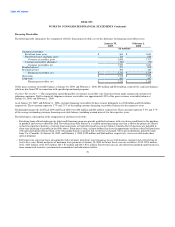

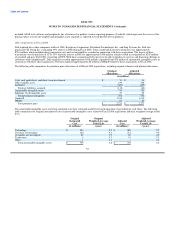

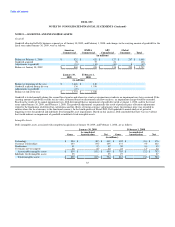

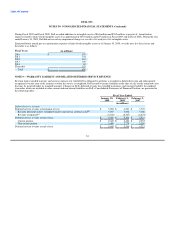

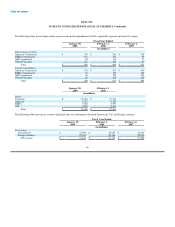

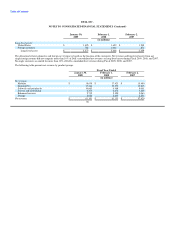

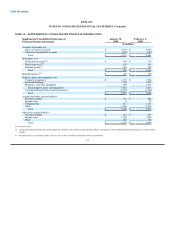

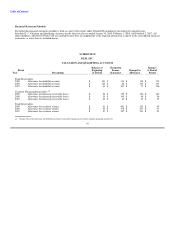

NOTE 11 —SEGMENT INFORMATION

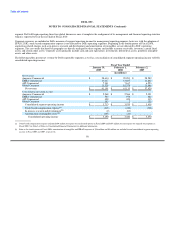

Dell conducts operations worldwide. Effective the first quarter of Fiscal 2009, Dell combined the consumer business of EMEA, APJ, and Americas

International (formerly reported through Americas Commercial) with the U.S. Consumer business and re-aligned its management and financial

reporting structure. As a result, effective May 2, 2008, Dell's operating segments consisted of the following four segments: Americas Commercial,

EMEA Commercial, APJ Commercial, and Global Consumer. Dell's commercial business includes sales to corporate, government, healthcare,

education, small and medium business customers, and value-added resellers and is managed through the Americas Commercial, EMEA

Commercial, and APJ Commercial segments. The Americas Commercial segment, which is based in Round Rock, Texas, encompasses the U.S.,

Canada, and Latin America. The EMEA Commercial segment, based in Bracknell, England, covers Europe, the Middle East, and Africa; and the

APJ Commercial segment, based in Singapore, encompasses the Asian countries of the Pacific Rim as well as Australia, New Zealand, and India.

The Global Consumer segment, which is based in Round Rock, Texas, includes global sales and product development for individual consumers and

retailers around the world. Dell revised previously reported operating segment information to conform to its new operating segments in effect as of

May 2, 2008.

On December 31, 2008, Dell announced its intent during Fiscal 2010 to move from geographic commercial segments to global business units

reflecting the impact of globalization on its customer base. Customer requirements now share more commonality based on their sector rather than

physical location. Dell expects to combine its current Americas Commercial, EMEA Commercial, and APJ Commercial segments and realign its

management structure. After this realignment, Dell's operating structure will consist of the following segments: Global Large Enterprise, Global

Public, Global Small and Medium Business, and its existing Global Consumer

87