Dell 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

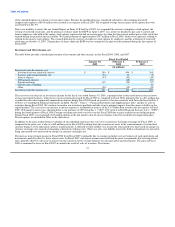

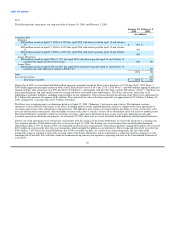

Our effective interest rate for the Senior Debentures was 4.57% for Fiscal 2009. The principal amount of the debt was $300 million at January 30,

2009. The estimated fair value of the long-term debt was approximately $294 million at January 30, 2009, compared to a carrying value of

$400 million at that date as a result of the termination of the interest rate swap agreements.

Prior to the termination of the interest rate swap contracts, the interest rate swaps qualified for hedge accounting treatment pursuant to

SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended. We designated the issuance of the Senior Debentures

and the related interest rate swap agreements as an integrated transaction. The changes in the fair value of the interest rate swap were reflected in the

carrying value of the interest rate swaps on the balance sheet. The carrying value of the debt on the balance sheet was adjusted by an equal and

offsetting amount. The differential to be paid or received on the interest rate swap agreements was accrued and recognized as an adjustment to

interest expense as interest rates changed.

On April 15, 2008, we repaid the principal balance of the 1998 $200 million 6.55% fixed rate senior notes (the "Senior Notes") upon their maturity.

Interest rate swap agreements related to the Senior Notes had a notional amount of $200 million and also matured April 15, 2008. Our effective

interest rate for the Senior Notes, prior to repayment, was 4.03% for the first quarter of Fiscal 2009.

As of January 30, 2009, we have a $1.5 billion commercial paper program with a supporting $1.5 billion senior unsecured revolving credit facility.

This program allows us to obtain favorable short-term borrowing rates. At January 30, 2009, $100 million was outstanding under the program, and

the weighted-average interest rate on those outstanding short-term borrowings was 0.19%. There were no outstanding advances under the

commercial paper program at February 1, 2008. We use the proceeds of the program and facility for short-term liquidity purposes and believe we

will be able to access the capital markets to meet these needs.

The credit facility requires compliance with conditions that must be satisfied prior to any borrowing, as well as ongoing compliance with specified

affirmative and negative covenants, including maintenance of a minimum interest coverage ratio. Amounts outstanding under the facility may be

accelerated for typical defaults, including failure to pay principal or interest, breaches of covenants, non-payment of judgments or debt obligations in

excess of $200 million, occurrence of a change of control, and certain bankruptcy events. There were no events of default as of January 30, 2009. On

April 3, 2009, $500 million of the credit facility expires, and the remainder expires June 1, 2011. We intend to have a new $500 million credit

facility in place prior to the expiration of the current facility on April 3, 2009.

Standard and Poor's Rating Services, Moody's Investors Services and Fitch Ratings currently rate our senior unsecured long-term debt A−, A2, and

A, and our short-term debt A-1, P-1, and F1, respectively. These rating agencies use proprietary and independent methods of evaluating our credit

risk. Factors used when determining our rating include, but are not limited to, publicly available information, industry trends and ongoing

discussions between the company and the agencies. We are not aware of any planned changes to our corporate credit ratings by the rating agencies.

However, in the event our rating was downgraded, our cost to borrow under the terms of the credit facility would increase. Also, a downgrade in our

credit rating could increase our borrowing costs and may limit our ability to issue commercial paper or additional term debt.

Off-Balance Sheet Arrangements

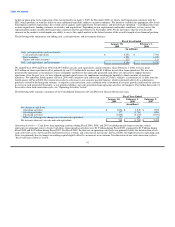

Asset Securitization — During Fiscal 2009, we continued to transfer customer financing receivables to unconsolidated qualifying special purpose

entities. The qualifying special purpose entities are bankruptcy remote legal entities with assets and liabilities separate from ours. The purpose of the

qualifying special purpose entities is to facilitate the funding of customer receivables in the capital markets. Our unconsolidated qualifying special

purpose entities have entered into financing arrangements with three multi-seller conduits that, in turn, issue asset-backed debt securities in the

capital markets. Two of the three conduits fund fixed-term leases and loans, and one conduit funds revolving loans. During Fiscal 2009 and Fiscal

2008, we transferred $1.4 billion and $1.2 billion, respectively, of customer receivables to unconsolidated qualifying special purpose entities. The

principal balance of the securitized receivables at January 30, 2009, and February 1, 2008, was $1.4 billion and $1.2 billion, respectively.

Certain transfers are accounted for as a sale in accordance with SFAS No. 140, Accounting for Transfers and Servicing of Financial Assets and

Extinguishment of Liabilities, ("SFAS 140"). Upon the sale of the customer receivables to qualifying special purpose entities, we recognize a gain on

the sale and retain an interest in the assets sold. We provide credit enhancement to the securitization in the form of over-collateralization.

Receivables transferred to the qualified special purpose entities exceed the level of debt issued. We retain the right to receive collections for assets

securitized exceeding the amount required to pay interest, principal, and other fees and expenses (referred to as retained interest). Retained interest is

included in Financing Receivables on the balance sheet. At January 30, 2009, and February 1, 2008, our retained interest in securitized receivables

was $396 million and $223 million, respectively. Our risk of loss related to securitized receivables is limited to the amount of our retained interest.

39