Dell 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

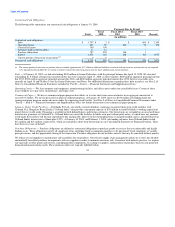

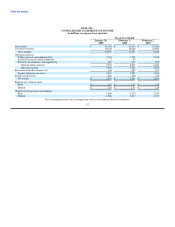

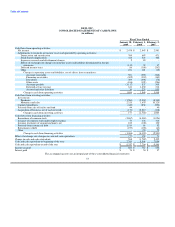

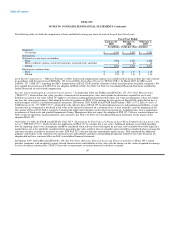

DELL INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in millions)

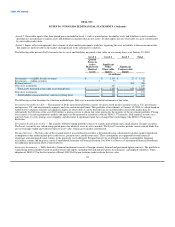

Common Stock

and Capital

in Excess Accumulated

of Par Value Other

Issued Treasury Stock Retained Comprehensive

Shares Amount Shares Amount Earnings Income/(Loss) Other Total

Balances at February 3, 2006 2,818 $ 9,503 488 $ (18,007) $ 12,699 $ (101) $ (47) $ 4,047

Net income - - - - 2,583 - - 2,583

Change in net unrealized gain on investments, net of taxes - - - - - 31 - 31

Foreign currency translation adjustments - - - - - (11) - (11)

Change in net unrealized gain on derivative instruments, net of taxes - - - - - 30 - 30

Valuation of retained interests in securitized assets, net of taxes - - - - - 23 - 23

Total comprehensive income - - - - - - - 2,656

Stock issuances under employee plans 14 196 - - - - - 196

Repurchases - - 118 (3,026) - - - (3,026)

Stock-based compensation expense under SFAS 123(R) - 368 - - - - - 368

Tax benefit from employee stock plans - 56 - - - - - 56

Other and shares issued to subsidiaries 475 (16) - - - - 47 31

Balances at February 2, 2007 3,307 10,107 606 (21,033) 15,282 (28) - 4,328

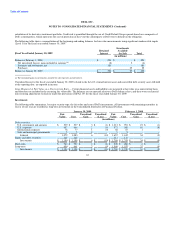

Net income - - - - 2,947 - - 2,947

Impact of adoption of SFAS 155 - - - - 29 (23) - 6

Change in net unrealized gain on investments, net of taxes - - - - - 56 - 56

Foreign currency translation adjustments - - - - - 17 - 17

Change in net unrealized loss on derivative instruments, net of taxes - - - - - (38) - (38)

Total comprehensive income - - - - - - - 2,988

Impact of adoption of FIN 48 - (3) - - (59) - - (62)

Stock issuances under employee plans(a) 13 153 - - - - - 153

Repurchases - - 179 (4,004) - - - (4,004)

Stock-based compensation expense under SFAS 123(R) - 329 - - - - - 329

Tax benefit from employee stock plans - 3 - - - - - 3

Balances at February 1, 2008 3,320 10,589 785 (25,037) 18,199 (16) - 3,735

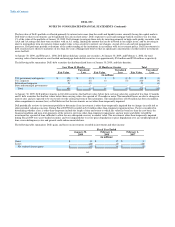

Net income - - - - 2,478 - - 2,478

Change in net unrealized loss on investments, net of taxes - - - - - (29) - (29)

Foreign currency translation adjustments - - - - - 5 - 5

Change in net unrealized gain on derivative instruments, net of taxes - - - - - 349 - 349

Total comprehensive income - - - - - - - 2,803

Stock issuances under employee plans 18 173 - - - - - 173

Repurchases - - 134 (2,867) - - - (2,867)

Stock-based compensation expense under SFAS 123(R) - 419 - - - - - 419

Tax benefit from employee stock plans - 8 - - - - - 8

Balances at January 30, 2009 3,338 $ 11,189 919 $ (27,904) $ 20,677 $ 309 $ - $ 4,271

(a) Includes 1 million shares and $17 million related to redeemable common stock.

The accompanying notes are an integral part of these consolidated financial statements.

54