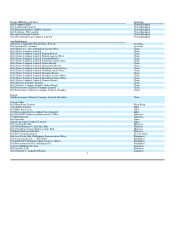

Dell 2008 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exhibit 10.22

United States — Executive Officer

Amended & Restated 2002 Plan

DELL INC.

Nonstatutory Stock Option Agreement

1. Purpose — Dell Inc., a Delaware corporation (the "Company"), is pleased to grant you options to purchase shares of the Company's common stock. The

number of options awarded to you (the "Options") and the Exercise Price per Option (the "Exercise Price") are stated in step one of the Stock Plan

Administrator's online grant acceptance process ("Grant Summary"). Each Option entitles you to purchase, on exercise, one share of the Company's common

stock as described below. This Nonstatutory Stock Option Agreement, the Grant Summary, and the Company's Amended and Restated 2002 Long-Term

Incentive Plan (the "Plan") set forth the terms of your Options identified in your Grant Summary. As a material inducement to the Company to grant you this

award, you agree to the following terms and conditions. You agree that you are not otherwise entitled to this award, that the Company is providing you this

award in consideration for your promises and agreements below, and that the Company would not grant you this award absent those promises and agreements.

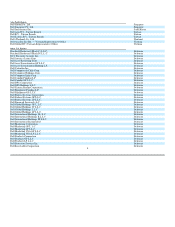

2. Vesting and Exercisability — You cannot exercise the Options until they have vested and become exercisable.

A. General Vesting — The Options will vest in accordance with the schedule in your Grant Summary (subject to the further provisions stated below).

B. Exercisability — You may exercise Options at any time after they vest and before they expire as described below.

3. Method of Exercise — You may exercise Options by giving notice to the Company or in accordance with instructions generally applicable to all option

holders. At the time of exercise, you must pay the Exercise Price for all Options being exercised and any taxes that are required to be withheld by the

Company or your Employer (as defined below). You may pay such amounts in cash or arrange for such amounts to be paid through a brokerage firm or in

another manner satisfactory to the Company. You agree that, subject to compliance with applicable law, the Company or your Employer may recover from

you taxes which may be payable by the Company or your Employer in any jurisdiction in relation to this award. You agree that the Company or your

Employer shall be entitled to use whatever method they may deem appropriate to recover such taxes including the sale of any shares, paying you a net amount

of shares (or cash), recovering the taxes via payroll and direct invoicing. You further agree that the Company or your Employer may, as it reasonably

considers necessary, amend or vary this agreement to facilitate such recovery of taxes.

4. Expiration — All Options will expire on the earlier of the tenth anniversary of the Date of Grant or any of the special expiration dates described below.

Once an Option expires, you will no longer have the right to exercise it. As used below, the term "Employment" means your regular full-time or part-time

employment with the Company or any of its consolidated Subsidiaries, and the term "Employer" means the Company (if you are employed by the Company)

or the consolidated Subsidiary of the Company that employs you.

A. Termination of Employment for Conduct Detrimental to the Company — If your Employment is terminated by your Employer for Conduct Detrimental to

the Company, all Options (whether or not vested) will expire at that time and you will be required to return option proceeds as described herein.

B. Termination of Employment for Other than Conduct Detrimental to the Company — If your Employment is terminated by you or by your Employer for

reasons other than Conduct Detrimental to the Company, Options that are not vested at the time your Employment is terminated will expire at that time and

Options that are vested at the time your Employment is terminated will expire at the close of business on the 90th day following the date your Employment is

terminated.

C. Death — If your Employment is terminated by reason of your death, Options that are not vested at the time your Employment is terminated will become

fully vested at that time. All Options will then expire on the first anniversary of the date your Employment is terminated and, until that time will be

exercisable by your legal representatives, legatees or distributees.

D. Permanent Disability — If your Employment is terminated by reason of your Permanent Disability, Options that are not vested at the time your

Employment is terminated will become fully vested at that time. All Options will then expire on the third anniversary of the date your Employment is

terminated and, until that time will be exercisable by you or your guardian or legal representative.

E. Retirement — If your Employment is terminated by reason of your Normal Retirement, Options that are not vested at the time your Employment is

terminated will expire at that time and Options that are vested at the time your Employment is terminated will expire on the third anniversary of the date your

Employment is terminated.

5. Leaves of Absence — If you take a leave of absence from active Employment that has been approved by the Company or your Employer or is one to which

you are legally entitled regardless of such approval, the following provisions will apply:

A. Exercisability of Options During Leave — Your right to exercise Options that are vested at the time the leave of absence begins will be unaffected by the

leave of absence.

B. Vesting of Options During Leave —Options will not vest during a leave of absence other than an approved employee medical, FMLA or military leave.

Notwithstanding the preceding, vesting shall not be deferred for any approved leave of absence of less than 30 days. The vesting date for all Options that

would have otherwise vested during a leave of absence other than an approved employee medical, FMLA or military leave will be deferred by the number of

days you are on a leave of absence. For example, if your vesting dates are August 1, 2007 through August 1, 2011, and you are on a 40-day leave of absence,

the vesting date for your options will be deferred to September 10, 2007 through September 10, 2011.

C. Effect of Termination During Leave — If your Employment is terminated during the leave of absence the Options will expire in accordance with the terms

stated under "Expiration" above.