Dell 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

material to any of the prior years' financial statements and the impact of correcting these errors in the current year is not material to the full year

Fiscal 2009 Consolidated Financial Statements, we recorded the correction of these errors in the Fiscal 2009 Consolidated Financial Statements.

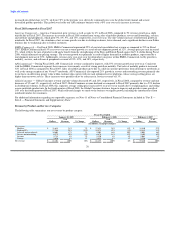

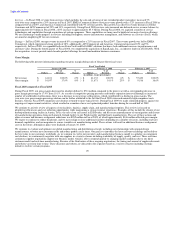

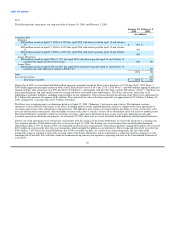

Accounts Receivable

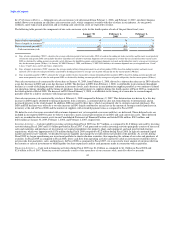

We sell products and services directly to customers and through a variety of sales channels, including retail distribution. At January 30, 2009, our

gross accounts receivable balance was $4.8 billion, a 20% decrease from our balance at February 1, 2008. This decrease in accounts receivable was

due to lower sales in the second half of Fiscal 2009 as compared to the prior year. We maintain an allowance for doubtful accounts to cover

receivables that may be deemed uncollectible. The allowance for losses is based on specific identifiable customer accounts that are deemed at risk

and general historical bad debt experience. As of January 30, 2009 and February 1, 2008, the allowance for doubtful accounts was $112 million and

$103 million, respectively. Based on our assessment, we believe we are adequately reserved for expected credit losses. We monitor the aging of our

accounts receivable and have taken actions in Fiscal 2009 to reduce our exposure to credit losses, including tightening our credit granting practices.

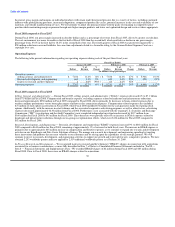

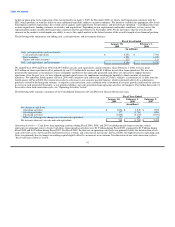

Financing Receivables

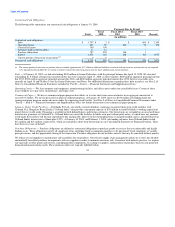

At January 30, 2009 and February 1, 2008, our net financing receivables balance was $2.2 billion and $2.1 billion respectively. The increase in

financing receivables is primarily attributable to an increase in our investment in retained interest, partially offset by a decrease in gross revolving

loan receivables. Retained interest increased $173 million from our balance at February 1, 2008, due to a modification to one of our securitization

agreements, resulting in a scheduled amortization of the transaction. During the scheduled amortization period, additional purchases made on

existing securitized revolving loans are transferred to the qualified special purpose entity, which increased our retained interest balance. See Off-

Balance Sheet Arrangements for additional information.

Gross revolving loan receivables decreased $100 million from our balance at February 1, 2008, due to a reduction in the amount of promotional

receivables. From time to time, we offer certain customers with the opportunity to finance their Dell purchases with special programs during which,

if the outstanding balance is paid in full, no interest is charged. During Fiscal 2009, we reduced our promotional offerings. Promotional receivables

were $352 million and $668 million, at January 30, 2009, and February 1, 2008, respectively.

We expect growth in financing receivables throughout Fiscal 2010. To manage this growth, we will continue to balance the use of our own working

capital and other sources of liquidity. The key decision factors in the funding decision are the cost of funds, required credit enhancements for

receivables sold to the conduits, and the ability to access the capital markets. See Note 6 of Notes to Consolidated Financial Statements included in

"Part II — Item 8 — Financial Statements and Supplementary Data" for additional information about our financing receivables.

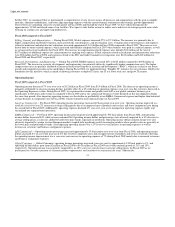

We maintain an allowance to cover financing receivable credit losses. Consistent with trends in the financial services industry, during Fiscal 2009

and Fiscal 2008, we experienced year-over-year increased financing receivable credit losses. Net principal charge-offs for Fiscal 2009 and Fiscal

2008 were $86 million and $40 million, respectively. These amounts represent 5.5% and 2.7% of the average outstanding customer financing

receivable balance (including accrued interest) for the respective years. We have taken underwriting actions to limit our exposure to losses, including

reducing our credit approval rate. We continue to assess our portfolio risk and take additional underwriting actions as we deem necessary. Our

estimate of subprime customer receivables was approximately 20% of the gross customer receivable balance at January 30, 2009, and February 1,

2008.

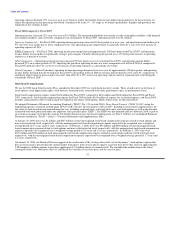

The allowance for losses is determined based on various factors, including historical and anticipated experience, past due receivables, receivable

type, and customer risk profile. Substantial changes in the economic environment or any of the factors mentioned above could change the

expectation of anticipated credit losses. As of January 30, 2009, and February 1, 2008, the allowance for financing receivable losses was

$149 million and $96 million, respectively. A 10% change in this allowance would not be material to our consolidated results. Based on our

assessment of the customer financing receivables and the associated risks, we believe that we are adequately reserved.

See Note 6 of Notes to Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and Supplementary Data" for

additional information.

35