Dell 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

caused by measuring related assets and liabilities differently, and it may reduce the need for applying complex hedge accounting provisions. While

SFAS 159 became effective for Dell's 2009 fiscal year, Dell did not elect the fair value measurement option for any of its financial assets or

liabilities.

Recently Issued Accounting Pronouncements — In December 2007, the FASB issued SFAS No. 141(R), Business Combinations ("SFAS 141(R)").

SFAS 141(R) requires that the acquisition method of accounting be applied to a broader set of business combinations and establishes principles and

requirements for how an acquirer recognizes and measures in its financial statements the identifiable assets acquired, liabilities assumed, any

noncontrolling interest in the acquiree, and the goodwill acquired. SFAS 141(R) also establishes the disclosure requirements to enable the evaluation

of the nature and financial effects of the business combination. SFAS 141(R) is effective for fiscal years beginning after December 15, 2008, and is

required to be adopted by Dell beginning in the first quarter of Fiscal 2010. Management believes the adoption of SFAS 141(R) will not have an

impact on Dell's results of operations, financial position, and cash flows for acquisitions completed prior to Fiscal 2010. The impact of SFAS 141

(R) on Dell's future consolidated results of operations and financial condition will be dependent on the size and nature of future combinations.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements — an amendment of ARB No. 51

("SFAS 160"). SFAS 160 requires that the noncontrolling interest in the equity of a subsidiary be accounted for and reported as equity, provides

revised guidance on the treatment of net income and losses attributable to the noncontrolling interest and changes in ownership interests in a

subsidiary and requires additional disclosures that identify and distinguish between the interests of the controlling and noncontrolling owners.

SFAS 160 also establishes disclosure requirements that clearly identify and distinguish between the interests of the parent and the interests of the

noncontrolling owners. SFAS 160 is effective for fiscal years beginning after December 15, 2008 and is required to be adopted by Dell beginning in

the first quarter of Fiscal 2010. Management does not expect the adoption of SFAS 160 to have a material impact on Dell's results of operations,

financial position, and cash flows.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB

Statement No. 133 ("SFAS 161"), which requires additional disclosures about the objectives of derivative instruments and hedging activities, the

method of accounting for such instruments under SFAS 133 and its related interpretations, and a tabular disclosure of the effects of such instruments

and related hedged items on a company's financial position, financial performance, and cash flows. SFAS 161 does not change the accounting

treatment for derivative instruments and is effective for Dell beginning Fiscal 2010.

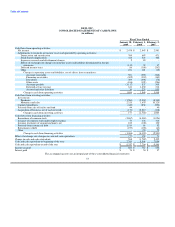

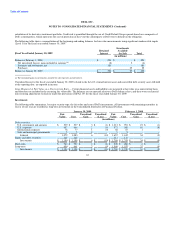

Reclassifications — To maintain comparability among the periods presented, Dell has revised the presentation of certain prior period amounts

reported within cash flow from operations presented in the Consolidated Statements of Cash Flows. The revision had no impact to the total change in

cash from operating activities. Dell has also revised the classification of certain prior period amounts within the Notes to Consolidated Financial

Statements. For further discussion regarding the reclassification of deferred service revenue and warranty liability, see Note 9 of Notes to

Consolidated Financial Statements.

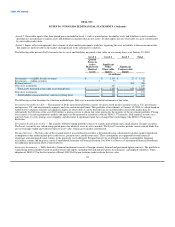

NOTE 2 — FINANCIAL INSTRUMENTS

Fair Value Measurements

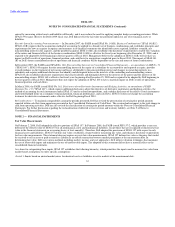

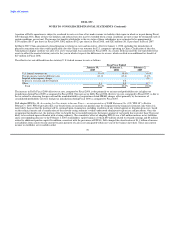

On February 2, 2008, Dell adopted the effective portions of SFAS 157. In February 2008, the FASB issued FSP 157-2, which provides a one year

deferral of the effective date of SFAS 157 for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair

value in the financial statements on a recurring basis (at least annually). Therefore, Dell adopted the provisions of SFAS 157 with respect to only

financial assets and liabilities. SFAS 157 defines fair value, establishes a framework for measuring fair value, and enhances disclosure requirements

for fair value measurements. This statement does not require any new fair value measurements. SFAS 157 defines fair value as the price that would

be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. In

determining fair value, Dell uses various methods including market, income, and cost approaches. Dell utilizes valuation techniques that maximize

the use of observable inputs and minimizes the use of unobservable inputs. The adoption of this statement did not have a material effect on the

consolidated financial statements.

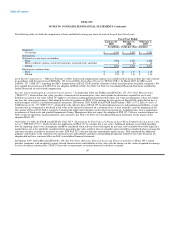

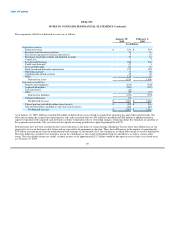

As a basis for categorizing these inputs, SFAS 157 establishes the following hierarchy, which prioritizes the inputs used to measure fair value from

market based assumptions to entity specific assumptions:

• Level 1: Inputs based on quoted market prices for identical assets or liabilities in active markets at the measurement date.

61