Dell 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Revenue Recognition and Related Allowances — We frequently enter into sales arrangements with customers that contain multiple elements or

deliverables such as hardware, software, peripherals, and services. Judgments and estimates are necessary to ensure compliance with GAAP. These

judgments relate to the allocation of the proceeds received from an arrangement to the multiple elements, the determination of whether any

undelivered elements are essential to the functionality of the delivered elements, and the appropriate timing of revenue recognition. We offer

extended warranty and service contracts to customers that extend and/or enhance the technical support, parts, and labor coverage offered as part of

the base warranty included with the product. Revenue from extended warranty and service contracts, for which we are obligated to perform, is

recorded as deferred revenue and subsequently recognized over the term of the contract or when the service is completed. Revenue from sales of

third-party extended warranty and service contracts, for which we are not obligated to perform, is recognized on a net basis at the time of sale, as we

do not meet the criteria for gross recognition under Emerging Issues Task Force 99-19, "Reporting Revenue Gross as a Principal versus Net as an

Agent."

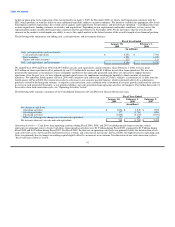

We record reductions to revenue for estimated customer sales returns, rebates, and certain other customer incentive programs. These reductions to

revenue are made based upon reasonable and reliable estimates that are determined by historical experience, contractual terms, and current

conditions. The primary factors affecting our accrual for estimated customer returns include estimated return rates as well as the number of units

shipped that have a right of return that has not expired as of the balance sheet date. If returns cannot be reliably estimated, revenue is not recognized

until a reliable estimate can be made or the return right lapses. Each quarter, we reevaluate our estimates to assess the adequacy of our recorded

accruals for customer returns and allowance for doubtful accounts, and adjust the amounts as necessary.

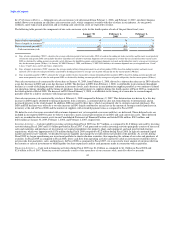

During Fiscal 2008, we began selling our products through retailers. Sales to our retail customers are generally made under agreements allowing for

limited rights of return, price protection, rebates, and marketing development funds. We have generally limited the return rights through contractual

caps. Our policy for sales to retailers is to defer the full amount of revenue relative to sales for which the rights of return apply as we do not currently

have sufficient historical data to establish reasonable and reliable estimates of returns, although we are in the process of accumulating the data

necessary to develop reliable estimates in the future. All other sales for which the rights of return do not apply are recognized upon shipment when

all applicable revenue recognition criteria have been met. To the extent price protection and return rights are not limited, all of the revenue and

related cost are deferred until the product has been sold by the retailer, the rights expire, or a reliable estimate of such amounts can be made.

Generally, we record estimated reductions to revenue or an expense for retail customer programs at the later of the offer or the time revenue is

recognized in accordance with EITF 01-09. Our customer programs primarily involve rebates, which are designed to serve as sales incentives to

resellers of our products and marketing funds.

We report revenue net of any revenue-based taxes assessed by governmental authorities that are imposed on and concurrent with specific revenue-

producing transactions.

Business Combinations and Intangible Assets Including Goodwill — We account for business combinations using the purchase method of

accounting and accordingly, the assets and liabilities of the acquired entities are recorded at their estimated fair values at the acquisition date.

Goodwill represents the excess of the purchase price over the fair value of net assets, including the amount assigned to identifiable intangible assets.

Given the time it takes to obtain pertinent information to finalize the acquired company's balance sheet, it may be several quarters before we are able

to finalize those initial fair value estimates. Accordingly, it is not uncommon for the initial estimates to be subsequently revised. The results of

operations of acquired businesses are included in the Consolidated Financial Statements from the acquisition date.

Identifiable intangible assets with finite lives are amortized over their estimated useful lives. They are generally amortized on a non-straight-line

approach based on the associated projected cash flows in order to match the amortization pattern to the pattern in which the economic benefits of the

assets are expected to be consumed. They are reviewed for impairment if indicators of potential impairment exist. Goodwill and indefinite lived

intangibles assets are tested for impairment on an annual basis in the second fiscal quarter, or sooner if an indicator of impairment occurs. Given the

rapid changes in the market place during the second half of Fiscal 2009, we updated our impairment analysis in the fourth quarter and concluded that

there were no impairment triggering events.

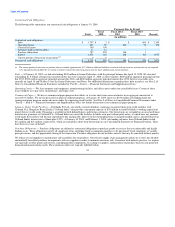

Warranty — We record warranty liabilities at the time of sale for the estimated costs that may be incurred under the terms of the limited warranty.

The specific warranty terms and conditions vary depending upon the product sold and country in which we do business, but generally include

technical support, parts, and labor over a period ranging from one to three years. Factors that affect our warranty liability include the number of

installed units currently under warranty, historical and anticipated rates of warranty claims on those units, and cost per claim to satisfy our warranty

obligation. The anticipated rate of warranty claims is the primary factor impacting our estimated warranty obligation. The other factors are less

significant due to the fact that the average remaining aggregate warranty period of the covered installed base is approximately 20 months, repair

parts are generally already in stock or available at pre-determined prices, and labor rates are generally arranged at pre-established amounts with

service providers. Warranty claims are reasonably predictable

46