Dell 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

expire in three months or less. These contracts are not designated as hedges under SFAS 133, and therefore, the change in the instrument's fair value

is recognized currently in earnings as a component of investment and other income, net.

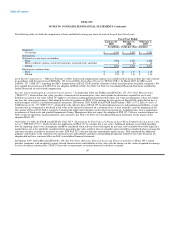

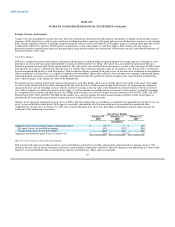

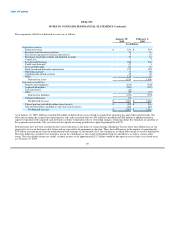

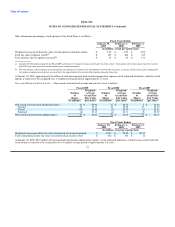

The gross notional value of foreign currency derivative financial instruments and the related net asset or liability was as follows:

January 30, 2009 February 1, 2008

Gross Net Asset Gross Net Asset

Notional (Liability) Notional (Liability)

(in millions)

Cash flow hedges $ 6,581 $ 542 $ 7,772 $ (9)

Other derivatives 581 (46) (1,338) 8

$ 7,162 $ 496 $ 6,434 $ (1)

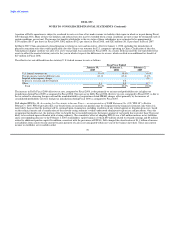

Commercial Paper

Dell has a commercial paper program with a supporting senior unsecured revolving credit facility that allows Dell to obtain favorable short-term

borrowing rates. The commercial paper program and related revolving credit facility were increased from $1.0 billion to $1.5 billion on April 4,

2008. Dell pays facility commitment fees at rates based upon Dell's credit rating. Unless extended, $500 million expires on April 3, 2009, and

$1.0 billion expires on June 1, 2011. The credit facility requires compliance with conditions that must be satisfied prior to any borrowing, as well as

ongoing compliance with specified affirmative and negative covenants, including maintenance of a minimum interest coverage ratio. Amounts

outstanding under the facility may be accelerated for typical defaults, including failure to pay principal or interest, breaches of covenants, non-

payment of judgments or debt obligations in excess of $200 million, occurrence of a change of control, and certain bankruptcy events. There were no

events of default as of January 30, 2009.

At January 30, 2009, there was $100 million outstanding under the commercial paper program and no outstanding advances under the related

revolving credit facilities. The weighted-average interest rate on these outstanding short-term borrowings was 0.19%. At February 1, 2008, there

were no outstanding advances under the commercial paper program or the related credit facility. Dell uses the proceeds of the program for short-

term liquidity needs.

India Credit Facilities

Dell India Pvt Ltd. ("Dell India"), Dell's wholly-owned subsidiary, maintains unsecured short-term credit facilities with Citibank N.A. Bangalore

Branch India ("Citibank India") that provide a maximum capacity of $30 million to fund Dell India's working capital and import buyers' credit

needs. The capacity increased from $30 million to $55 million on August 6, 2008. The incremental $25 million line of credit expired on

December 31, 2008, and was not renewed. Financing is available in both Indian Rupees and foreign currencies. The borrowings are extended on an

unsecured basis based on Dell's guarantee to Citibank N.A. Citibank India can cancel the facilities in whole or in part without prior notice, at which

time any amounts owed under the facilities will become immediately due and payable. Interest on the outstanding loans is charged monthly and is

calculated based on Citibank India's internal cost of funds plus 0.25%. At January 30, 2009, and February 1, 2008, outstanding advances from

Citibank India totaled $12 million and $23 million, respectively, and are included in short-term debt on Dell's Consolidated Statement of Financial

Position. There have been no events of default.

66