Dell 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

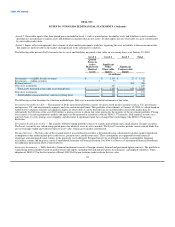

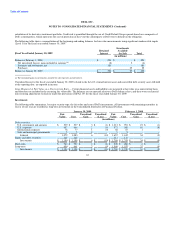

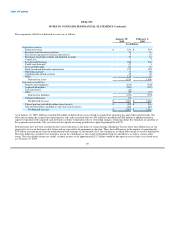

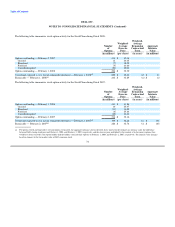

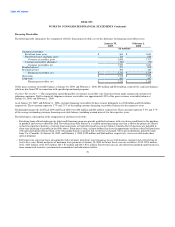

The components of Dell's net deferred tax asset are as follows:

January 30, February 1,

2009 2008

(in millions)

Deferred tax assets:

Deferred revenue $ 633 $ 597

Inventory and warranty provisions 36 46

Investment impairments and unrealized losses 5 10

Provisions for product returns and doubtful accounts 53 61

Capital loss 1 7

Leasing and financing 242 302

Credit carryforwards 47 3

Loss carryforwards 88 16

Stock-based and deferred compensation 233 188

Operating accruals 33 58

Compensation related accruals 48 40

Other 116 78

Deferred tax assets 1,535 1,406

Deferred tax liabilities:

Property and equipment (160) (105)

Acquired intangibles (204) (199)

Unrealized gains (14) -

Other (59) (21)

Deferred tax liabilities (437) (325)

Valuation allowance (31) -

Net deferred tax asset $ 1,067 $ 1,081

Current portion (included in other current assets) $ 499 $ 596

Non-current portion (included in other non-current assets) 568 485

Net deferred tax asset $ 1,067 $ 1,081

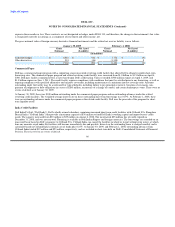

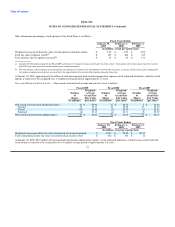

As of January 30, 2009, Dell has recorded $76 million of deferred tax assets related to acquired net operating loss and credit carryforwards. The

offset for recording the acquired net operating loss and credit carryforwards was $56 million to goodwill and $20 million to additional-paid-in-

capital. Utilization of the acquired carryforwards is subject to limitations due to ownership changes, which may delay the utilization of a portion of

the acquired carryforwards. The carryforwards for significant taxing jurisdictions expire beginning Fiscal 2017.

Deferred taxes have not been recorded on the excess book basis in the shares of certain foreign subsidiaries because these basis differences are not

expected to reverse in the foreseeable future and are expected to be permanent in duration. These basis differences in the amount of approximately

$9.9 billion arose primarily from the undistributed book earnings of substantially all of the subsidiaries in which Dell intends to reinvest indefinitely.

The basis differences could reverse through a sale of the subsidiaries or the receipt of dividends from the subsidiaries, as well as various other

events. Net of available foreign tax credits, residual income tax of approximately $3.2 billion would be due upon reversal of this excess book basis

as of January 30, 2009.

69