Dell 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 — DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description of Business — Dell Inc., a Delaware corporation (both individually and together with its consolidated subsidiaries, "Dell"), offers a

broad range of technology product categories, including mobility products, desktop PCs, software and peripherals, servers and networking products,

services, and storage. Dell sells its products and services directly to customers through dedicated sales representatives, telephone-based sales, and

online at www.dell.com, and through a variety of indirect sales channels. Dell's customers include large corporate, government, healthcare, and

education accounts, as well as small and medium businesses and individual consumers.

Fiscal Year — Dell's fiscal year is the 52- or 53-week period ending on the Friday nearest January 31. The fiscal years ending January 30, 2009,

February 1, 2008, and February 2, 2007 included 52 weeks.

Principles of Consolidation — The accompanying consolidated financial statements include the accounts of Dell Inc. and its wholly-owned

subsidiaries and have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). All

significant intercompany transactions and balances have been eliminated.

Dell was formerly a partner in Dell Financial Services L.L.C. ("DFS"), a joint venture with CIT Group Inc. ("CIT"). Dell purchased the remaining

30% interest in DFS from CIT effective December 31, 2007; therefore, DFS is a wholly-owned subsidiary at February 1, 2008. DFS' financial

results have previously been consolidated by Dell in accordance with Financial Accounting Standards Board ("FASB") Interpretation No. 46R

("FIN 46R"), as Dell was the primary beneficiary. DFS allows Dell to provide its customers with various financing alternatives. See Note 6 of Notes

to Consolidated Financial Statements for additional information.

Use of Estimates — The preparation of financial statements in accordance with GAAP requires the use of management's estimates. These estimates

are subjective in nature and involve judgments that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and

liabilities at fiscal year-end, and the reported amounts of revenues and expenses during the fiscal year. Actual results could differ from those

estimates.

Cash and Cash Equivalents — All highly liquid investments, including credit card receivables due from banks, with original maturities of three

months or less at date of purchase are carried at cost and are considered to be cash equivalents. All other investments not considered to be cash

equivalents are separately categorized as investments.

Investments — Dell's investments in debt securities are classified as available-for-sale and are reported at fair value (based on quoted prices and

market observable inputs) using the specific identification method. Unrealized gains and losses, net of taxes, are reported as a component of

stockholders' equity. Publicly traded equity securities are classified as trading and are reported at fair value (based on quoted prices and market

observable inputs) using the specific identification method. Unrealized gains and losses are reported in investment and other income, net. Realized

gains and losses on investments are included in investment and other income, net when realized. All other investments are initially recorded at cost.

Any impairment loss to reduce an investment's carrying amount to its fair market value is recognized in income when a decline in the fair market

value of an individual security below its cost or carrying value is determined to be other than temporary.

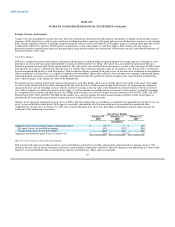

Financing Receivables — Financing receivables consist of customer receivables, residual interest and retained interest in securitized receivables.

Customer receivables include revolving loans and fixed-term leases and loans resulting from the sale of Dell products and services. Financing

receivables are presented net of the allowance for losses. See Note 6 of Notes to Consolidated Financial Statements for additional information.

Asset Securitization -— Dell transfers certain financing receivables to unconsolidated qualifying special purpose entities in securitization

transactions. These receivables are removed from the Consolidated Statement of Financial Position at the time they are sold in accordance with

Statement of Financial Accounting Standards ("SFAS") No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishment of

Liabilities — a Replacement of SFAS No. 125. Receivables are considered sold when the receivables are transferred beyond the reach of Dell's

creditors, the transferee has the right to pledge or exchange the assets, and Dell has surrendered control over the rights and obligations of the

receivables. Gains and losses from the sale of revolving loans and fixed-term leases and loans are recognized in the period the sale occurs, based

upon the relative fair value of the assets sold and the remaining retained interest. Subsequent to the sale, retained interest estimates are periodically

updated based upon current information and events to determine the current fair value, with any changes in fair value recorded in earnings. In

estimating the value of retained interest, Dell makes a variety of

55