Dell 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

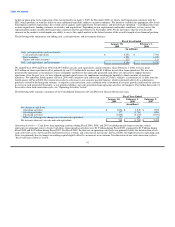

Current Market Conditions

In connection with the weakened global economic conditions, during Fiscal 2009, we took the following actions to manage our risks:

• Diversified financial partner exposure.

• Monitored the financial health of our supplier base.

• Tightened requirements for customer credit.

• Monitored the risk concentration of our cash and cash equivalents balance.

• Continued to monitor our balance sheet exposure, primarily trade accounts receivable and financing receivables, to ensure that we do not have

significant concentrations of risk with any single customer or industry group. As of January 30, 2009, no single industry group or specific

customer represented more than 10% of our trade accounts or financing receivables balance.

• Updated our second quarter analysis of potential triggering events for goodwill and intangible asset impairment in the fourth quarter of Fiscal

2009. Based on this analysis, we concluded that there was no evidence that would indicate an impairment of goodwill or intangible assets.

• Changed our investment strategy to hold securities with shorter durations.

• Continued to monitor the effectiveness of our foreign currency hedging program.

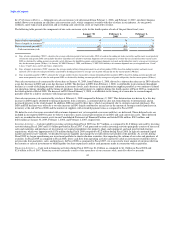

We monitor credit risk associated with our financial counterparties using various market credit risk indicators such as reviews and actions taken by

rating agencies and changes in credit default swap levels. We perform periodic evaluations of our positions with these counterparties and may limit

the amount of agreements or contracts entered into with any one counterparty in accordance with our policies. We do not anticipate non-performance

by any counterparty. We believe that no significant concentration of credit risk for investments exists. The impact on the financial statements of any

credit adjustments related to these counterparties has been immaterial.

Market Risk

We are exposed to a variety of risks, including foreign currency exchange rate fluctuations and changes in the market value of our investments. In

the normal course of business, we employ established policies and procedures to manage these risks.

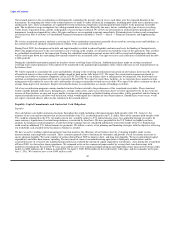

Foreign Currency Hedging Activities

Our objective in managing our exposures to foreign currency exchange rate fluctuations is to reduce the impact of adverse fluctuations on earnings

and cash flows associated with foreign currency exchange rate changes. Accordingly, we utilize foreign currency option contracts and forward

contracts to hedge our exposure on forecasted transactions and firm commitments in more than 20 currencies in which we transact business. Our

exposure to foreign currency movements is comprised of certain principal currencies. During Fiscal 2009, these principal currencies were the Euro,

British Pound, Japanese Yen, Canadian Dollar, and Australian Dollar. We monitor our foreign currency exchange exposures to ensure the overall

effectiveness of our foreign currency hedge positions. However, there can be no assurance that our foreign currency hedging activities will continue

to substantially offset the impact of fluctuations in currency exchange rates on our results of operations and financial position in the future. During

Fiscal 2009, the U.S. dollar strengthened relative to the other principal currencies in which we transact business with the exception of the Japanese

Yen. However, we manage our business on a U.S. dollar basis, and as a result of our comprehensive hedging program, foreign currency fluctuations

did not have a significant impact on our consolidated results of operations.

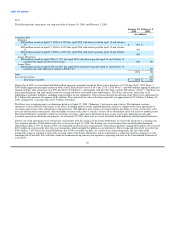

Based on our foreign currency cash flow hedge instruments outstanding at January 30, 2009, and February 1, 2008, we estimate a maximum

potential one-day loss in fair value of approximately $393 million and $57 million, respectively, using a Value-at-Risk ("VAR") model. By using

market implied rates and incorporating volatility and correlation among the currencies of a portfolio, the VAR model simulates three thousand

randomly generated market prices and calculates the difference between the fifth percentile and the average as the Value-at-Risk. In Fiscal 2009,

both higher volatility and correlation increased the VAR significantly. Forecasted transactions, firm commitments, fair value hedge instruments, and

accounts receivable and payable denominated in foreign currencies were excluded from the model. The VAR model is a risk estimation tool, and as

such, is not intended to represent actual losses in fair value that will be incurred. Additionally, as we utilize foreign currency instruments for hedging

forecasted and firmly committed transactions, a loss in fair value for those instruments is generally offset by increases in the value of the underlying

exposure.

36