Dell 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

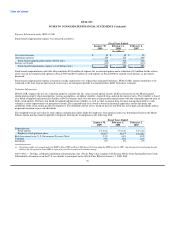

The floating rates were based on three-month London Interbank Offered Rates plus 0.79%. In January 2009, Dell terminated its interest rate swap

contracts with notional amounts totaling $300 million. Dell received $103 million in cash proceeds from the swap terminations, which included

$1 million in accrued interest. These swaps had effectively converted its $300 million, 7.10% fixed rate Senior Debentures due 2028 to variable rate

debt. As a result of the swap terminations, the fair value of the terminated swaps are reported as part of the carrying value of the Senior Debentures

and are amortized as a reduction of interest expense over the remaining life of the debt. The cash flows from the terminated swap contracts are

reported as operating activities in the Consolidated Statement of Cash Flows.

As of January 30, 2009, there were no events of default for the Indenture and the Senior Debentures.

Dell's effective interest rate for the Senior Debentures was 4.57% for Fiscal 2009. The principal amount of the debt was $300 million at January 30,

2009. The estimated fair value of the long-term debt was approximately $294 million at January 30, 2009, compared to a carrying value of

$400 million at that date as a result of the termination of the interest rate swap agreements.

Prior to the termination of the interest rate swap contracts, the interest rate swaps qualified for hedge accounting treatment pursuant to

SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended. Dell designated the issuance of the Senior Debentures

and the related interest rate swap agreements as an integrated transaction. The changes in the fair value of the interest rate swaps were reflected in

the carrying value of the interest rate swaps on the balance sheet. The carrying value of the debt on the balance sheet was adjusted by an equal and

offsetting amount. The differential to be paid or received on the interest rate swap agreements was accrued and recognized as an adjustment to

interest expense as interest rates changed.

On April 15, 2008, Dell repaid the principal balance of the 1998 $200 million 6.55% fixed rate senior notes (the "Senior Notes") upon their maturity.

Interest rate swap agreement related to the Senior Notes had a notional amount of $200 million and also matured April 15, 2008. Dell's effective

interest rate for the Senior Notes, prior to repayment, was 4.03% for the first quarter of Fiscal 2009.

In November 2008, Dell filed a shelf registration statement with the SEC, which provides Dell with the ability to issue additional term debt up to

$1.5 billion, subject to market conditions.

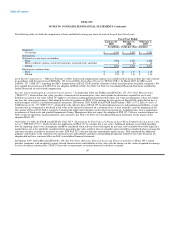

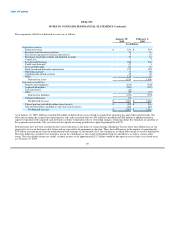

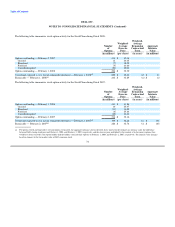

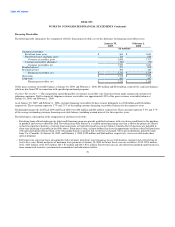

NOTE 3 — INCOME TAXES

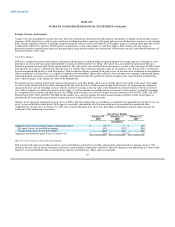

Income before income taxes included approximately $2.6 billion, $3.2 billion, and $2.6 billion related to foreign operations in Fiscal 2009, 2008 and

2007 respectively.

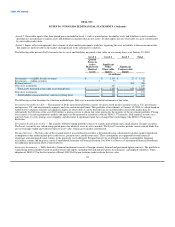

The provision for income taxes consisted of the following:

Fiscal Year Ended

January 30, February 1, February 2,

2009 2008 2007

(in millions)

Current:

Domestic $ 465 $ 901 $ 846

Foreign 295 287 178

Deferred 86 (308) (262)

Provision for income taxes $ 846 $ 880 $ 762

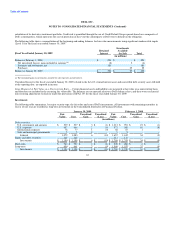

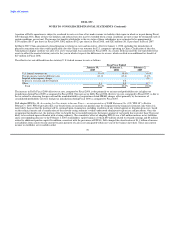

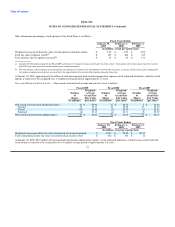

Deferred tax assets and liabilities for the estimated tax impact of temporary differences between the tax and book basis of assets and liabilities are

recognized based on the enacted statutory tax rates for the year in which Dell expects the differences to reverse. A valuation allowance is established

against a deferred tax asset when it is more likely than not that the asset or any portion thereof will not be realized. Based upon all the available

evidence including expectation of future taxable income, Dell has provided a valuation allowance of $31 million related to state credit

carryforwards, but determined that it will be able to realize the remainder of its deferred tax assets.

68