Dell 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

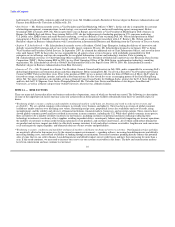

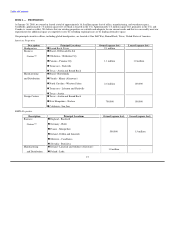

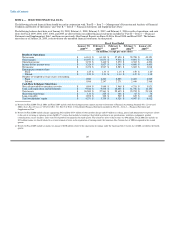

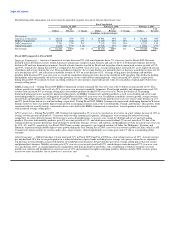

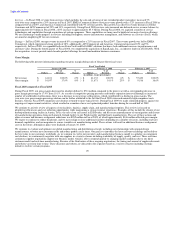

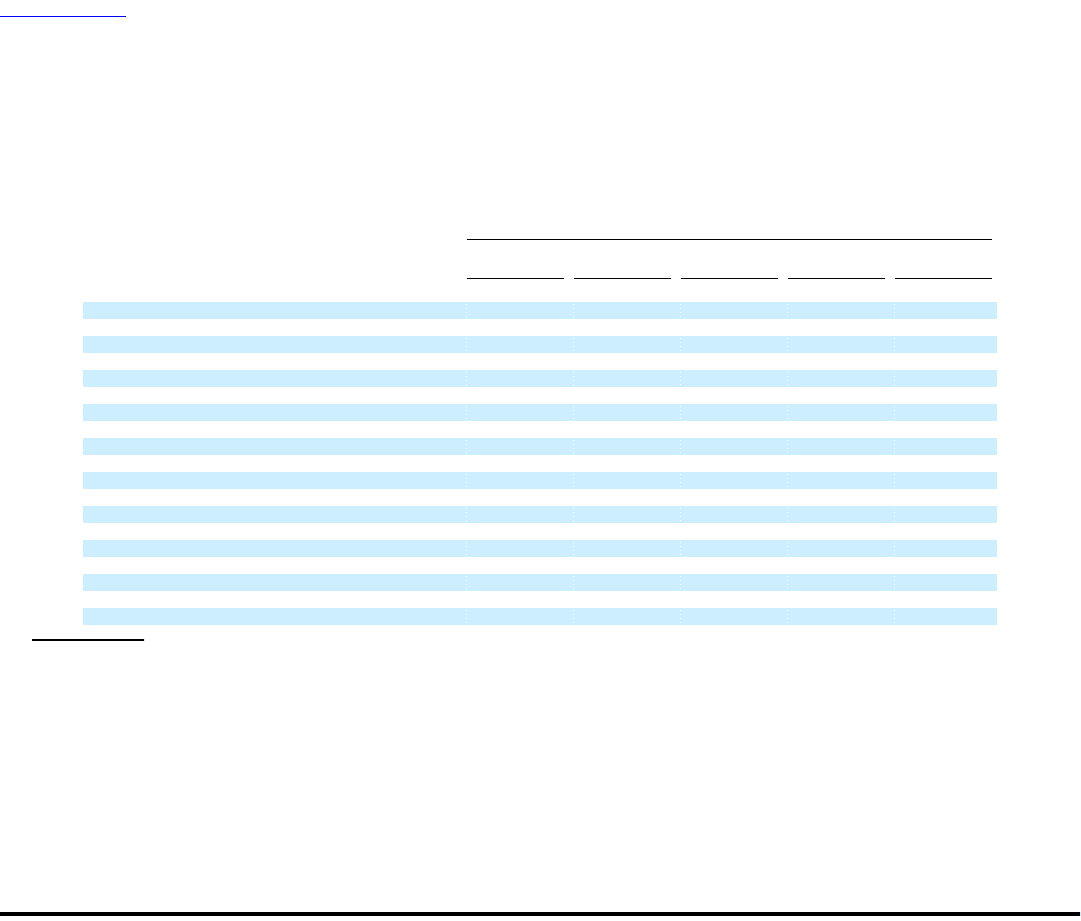

ITEM 6 — SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with "Part II — Item 7 — Management's Discussion and Analysis of Financial

Condition and Results of Operations" and "Part II — Item 8 — Financial Statements and Supplementary Data."

The following balance sheet data as of January 30, 2009, February 1, 2008, February 2, 2007, and February 3, 2006, results of operations, and cash

flows for Fiscal 2009, 2008, 2007, 2006, and 2005 are derived from our audited financial statements included in "Part II — Item 8 — Financial

Statements and Supplementary Data" and from our previously filed Annual Reports on Form 10-K for Fiscal 2008 and Fiscal 2007. The balance

sheet data as of January 28, 2005, is derived from our unaudited financial statements for that period.

Fiscal Year Ended

January 30, February 1, February 2, February 3, January 28,

2009(a) 2008(a) 2007(a) 2006(b) 2005(c)

(in millions, except per share data)

Results of Operations:

Net revenue $ 61,101 $ 61,133 $ 57,420 $ 55,788 $ 49,121

Gross margin $ 10,957 $ 11,671 $ 9,516 $ 9,891 $ 9,018

Operating income $ 3,190 $ 3,440 $ 3,070 $ 4,382 $ 4,206

Income before income taxes $ 3,324 $ 3,827 $ 3,345 $ 4,608 $ 4,403

Net income $ 2,478 $ 2,947 $ 2,583 $ 3,602 $ 3,018

Earnings per common share:

Basic $ 1.25 $ 1.33 $ 1.15 $ 1.50 $ 1.20

Diluted $ 1.25 $ 1.31 $ 1.14 $ 1.47 $ 1.18

Number of weighted-average shares outstanding:

Basic 1,980 2,223 2,255 2,403 2,509

Diluted 1,986 2,247 2,271 2,449 2,568

Cash Flow & Balance Sheet Data:

Net cash provided by operating activities $ 1,894 $ 3,949 $ 3,969 $ 4,751 $ 5,821

Cash, cash equivalents and investments $ 9,546 $ 9,532 $ 12,445 $ 11,756 $ 14,101

Total assets $ 26,500 $ 27,561 $ 25,635 $ 23,252 $ 23,318

Short-term borrowings $ 113 $ 225 $ 188 $ 65 $ 74

Long-term debt $ 1,898 $ 362 $ 569 $ 625 $ 662

Total stockholders' equity $ 4,271 $ 3,735 $ 4,328 $ 4,047 $ 6,412

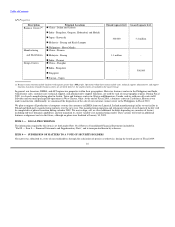

(a) Results for Fiscal 2009, Fiscal 2008, and Fiscal 2007 include stock-based compensation expense pursuant to Statement of Financial Accounting Standards No. 123 (revised

2004), Share-Based Payment ("SFAS 123(R)"). See Note 5 of Notes to Consolidated Financial Statements included in "Part II — Item 8 — Financial Statements and

Supplementary Data."

(b) Results for Fiscal 2006 include charges aggregating $421 million ($338 million of other product charges and $83 million in selling, general and administrative expenses) related

to the cost of servicing or replacing certain OptiPlexTM systems that included a vendor part that failed to perform to our specifications, workforce realignment, product

rationalizations, excess facilities, and a write-off of goodwill recognized in the third quarter. The related tax effect of these items was $96 million. Fiscal 2006 also includes an

$85 million income tax benefit related to a revised estimate of taxes on the repatriation of earnings under the American Jobs Creation Act of 2004 recognized in the second

quarter.

(c) Results for Fiscal 2005 include an income tax charge of $280 million related to the repatriation of earnings under the American Jobs Creation Act of 2004 recorded in the fourth

quarter.

20