Costco 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

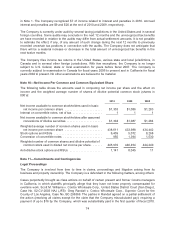

in Note 1. The Company recognized $7 of income related to interest and penalties in 2010. Accrued

interest and penalties are $9 and $20 at the end of 2010 and 2009, respectively.

The Company is currently under audit by several taxing jurisdictions in the United States and in several

foreign countries. Some audits may conclude in the next 12 months and the unrecognized tax benefits

we have recorded in relation to the audits may differ from actual settlement amounts. It is not possible

to estimate the effect, if any, of any amount of such change during the next 12 months to previously

recorded uncertain tax positions in connection with the audits. The Company does not anticipate that

there will be a material increase or decrease in the total amount of unrecognized tax benefits in the

next twelve months.

The Company files income tax returns in the United States, various state and local jurisdictions, in

Canada and in several other foreign jurisdictions. With few exceptions, the Company is no longer

subject to U.S. federal, state or local examination for years before fiscal 2007. The Company is

currently subject to examination in Canada for fiscal years 2006 to present and in California for fiscal

years 2004 to present. No other examinations are believed to be material.

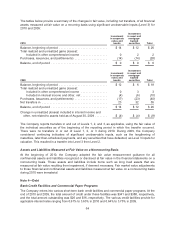

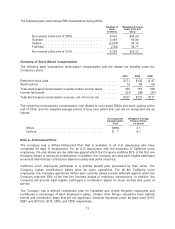

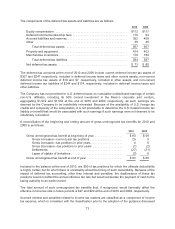

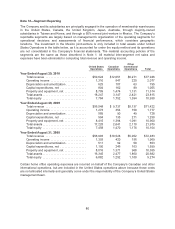

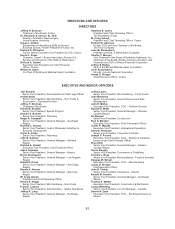

Note 10—Net Income Per Common and Common Equivalent Share

The following table shows the amounts used in computing net income per share and the effect on

income and the weighted average number of shares of dilutive potential common stock (shares in

000’s):

2010 2009 2008

Net income available to common stockholders used in basic

net income per common share ........................ $1,303 $1,086 $1,283

Interest on convertible notes, net of tax ................... 1 1 1

Net income available to common stockholders after assumed

conversions of dilutive securities ....................... $1,304 $1,087 $1,284

Weighted average number of common shares used in basic

net income per common share ........................ 438,611 433,988 434,442

Stock options and RSUs ............................... 6,409 5,072 8,268

Conversion of convertible notes ......................... 950 1,394 1,530

Weighted number of common shares and dilutive potential of

common stock used in diluted net income per share ....... 445,970 440,454 444,240

Anti-dilutive stock options and RSUs ..................... 1,141 8,045 11

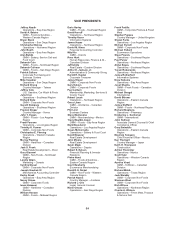

Note 11—Commitments and Contingencies

Legal Proceedings

The Company is involved from time to time in claims, proceedings and litigation arising from its

business and property ownership. The Company is a defendant in the following matters, among others:

Cases purportedly brought as class actions on behalf of certain present and former Costco managers

in California, in which plaintiffs principally allege that they have not been properly compensated for

overtime work. Scott M. Williams v. Costco Wholesale Corp., United States District Court (San Diego),

Case No. 02-CV-2003 NAJ (JFS); Greg Randall v. Costco Wholesale Corp., Superior Court for the

County of Los Angeles, Case No. BC-296369. The parties in Randall agreed on a partial settlement of

the action (resolving all claims except for the claim that the Company miscalculated pay), requiring a

payment of up to $16 by the Company, which was substantially paid in the first quarter of fiscal 2010.

74