Costco 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

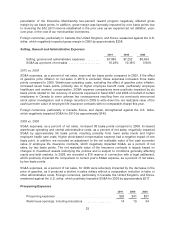

charge to membership fees related to a litigation settlement concerning our membership renewal

policy, and the additional membership sign-ups at the 13 new warehouses opened in 2010 (14 opened

and one closed due to a relocation). Our member renewal rate, currently at 88% in the U.S. and

Canada, is consistent with recent years.

Foreign currencies, particularly in Canada, Korea, and Japan, strengthened against the U.S. dollar in

2010, which positively impacted membership fees by approximately $36.

2009 vs. 2008

Membership fees increased 1.8% in 2009 compared to 2008. The increase was primarily due to

membership sign-ups at the 15 new warehouses opened in 2009 (19 opened, two closed due to

relocations, and two closed Costco Home locations), the continued benefit of membership sign-ups at

warehouses opened in 2008, and increased penetration of our higher-fee Executive Membership

program. This increase was negatively impacted by the $27 charge for the litigation settlement

discussed above, the weakening of foreign currencies against the U.S. dollar, particularly in Canada,

the United Kingdom, and Korea, which negatively impacted membership fees during 2009 by

approximately $50, and a lower number of warehouse openings year-over-year. Our member renewal

rate at the end of 2009 was 87% in the U.S. and Canada.

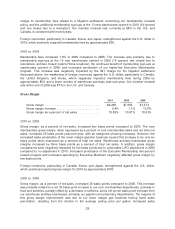

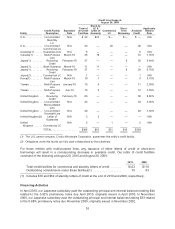

Gross Margin

2010 2009 2008

Gross margin ................................... $8,260 $7,554 $7,474

Gross margin increase ............................ 9.4% 1.1% 12.6%

Gross margin as a percent of net sales .............. 10.83% 10.81% 10.53%

2010 vs. 2009

Gross margin, as a percent of net sales, increased two basis points compared to 2009. The core

merchandise gross margin, when expressed as a percent of core merchandise sales and not total net

sales, increased 25 basis points year-over-year, with all categories showing increases. However, the

increased sales penetration of the lower margin gasoline business caused this increase to be only six

basis points when expressed as a percent of total net sales. Warehouse ancillary businesses gross

margins increased by three basis points as a percent of total net sales. In addition, gross margin

comparisons were negatively impacted by five basis points due to a favorable LIFO adjustment in 2009

compared to no adjustment in 2010. Increased penetration of the Executive Membership two-percent

reward program and increased spending by Executive Members negatively affected gross margin by

two basis points.

Foreign currencies, particularly in Canada, Korea, and Japan, strengthened against the U.S. dollar,

which positively impacted gross margin for 2010 by approximately $183.

2009 vs. 2008

Gross margin, as a percent of net sales, increased 28 basis points compared to 2008. This increase

was primarily related to a net 18 basis point increase in our core merchandise departments, primarily in

food and sundries, partially offset by a decrease in softlines, and a net seven basis point increase from

our warehouse ancillary businesses, primarily our gasoline and pharmacy departments. The majority of

this gross margin improvement was due to our lower margin gas business having lower sales

penetration, resulting from the decline in the average selling price per gallon. Increased sales

28