Costco 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

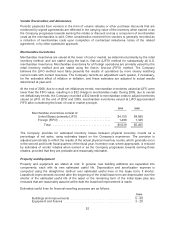

Asset and mortgage-backed securities:

The vast majority of the Company’s asset and mortgage-backed securities have investment grade

credit ratings from the major rating agencies. These investments are collateralized by residential real

estate credit, credit card receivables, commercial real estate, foreign mortgage receivables, and lease

receivables. Estimates of fair value are based upon a variety of factors including, but not limited to,

credit rating of the issuer, internal credit risk, interest rate variation, prepayment assumptions, and the

potential for default.

Certificates of deposit:

Certificate of deposits are short-term interest-bearing debt instruments issued by various financial

institutions with which the Company has an established banking relationship.

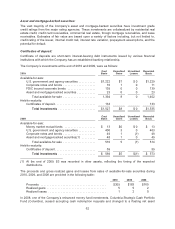

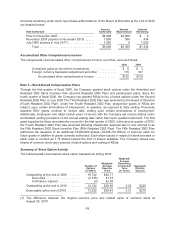

The Company’s investments at the end of 2010 and 2009, were as follows:

2010:

Cost

Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Available-for-sale:

U.S. government and agency securities ........... $1,222 $7 $ 0 $1,229

Corporate notes and bonds ..................... 10 1 0 11

FDIC insured corporate bonds .................. 139 0 0 139

Asset and mortgage-backed securities ............ 23 0 0 23

Total available-for-sale ..................... 1,394 8 0 1,402

Held-to-maturity:

Certificates of deposit .......................... 133 133

Total investments ........................ $1,527 $8 $ 0 $1,535

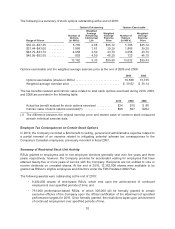

2009:

Cost

Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Available-for-sale:

Money market mutual funds .................... $ 13 $0 $0 $ 13

U.S. government and agency securities ........... 400 3 0 403

Corporate notes and bonds ..................... 49 1 (1) 49

Asset and mortgage-backed securities(1) ......... 48 1 0 49

Total available-for-sale ..................... 510 5 (1) 514

Held-to-maturity:

Certificates of deposit .......................... 59 59

Total investments ........................ $ 569 $5 $(1) $ 573

(1) At the end of 2009, $3 was recorded in other assets, reflecting the timing of the expected

distributions.

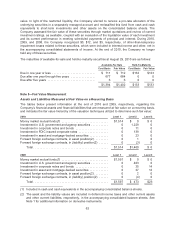

The proceeds and gross realized gains and losses from sales of available-for-sale securities during

2010, 2009, and 2008 are provided in the following table:

2010 2009 2008

Proceeds .......................................... $309 $183 $165

Realized gains ...................................... 5 5 2

Realized losses ..................................... 1 2 0

In 2008, one of the Company’s enhanced money fund investments, Columbia Strategic Cash Portfolio

Fund (Columbia), ceased accepting cash redemption requests and changed to a floating net asset

62