Costco 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

value. In light of the restricted liquidity, the Company elected to receive a pro-rata allocation of the

underlying securities in a separately managed account and reclassified this fund from cash and cash

equivalents to short-term investments and other assets on the consolidated balance sheets. The

Company assessed the fair value of these securities through market quotations and review of current

investment ratings, as available, coupled with an evaluation of the liquidation value of each investment

and its current performance in meeting scheduled payments of principal and interest. During 2010,

2009, and 2008, the Company recognized $0, $12, and $5, respectively, of other-than-temporary

impairment losses related to these securities, which were included in interest income and other, net in

the accompanying consolidated statements of income. At the end of 2010, the Company no longer

held any of these securities.

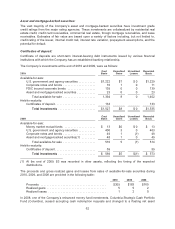

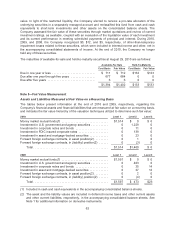

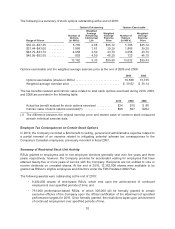

The maturities of available-for-sale and held-to-maturity securities at August 29, 2010 are as follows:

Available-For-Sale Held-To-Maturity

Cost Basis Fair Value Cost Basis Fair Value

Due in one year or less ............................ $ 711 $ 712 $133 $133

Due after one year through five years ................ 677 684 0 0

Due after five years ............................... 6 6 0 0

$1,394 $1,402 $133 $133

Note 3—Fair Value Measurement

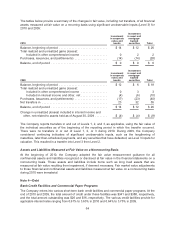

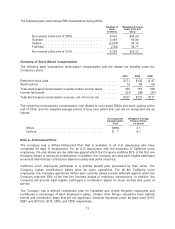

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The tables below present information at the end of 2010 and 2009, respectively, regarding the

Company’s financial assets and financial liabilities that are measured at fair value on a recurring basis,

and indicates the fair value hierarchy of the valuation techniques utilized to determine such fair value:

2010: Level 1 Level 2 Level 3

Money market mutual funds(1) .............................. $1,514 $ 0 $ 0

Investment in U.S. government and agency securities ........... 0 1,229 0

Investment in corporate notes and bonds ..................... 0 11 0

Investment in FDIC insured corporate notes ................... 0 139 0

Investment in asset and mortgage-backed securities ............ 0 23 0

Forward foreign exchange contracts, in asset position(2) ......... 0 1 0

Forward foreign exchange contracts, in (liability) position(2) ...... 0 (3) 0

Total ................................................ $1,514 $1,400 $ 0

2009: Level 1 Level 2 Level 3

Money market mutual funds(1) .............................. $1,597 $ 0 $ 0

Investment in U.S. government and agency securities ........... 0 403 0

Investment in corporate notes and bonds ..................... 0 35 14

Investment in asset and mortgage-backed securities ............ 0 37 12

Forward foreign exchange contracts, in asset position(2) ......... 0 2 0

Forward foreign exchange contracts, in (liability) position(2) ...... 0 (4) 0

Total ................................................ $1,597 $ 473 $26

(1) Included in cash and cash equivalents in the accompanying consolidated balance sheets.

(2) The asset and the liability values are included in deferred income taxes and other current assets

and other current liabilities, respectively, in the accompanying consolidated balance sheets. See

Note 1 for additional information on derivative instruments.

63