Costco 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

common stock on the measurement date less the present value of the expected dividends forgone

during the vesting period. The fair value of stock options is measured using the Black-Scholes

valuation model. While options and RSUs granted to employees generally vest over five years, all

grants allow for either daily or quarterly vesting of the pro-rata number of stock-based awards that

would vest on the next anniversary of the grant date in the event of retirement or voluntary termination.

The historical experience rate of actual forfeitures has been minimal. As such, the Company does not

reduce stock-based compensation for an estimate of forfeitures because the estimate is

inconsequential in light of historical experience and considering the awards vest on either a daily or

quarterly basis. The impact of actual forfeitures arising in the event of involuntary termination is

recognized as actual forfeitures occur, which generally has been infrequent. Stock options have a

ten-year term. Stock-based compensation expense is included in merchandise costs and selling,

general and administrative expenses on the consolidated statements of income. See Note 7 for

additional information on the Company’s stock-based compensation plans.

Preopening Expenses

Preopening expenses related to new warehouses, new regional offices and other startup operations

are expensed as incurred.

Closing Costs

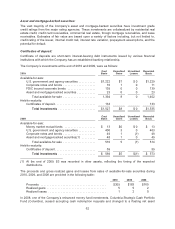

Warehouse closing costs incurred relate principally to the Company’s relocation of certain warehouses

(that were not otherwise impaired) to larger and better-located facilities. The provisions for 2010, 2009,

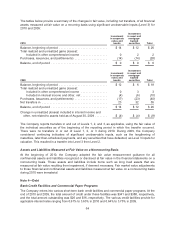

and 2008 included charges in the amounts indicated below:

2010 2009 2008

Warehouse closing expenses .......................... $6 $ 9 $ 9

Impairment of long-lived assets ........................ 2 8 10

Net gains on sale of real property ....................... 0 0 (19)

Total .......................................... $8 $17 $ 0

Warehouse closing expenses primarily relate to accelerated building depreciation based on the

shortened useful life through the expected closing date and remaining lease obligations, net of

estimated sublease income, for leased locations. At the end of 2010 and 2009, the Company’s reserve

for warehouse closing costs was $5 and primarily related to estimated future lease obligations.

Fair Value of Financial Instruments

The carrying value of the Company’s financial instruments, including cash and cash equivalents,

receivables, and accounts payable approximate fair value due to their short-term nature or variable

interest rates. See Notes 2, 3, and 4 for the carrying value and fair value of the Company’s

investments, derivative instruments, and fixed rate debt.

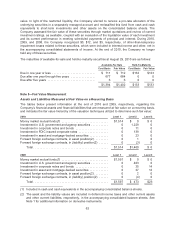

The Company follows the authoritative guidance for fair value measurements relating to financial and

nonfinancial assets and liabilities, including presentation of required disclosures, in its consolidated

financial statements. This guidance defines fair value as the price that would be received to sell an asset

or paid to transfer a liability (an exit price) in an orderly transaction between market participants at the

measurement date. The guidance also establishes a fair value hierarchy, which requires maximizing the

use of observable inputs when measuring fair value. The three levels of inputs that may be used are:

Level 1: Quoted market prices in active markets for identical assets or liabilities.

Level 2: Observable market based inputs or unobservable inputs that are corroborated by

market data.

Level 3: Significant unobservable inputs that are not corroborated by market data.

57