Costco 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

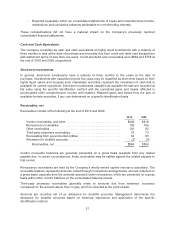

• Reported separately within our consolidated statements of equity and comprehensive income,

distributions and cumulative balances attributable to noncontrolling interests.

These reclassifications did not have a material impact on the Company’s previously reported

consolidated financial statements.

Cash and Cash Equivalents

The Company considers as cash and cash equivalents all highly liquid investments with a maturity of

three months or less at the date of purchase and proceeds due from credit and debit card transactions

with settlement terms of less than one week. Credit and debit card receivables were $862 and $758 at

the end of 2010 and 2009, respectively.

Short-term Investments

In general, short-term investments have a maturity of three months to five years at the date of

purchase. Investments with maturities beyond five years may be classified as short-term based on their

highly liquid nature and because such marketable securities represent the investment of cash that is

available for current operations. Short-term investments classified as available-for-sale are recorded at

fair value using the specific identification method with the unrealized gains and losses reflected in

accumulated other comprehensive income until realized. Realized gains and losses from the sale of

available-for-sale securities, if any, are determined on a specific identification basis.

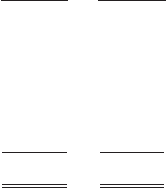

Receivables, net

Receivables consist of the following at the end of 2010 and 2009:

2010 2009

Vendor receivables, and other .................................. $448 $418

Reinsurance receivables ....................................... 196 169

Other receivables ............................................. 103 82

Third-party pharmacy receivables ................................ 75 73

Receivables from governmental entities ........................... 64 95

Allowance for doubtful accounts ................................. (2) (3)

Receivables, net .......................................... $884 $834

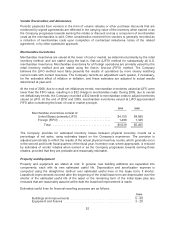

Vendor receivable balances are generally presented on a gross basis separate from any related

payable due. In certain circumstances, these receivables may be settled against the related payable to

that vendor.

Reinsurance receivables are held by the Company’s wholly-owned captive insurance subsidiary. The

receivable balance represents amounts ceded through reinsurance arrangements, and are reflected on

a gross basis, separate from the amounts assumed under reinsurance, which are presented on a gross

basis within other current liabilities on the consolidated balance sheets.

Third-party pharmacy receivables generally relate to amounts due from members’ insurance

companies for the amount above their co-pay, which is collected at the point-of-sale.

Amounts are recorded net of an allowance for doubtful accounts. Management determines the

allowance for doubtful accounts based on historical experience and application of the specific

identification method.

51