Costco 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

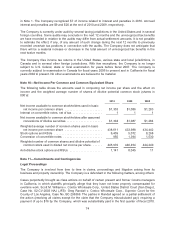

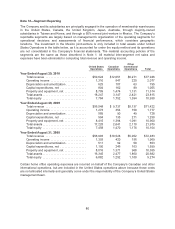

Note 9—Income Taxes

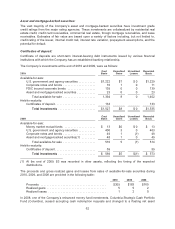

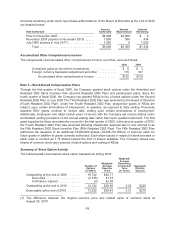

Income before income taxes is comprised of the following:

2010 2009 2008

Domestic (including Puerto Rico) ................... $1,426 $1,426 $1,542

Foreign ........................................ 628 301 469

Total ....................................... $2,054 $1,727 $2,011

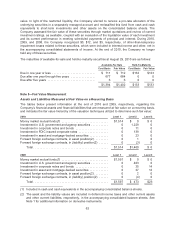

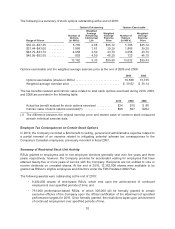

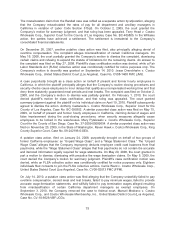

The provisions for income taxes for 2010, 2009, and 2008 are as follows:

2010 2009 2008

Federal:

Current ..................................... $445 $396 $470

Deferred .................................... 1 67 35

Total federal ............................. 446 463 505

State:

Current ..................................... 79 66 84

Deferred .................................... 5 12 (7)

Total state .............................. 84 78 77

Foreign:

Current ..................................... 200 94 138

Deferred .................................... 1 (7) (4)

Total foreign ............................. 201 87 134

Total provision for income taxes .................... $ 731 $ 628 $ 716

Tax benefits associated with the exercise of employee stock options and other employee stock

programs were allocated to equity attributable to Costco in the amount of $15, $2, and $62, in 2010,

2009, and 2008, respectively.

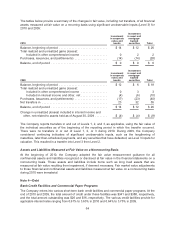

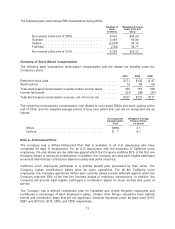

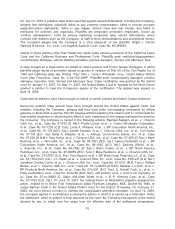

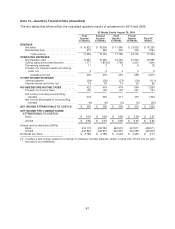

The reconciliation between the statutory tax rate and the effective rate for 2010, 2009, and 2008 is as

follows:

2010 2009 2008

Federal taxes at statutory rate .............. $718 35.0% $604 35.0% $704 35.0%

State taxes, net .......................... 56 2.7 48 2.8 51 2.5

Foreign taxes, net ........................ (38) (1.9) (24) (1.4) (28) (1.4)

Tax (provision) benefit on unremitted

earnings .............................. 0 0 (1) (0.1) 4 0.2

Other ................................... (5) (0.2) 1 0.1 (15) (0.7)

Total ............................... $731 35.6% $628 36.4% $716 35.6%

72