Costco 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

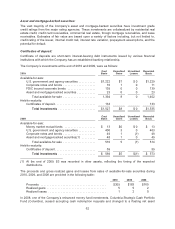

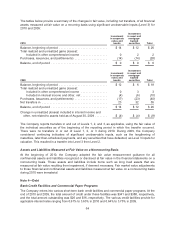

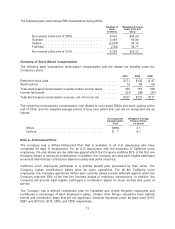

Short-Term Borrowings

The weighted average borrowings, maximum borrowings, and weighted average interest rate under all

short-term borrowing arrangements were as follows for 2010 and 2009:

Category of Aggregate

Short-term Borrowings

Maximum Amount

Outstanding

During the Fiscal Year

Average Amount

Outstanding

During the Fiscal Year

Weighted Average

Interest Rate

During the Fiscal Year

Year ended August 29, 2010

Bank borrowings:

Canada .................... $ 1 $ 1 2.75%

Japan ...................... 64 39 0.63

Bank overdraft facility:

United Kingdom .............. 5 2 1.50

Year ended August 30, 2009

Bank borrowings:

Canada .................... $90 $64 2.80%

United Kingdom .............. 31 23 1.72

Japan ...................... 29 22 0.93

Bank overdraft facility:

United Kingdom .............. 20 4 1.64

Other:

United Kingdom Money Market

Line Borrowing ............. 31 13 4.47

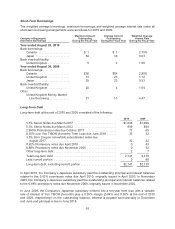

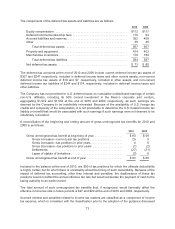

Long-Term Debt

Long-term debt at the end of 2010 and 2009 consisted of the following:

2010 2009

5.5% Senior Notes due March 2017 ........................... $1,096 $1,096

5.3% Senior Notes due March 2012 ........................... 899 899

2.695% Promissory notes due October 2017 .................... 77 69

0.35% over Yen TIBOR (6-month) Term Loan due June 2018 ...... 35 32

3.5% Zero Coupon convertible subordinated notes due

August 2017 ............................................. 32 32

0.92% Promissory notes due April 2010 ........................ 0 43

0.88% Promissory notes due November 2009 ................... 0 32

Other long-term debt ........................................ 2 7

Total long-term debt ........................................ 2,141 2,210

Less current portion ........................................ 0 80

Long-term debt, excluding current portion ....................... $2,141 $2,130

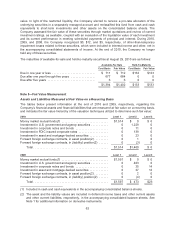

In April 2010, the Company’s Japanese subsidiary paid the outstanding principal and interest balances

related to the 0.92% promissory notes due April 2010, originally issued in April 2003. In November

2009, the Company’s Japanese subsidiary paid the outstanding principal and interest balances related

to the 0.88% promissory notes due November 2009, originally issued in November 2002.

In June 2008, the Company’s Japanese subsidiary entered into a ten-year term loan with a variable

rate of interest of Yen TIBOR (6-month) plus a 0.35% margin (0.84% and 0.95% at the end of 2010

and 2009, respectively) on the outstanding balance. Interest is payable semi-annually in December

and June and principal is due in June 2018.

65