Costco 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

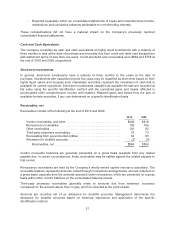

Derivatives

The Company is exposed to foreign currency exchange-rate fluctuations in the normal course of its

business, which the Company manages, in part, through the use of forward foreign exchange

contracts, seeking to hedge the impact of fluctuations of foreign exchange on known future

expenditures denominated in a foreign currency. The contracts are intended primarily to hedge U.S.

dollar merchandise inventory expenditures. Currently, these contracts do not qualify for derivative

hedge accounting. The Company seeks to mitigate risk with the use of these contracts and does not

intend to engage in speculative transactions. The aggregate notional amount of forward foreign

exchange contracts was $225 and $183 at the end of 2010 and 2009, respectively. These contracts do

not contain any credit-risk-related contingent features.

The Company seeks to manage the counterparty risk associated with these contracts by limiting

transactions to counterparties with which the Company has an established banking relationship. There

can be no assurance, however, that this practice effectively mitigates counterparty risk. The contracts

are limited to less than one year. See Note 3 for information on the fair value of these contracts.

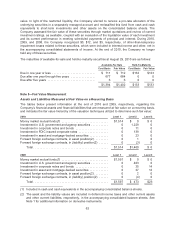

The following table summarizes the amount of net gain or (loss) recognized in interest income and

other, net in the accompanying consolidated statements of income:

2010 2009 2008

Forward foreign exchange contracts .................... $1 $(5) $6

The Company is exposed to fluctuations in energy prices, particularly electricity and natural gas, which

it seeks to partially mitigate through the use of fixed-price contracts for approximately 26% of its

warehouses and other facilities in the U.S. and Canada. The Company also enters into variable-priced

derivative contracts for some purchases of natural gas, in addition to fuel for its gas stations, on an

index basis. These contracts generally qualify for treatment as normal purchases or normal sales and

require no mark-to-market adjustment.

Foreign Currency Translation

The functional currencies of the Company’s international subsidiaries are the local currency of the

country in which the subsidiary is located. Assets and liabilities recorded in foreign currencies, as well

as the Company’s investment in Costco Mexico, are translated at the exchange rate on the balance

sheet date. Translation adjustments resulting from this process are recorded in accumulated other

comprehensive income. Revenues and expenses of the Company’s consolidated foreign operations

are translated at average rates of exchange prevailing during the year. Gains and losses on foreign

currency transactions are included in interest income and other, net and were $13 in 2010 and not

significant in 2009 or 2008.

Revenue Recognition

The Company generally recognizes sales, net of estimated returns, at the time the member takes

possession of merchandise or receives services. When the Company collects payments from

customers prior to the transfer of ownership of merchandise or the performance of services, the

amounts received are generally recorded as deferred revenue on the consolidated balance sheets until

the sale or service is completed. The Company provides for estimated sales returns based on historical

trends in merchandise returns. Amounts collected from members, which under common trade practices

are referred to as sales taxes, are recorded on a net basis.

The Company evaluates whether it is appropriate to record the gross amount of merchandise sales

and related costs or the net amount earned as commissions. Generally, when Costco is the primary

55